CBJ's Fast 50 Awards: Private companies with rapid revenue growth – Charlotte Business Journal – The Business Journals

CBJ’s Fast 50 Awards program puts a spotlight on some of the Charlotte region’s fastest-growing, privately held companies.

CBJ PHOTO ILLUSTRATION

The companies in the Charlotte Business Journal‘s 2022 class of winners in the Fast 50 Awards program are going places — in a hurry. This year’s class accelerated through a pandemic that brought about unprecedented challenges to maintain rapid revenue growth.

This marks CBJ’s 30th year of the Fast 50, one of our longest-running, signature awards programs. It seeks to highlight the Charlotte region’s fastest-growing private companies.

Fifteen of the companies in this year’s ranking posted growth in revenue of more than 100% for 2019-21.

The honorees come from a variety of industries, from real estate teams, contractors and logistics companies to tech firms and health-care services. Many are repeat winners, having sustained strong growth over time.

Companies applied for inclusion in this program after CBJ solicited nominations. Each nominee provided financial documentation to be evaluated by accounting firm CliftonLarsonAllen, which ranked participants based on average annual revenue growth over three years. To qualify for the program, nominees had to:

Should your firm be on this list? Reach out now to Research Director Amy Shapiro at ashapiro@bizjournals.com so we can contact you when nominations open for 2023.

CBJ celebrated the honorees’ achievements — and revealed the 2022 ranking for the first time — during an awards ceremony and reception last night at The Westin Charlotte hotel in uptown.

Here is the complete ranking of Fast 50 honorees in 2022:

No. 1: Shred America

586.41% average growth rate over 3 years

Shred America is a nationwide platform of service and equipment offering document shredding and hard-drive shredding. The Fort Mill-based company began in 2016 as Carolina Shred and, in 2018, became Shred America. The company now has offices and equipment in nine states with a partner network of about 60 smaller document-shredding companies in additional cities.

Read more here: Local veteran leans on military skills in building Shred America

No. 2: Croixstone Consulting

277.88% average growth rate over 3 years

Croixstone Consulting is a business management consultant that drives outcomes by accelerating and sustaining transformations. Croixstone is a six-year-old firm founded by Patti and Mark Weber that serves middle-market companies in such industries as health care, financial services and fintech, and manufacturing.

Read more here: How consulting firm Croixstone fills niche for middle-market companies

No. 3: Pursuit Search Group

230.80% average growth rate over 3 years

Pursuit Search Group is a recruiting firm specializing in executive search, consulting, staffing and shared services. The company focuses on accounting and finance, HR, mortgage, sales and executive support. It began in 2018.

Read more here: How Pursuit Search Group is navigating shifts in recruiting, workforce

No. 4: Springdale Custom Builders

156.53% average growth rate over 3 years

Springdale Custom Builders is a residential contractor led by Andrea and Brian Seymour. Springdale focuses on new home construction and renovations in Charlotte’s close-in neighborhoods. Renovations start at $500,000 and new homes are up to $2 million.

Read more here: Focus on easing home construction process sets Springdale apart

No. 5: Zapps Wholesale

149.80% average growth rate over 3 years

Zapps Wholesale is one of the largest distributors in America. The company buys merchandise in bulk directly from big-box retailers. The merchandise is just about anything — from furniture to tools, toys to clothing, electronics to sporting goods — that the retailer no longer intends to put on the shelf. Zapps brings the product to its distribution centers and resells it to businesses and individuals.

Read more here: How Zapps Wholesale is working to ‘revolutionize’ retail liquidation

No. 6: PetScreening

145.47% average growth rate over 3 years

PetScreening is a platform that allows property managers to outsource the process of pet risk assessment and validates service or support animals. Housing providers and property managers use PetScreening to validate reasonable accommodation requests for assistance animals and to confirm every resident understands their pet policies. A pet screening gives a landlord insight into the pet’s behavior, personality and health. The pet screening “paw score” determines the amount of additional monthly rent that is paid per animal if the application is accepted.

No. 7: Undergrads

143.05% average growth rate over 3 years

Undergrads is a labor-only moving company started by college students as a class-friendly way to earn money. Working in five states, the company provides a team of enthusiastic and hard-working movers and eliminates the overhead costs associated with a traditional moving company.

No. 8: MedChat

135.55% average growth rate over 3 years

MedChat is a modern patient access and messaging platform that provides HIPAA-compliant live chat, chatbots, an answer bot using artificial intelligence and two-way texting. MedChat deploys custom chatbots that enhance communication and automate workflows. The platform is used by hundreds of health-care organizations.

No. 9: Loan Pronto Inc.

132.40% average growth rate over 3 years

Loan Pronto offers residential mortgages in 20 states, fueled by an aggressive marketing campaign on dozens of radio stations and a quick online application process. Customers get rates and apply online and can be in underwriting for a new home loan within hours. The company’s robust marketing campaign enables its loan officers to close five to seven times the number of loans monthly as a typical mortgage officer.

No. 10: Dualboot Partners

128.86% average growth rate over 3 years

Dualboot Partners is an on-demand, product design and software engineering firm. The company provides product strategy, design, web development and mobile development to help companies scale and grow. Dualboot works with clients in multiple verticals, including fintech, retail, manufacturing, automotive, beverage, construction and health tech.

No. 11: TUSK Partners

123.81% average growth rate over 3 years

Tusk Partners is a business broker specializing in the dental industry. The firm has completed over $650 million worth of transactions across all specialties. Tusk has an in-depth understanding of the marketplace and access to hundreds of buyers nationwide to help clients pursue transactions that maximize long-term value.

No. 12: Riverstone Logistics

117.20% average growth rate over 3 years

Riverstone Logistics offers final-mile solutions for heavy goods retailers needing delivery and installation. The firm was founded in 2017 by four partners who work in the business. Riverstone provides final-mile deliveries through dedicated and network models for various clients across the nation. In 2021, the company expanded into delivering building products and appliance delivery and installation.

No. 13: Carolinas Dream Team

112.31% average growth rate over 3 years

Carolinas Dream Team is a residential real estate firm affiliated with Keller Williams that is based in Fort Mill with offices in Spartanburg. The firm is led by Mike Morrell and Faiyaz Dossaji. The team focuses on the robust markets of upstate South Carolina and in Charlotte.

No. 14: Contractor Growth Network

110.85% average growth rate over 3 years

Contractor Growth Network is a digital marketing and search-engine optimization agency. The company only does marketing for contractors; that specialty helps contractors find high-value, pre-qualified leads so they can pick and choose the clients they want instead of chasing low-margin jobs. The network helps contractors improve digital visibility with websites, SEO strategies, marketing and video marketing.

No. 15: Impact Marketing of NC

109.80% average growth rate over 3 years

Impact Marketing of NC is a full-service marketing and advertising agency. Impact Marketing helps birth brands and builds the marketing strategy across all media platforms in 100 markets across the U.S.

No. 16: Open Broadband

98.15% average growth rate over 3 years

Open Broadband’s fixed-wireless internet service provides qualified households and small businesses with high speeds via outdoor antenna and indoor Wi-Fi gateway router. The company uses several different technologies to bring speed and reliability to customers. Open Broadband brings internet to underserved areas in 19 North Carolina counties and additional counties in Virginia and South Carolina.

No. 17: Pinnacle Solutions Group

89.19% average growth rate over 3 years

Pinnacle Solutions Group is an IT consulting services firm specializing in business intelligence, e-business solutions, mobile applications and custom technology solutions. Pinnacle has offices in Cincinnati and Charlotte.

No. 18: Lightserve Corp.

88.13% average growth rate over 3 years

Lightserve provides lighting solutions for commercial, industrial, health care, institutional and retail customers. The company provides design, maintenance, IoT controls and audit to ensure customers have well-lit workplaces. Lightserve provides enterprise-level program management, from LED retrofits and smart ceilings to electrical rollouts and electric vehicle charging stations.

No. 19: McCray Griffin Corp.

80.86% average growth rate over 3 years

McCray Griffin Corp. is a family-owned company that performs the installation of resinous flooring, polished concrete and self-leveling toppings for commercial and industrial projects.

No. 20: QC Kinetix

77.19% average growth rate over 3 years

QC Kinetix is a Charlotte-based franchise company offering comprehensive regenerative medicine treatments to address musculoskeletal conditions and joint pain. QC Kinetix uses the body’s own healing properties through state-of-the-art, natural biologic treatments as alternatives to invasive surgery and addictive pain medications. The health-care franchise currently operates in 17 cities.

No. 21: MigWay Inc.

76.40% average growth rate over 3 years

MigWay is an asset-based freight carrier specifically designed for rushing critical loads. The company offers warehousing, dry vans and flatbed trucks to get loads where they need to be quickly. Founder David Voronin started the company in 2012 and has grown it to 230 trucks.

No. 22: 4TEKGear.com

71.08% average growth rate over 3 years

4TEKgear sells hardware, software, services and solutions primarily to IT professionals using a highly digitized inventory system. The company uses digital analytics for nearly real-time insights on when products are available while other websites merely provide out-of-stock notices. Through partnerships with major manufacturers, 4TEKgear eliminates the need for significant product warehousing.

No. 23: Aruza Pest Control

65.88% average growth rate over 3 years

Founded in 2016, Aruza Pest Control serves residential, commercial and industrial properties in North Carolina, South Carolina and Florida. Friends started the business with two trucks, knocking on doors to find customers. The business has grown to more than 100 employees and is fueled by an internship program that employs more than 250 college students in door-to-door marketing roles.

No. 24: Hylaine

54.20% average growth rate over 3 years

Founded in 2017, Hylaine is an IT consulting firm that helps companies with digital transformation. Based in Charlotte, Hylaine has offices in Raleigh, Atlanta and the Dallas-Fort Worth area. Hylaine aims to be a smaller, high-touch consulting firm to stand in contrast to consolidated larger firms.

No. 25: Airwavz Solutions Inc.

51.83% average growth rate over 3 years

Airwavz Solutions designs, installs, owns and operates wireless infrastructure inside commercial office and hospitality buildings in dense metropolitan areas. The company ensures building tenants and guests receive exceptional cellular service while also allowing wireless carriers to improve coverage and increase capacity throughout their networks.

No. 26: Lumaverse Technologies

51.06% average growth rate over 3 years

Lumaverse Technologies launched in 2020 to bring more value to SignUpGenius customers. The company is comprised of a suite of software tools that includes SignUpGenius, NonProfitEasy, TimeTap, Fundly, Membership Toolkit, AtoZConnect, Learning Stream, GoSignMeUp and RegistrationMax. Together, the solutions focus on scheduling, coordination, communication, registration, membership, volunteers and fundraising management challenges.

No. 27: Aegis Logistics

50.10% average growth rate over 3 years

Aegis Logistics Group is a Matthews-based freight management and logistics firm. As a freight broker, Aegis provides an array of freight management and supply-chain services, from everyday products and equipment to time-critical shipments, including cold-chain freight. Founded in 2016, Aegis has a network of trusted carriers throughout North America.

No. 28: Dry Otter Waterproofing

48.78% average growth rate over 3 years

Dry Otter Waterproofing is a locally owned and operated company providing basement and crawl space waterproofing and moisture control for the greater Charlotte area. The Denver-based company began in 2013 and specializes in waterproofing, sump pumps, French drains, mold remediation and crawl space repair and encapsulation.

No. 29: Elevate Digital

46.34% average growth rate over 3 years

Elevate Digital is a national provider of solutions for the digital economy, filling the space between in-house talent and a traditional consultancy. Elevate helps companies advance digital transformation with a focus on marketing, cloud, process automation, data and analytics, cybersecurity and contact centers. The company operates offices in Charlotte, Atlanta, New York, Austin, Pittsburgh and St. Louis.

No. 30: Galasso Learning Solutions

41.63% average growth rate over 3 years

Galasso Learning Solutions partners with accounting firms to provide custom training solutions for National Association of State Boards of Accountancy-certified continuing professional education. Melisa Galasso founded the company in 2016 and works to create educational programs that include real-world information and promote interactive learning, focusing on a company’s individual needs to meet their professional development objectives. Galasso provides live training events and webinars.

No. 31: Renu Energy Solutions

40.46% average growth rate over 3 years

Founded in 2010, Renu Energy Solutions is a Charlotte-based, full-service solar energy installer and provider of energy-saving products and services, such as energy storage and system monitoring. The company works in residential and commercial markets and has served over 4,500 homes and businesses across the Southeast. With offices in Charlotte, Raleigh, Asheville and Columbia. Renu provides end-to-end, customized solar solutions. It recently completed a high-profile project at New Belgium Brewery in Asheville.

No. 32: BuildingPoint Southeast

36.59% average growth rate over 3 years

BuildingPoint Southeast is a construction equipment supplier providing advanced hardware and software to help contractors build great projects. BuildingPoint Southeast provides such tools as 3D scanning, robotics, lasers and mixed-reality tools to digitally transform the design-build process. The company was founded in 2016 and serves the Carolinas, Georgia, Virginia and Washington, D.C.

No. 33: Armstrong Transport Group

36.12% average growth rate over 3 years

Armstrong Transport is a third-party logistics provider founded in 2006. The company is a non-asset-based freight brokerage with over 150 freight agent offices and 1,000 logistics professionals working around the country. In October, Armstrong Transport moved to larger offices in Vantage South End’s East Tower to accommodate future growth.

No. 34: Ekos

36.01% average growth rate over 3 years

Ekos is a business management technology platform for the craft beverage industry. The company helps more than 18,000 users on six continents drive efficiencies and power growth in their breweries, wineries, cideries and seltzer-making facilities. Ekos makes it easy to manage inventory, production, sales and accounting. It was founded in 2014 by CEO Josh McKinney and Greg Forehand; the pair grew the business from a garage operation to more than 65 employees.

No. 35: Urban Design Partners

35.31% average growth rate over 3 years

Urban Design Partners is a civil engineering firm focused on planning, landscape design, architecture, engineering and urban design. The company specializes in complex projects where design solutions connect people, nature and the economy. Urban Design operates offices in Charlotte, Raleigh and Rock Hill. Recent projects include Optimist Hall and work at Charlotte Douglas International Airport.

No. 36: Team Auto Group

35.23% average growth rate over 3 years

Team Auto Group is an automotive dealership for Buick, Chevrolet, GMC, Chrysler, Dodge, Jeep and Ram. Team Auto has grown from one to six dealerships across North Carolina since 2017. The company has pursued uncommon revenue streams to contribute to its financial success while providing new and pre-owned sales and service. It has nearly 400 employees.

No. 37: McFarland Construction

32.92% average growth rate over 3 years

McFarland Construction is a full-service commercial construction firm specializing in the delivery of projects through general contracting, design-build and construction management services. The firm offers pre-construction planning and project controls on a consulting basis. With headquarters in Charlotte, McFarland has satellite offices in Fayetteville and a recently opened location in Raleigh. Tino McFarland started the business in 2010 and has grown it into one of the largest Black-owned businesses in the Charlotte area.

No. 38: The Redbud Group

31.42% average growth rate over 3 years

The Redbud Group is a real estate team with Keller Williams SouthPark assisting homebuyers and sellers. Real estate broker and CEO Trent Corbin started the company in 2015 and has grown it to 60 agents in Charlotte and a team in Asheville. The Redbud Group is the official real estate partner of Charlotte FC.

No. 39: Let’s Talk Interactive

30.89% average growth rate over 3 years

Let’s Talk Interactive is a software company that develops easy, fast and safe virtual connections between people and professionals anywhere in the world. The company developed a virtual care ecosystem comprised of innovative telehealth solutions, software development, provider networks, medical hardware and 3D printing. The telehealth platform is an AWS Public Sector Partner providing access to more than 240 countries around the world.

No. 40: JLPollack CPA

30.82% average growth rate over 3 years

JLPollack CPA is an accounting firm focused on small to midsize businesses and the needs of individuals. James Pollack started the firm in 2011 and has grown it to eight accountants. The team guides clients through ever-changing tax laws and regulations and assists with real estate investments, capital gains and losses, unreimbursed employee expenses, education and child-care expenses and credits, multi-state returns and other scenarios. For small companies, JLPollack helps with business setup, income tax returns, payroll advice and sales tax.

No. 41: PresPro Homes

30.79% average growth rate over 3 years

PresPro Homes is a custom homebuilder constructing and renovating homes across the region and in Georgia. PresPro builds high-end, luxury homes and affordable, entry-level homes. The company has a division dedicated to building duplexes and homes to be turned into rentals. PresPro began in 2009 to renovate and repair homes that had returned to bank ownership after the housing crisis. The company won the top spot in the Fast 50 in 2017.

No. 42: Environmental Service Systems

30.42% average growth rate over 3 years

Environmental Service Systems is a national janitorial and facility maintenance company based in Charlotte. This minority-owned company provides custom maintenance, safety and training programs and green-cleaning options. Environmental Service Systems works with clients in the health care, industrial, retail, automotive, financial, energy and corporate headquarters sectors.

No. 43: NJR Construction

27.66% average growth rate over 3 years

NJR Construction is a subcontractor specializing in metal framing, drywall and acoustical ceilings. The company was formed in 2014. Past projects include the American Legion Memorial Stadium and Bechtler Museum of Art.

No. 44: City Wide Exterminating

19.91% average growth rate over 3 years

City Wide Exterminating is a family-owned pest-control company. Headquartered in Locust, City Wide offers residential and commercial solutions. Services include pest control, termite control, wildlife removal and moisture control and encapsulation.

No. 45: Plancentric Financial Group

19.65% average growth rate over 3 years

Plancentric Financial Group is an affiliate of Northwestern Mutual. The firm delivers an integrated approach to comprehensive financial planning and investment management. Services include financial planning, wealth management, retirement planning, risk management solutions, disability income planning and estate planning.

No. 46: FirstLight Home Care of Greater Charlotte

17.21% average growth rate over 3 years

FirstLight Home Care provides in-home assistance to seniors, new mothers, people recovering from surgery or those who just need extra help. Highly trained assistants provide services from meal preparation to personal care and companionship in 36 states. FirstLight champions family caregivers who give countless hours to their loved ones every day by providing the resources and support needed to help them maintain balance in their own lives.

No. 47: Prochant

15.32% average growth rate over 3 years

Prochant is a reimbursement firm focused on home medical equipment and pharmacy. The company helps health-care providers outsource their billing processes to accelerate cash flow from insurance payers with end-to-end revenue cycle management.

No. 48: Broad River Retail

15.30% average growth rate over 3 years

Broad River Retail is a home furnishings retailer and operator of Ashley Home Stores. The company operates 31 stores throughout the Southeast and three distribution centers.

No. 49: Perry’s Diamonds & Estate Jewelry

14.05% average growth rate over 3 years

Perry’s Diamonds & Estate Jewelry is a 45-year-old, family-owned jewelry store specializing in vintage and estate jewelry, engagement rings, loose diamonds, custom jewelry and repair. The SouthPark-area store is a staple of the local retail scene and employs 10 graduate gemologists.

No. 50: Jackrabbit Technologies

14.04% average growth rate over 3 years

Jackrabbit Technologies is a software company whose technology powers more than 12,000 gyms, dance studios and other athletic organizations with studio and class management systems offered through subscription.

We’re looking for 25 women from every industry and profession — women who have made a difference in their workplace and are blazing trails for other women. Nominate today!

© 2022 American City Business Journals. All rights reserved. Use of and/or registration on any portion of this site constitutes acceptance of our User Agreement (updated January 1, 2021) and Privacy Policy and Cookie Statement (updated July 1, 2022). The material on this site may not be reproduced, distributed, transmitted, cached or otherwise used, except with the prior written permission of American City Business Journals.

- Published in Uncategorized

This new feature will make Microsoft Word feel even more like Google Docs – TechRadar

- Published in Uncategorized

Component (Document) Content Management System (CCMS) Industry 2022: Complete Examination on Trends, Possibili – openPR

Component (Document) Content Management System (CCMS) Industry 2022: Complete Examination on Trends, Possibilities, and Barriers a

Permanent link to this press release:

All 5 Releases

- Published in Uncategorized

Edited Transcript of WDAY.OQ earnings conference call or presentation 29-Nov-22 9:30pm GMT – Yahoo Finance

Q3 2023 Workday Inc Earnings Call Pleasanton Nov 30, 2022 (Thomson StreetEvents) — Edited Transcript of Workday Inc earnings conference call or presentation Tuesday, November 29, 2022 at 9:30:00pm GMT TEXT version of Transcript ================================================================================ Corporate Participants ================================================================================ * Aneel Bhusri Workday, Inc. – Co-Founder, Co-CEO & Chairman of the Board * Barbara Larson Workday, Inc. – CFO * Doug A. Robinson Workday, Inc. – Co-President * Justin Allen Furby Workday, Inc. – Senior Director of IR * Luciano Fernandez Gomez Workday, Inc. – Co-CEO & Director * Peter Schlampp Workday, Inc. – Chief Strategy Officer ================================================================================ Conference Call Participants ================================================================================ * Aleksandr J. Zukin Wolfe Research, LLC – MD & Head of the Software Group * Bradley Hartwell Sills BofA Securities, Research Division – Director, Analyst * Brent John Thill Jefferies LLC, Research Division – Equity Analyst * David E. Hynes Canaccord Genuity Corp., Research Division – Analyst * Joshua Phillip Baer Morgan Stanley, Research Division – Equity Analyst * Kasthuri Gopalan Rangan Goldman Sachs Group, Inc., Research Division – Analyst * Mark Ronald Murphy JPMorgan Chase & Co, Research Division – MD * Raimo Lenschow Barclays Bank PLC, Research Division – MD & Analyst * Scott Randolph Berg Needham & Company, LLC, Research Division – Senior Analyst * Stewart Kirk Materne Evercore ISI Institutional Equities, Research Division – Senior MD & Fundamental Research Analyst ================================================================================ Presentation ——————————————————————————– Operator [1] ——————————————————————————– Welcome to Workday's Third Quarter Fiscal Year 2023 Earnings Call. (Operator Instructions) With that, I will now hand it over to Justin Furby, Vice President of Investor Relations. Thank you. Justin, you may begin. ——————————————————————————– Justin Allen Furby, Workday, Inc. – Senior Director of IR [2] ——————————————————————————– (technical difficulty) and Chano Fernandez, our co-CEOs; Barbara Larson, our CFO; Pete Schlampp, our Chief Strategy Officer; and Doug Robinson, our co-President. Following prepared remarks, we will take questions. Our press release was issued after close of market and is posted on our website where this call is being simultaneously webcast. Before we get started, we want to emphasize that some of our statements on this call, particularly our guidance, are based on the information we have as of today and include forward-looking statements regarding our financial results, applications, customer demand, operations and other matters. These statements are subject to risks, uncertainties and assumptions, including those related to the impact of the ongoing COVID-19 pandemic and recent macroeconomic events on our business and global economic conditions. Please refer to the press release and the risk factors in documents we file with the Securities and Exchange Commission, including our 2022 annual report on Form 10-K and our most recent quarterly report on Form 10-Q, for additional information on risks, uncertainties and assumptions that may cause actual results to differ materially from those set forth in such statements. In addition, during today's call, we will discuss non-GAAP financial measures, which we believe are useful as supplemental measures of Workday's performance. These non-GAAP measures should be considered in addition to and not as a substitute for or in isolation from GAAP results. You can find additional disclosures regarding these non-GAAP measures, including reconciliations with comparable GAAP results, in our earnings press release, in our investor presentation and on the Investor Relations page of our website. The webcast replay of this call will be available for the next 90 days on our company website under the Investor Relations link. Additionally, our quarterly investor presentation will be posted on our Investor Relations website following this call. Also, the customers' page of our website includes a list of selected customers and is updated monthly. Our fourth quarter fiscal 2023 quiet period begins on January 15, 2023. Unless otherwise stated, all financial comparisons in this call will be to our results for the comparable period of our fiscal 2022. With that, I'll hand the call over to Aneel. ——————————————————————————– Aneel Bhusri, Workday, Inc. – Co-Founder, Co-CEO & Chairman of the Board [3] ——————————————————————————– Thank you, Justin, and welcome to Workday's Third Quarter Fiscal '23 Earnings Conference Call. I'm happy to report that we had a solid Q3 as we once again outperformed across our key operating metrics. There is no question that the macro environment presents increased uncertainty, but as we've said before, we are well positioned in this type of environment because our cloud finance and HR solutions are truly mission-critical. As our Q3 results showed, more and more organizations are selecting Workday as their trusted partner to help them successfully navigate today's changing world. We remain confident in our ability to capitalize on the opportunity ahead and are pleased to announce our first-ever share repurchase program of up to $500 million under authorization. This program will help reduce the rate of our share dilution going forward and is driven by our belief that our share price is undervalued given the long-term growth opportunity ahead. Barbara will share details shortly, but know that we feel confident that we'll reach a scale where we can roll out this repurchase program while continuing to prioritize investing for long-term profitable growth. With that, I'd like to share some highlights from the quarter. In Q3, we further solidified our position as a leader in cloud HR with notable new HCM customers, including Intermountain Health, SGS and Texas Roadhouse. In addition, we had several key HCM go-lives, including Best Buy, Canadian Tire Corporation and the state of Oklahoma. For Workday Financial Management, we continue to see strong demand and momentum in Q3. Key new wins included a Fortune 200 provider of information technology solutions, Cincinnati Children's Hospital Medical Center, EZCORP and Thomas Jefferson University. It's important to note that each of these customers have also selected us for HCM, reinforcing the power of the full Workday platform and providing further evidence that companies are going all in with us. Key financial management go-lives during the quarter included City of Baltimore and Medical University of South Carolina. Q3 also saw us get back in person for Workday Rising, our annual customer conference for the first time since 2019. We had nearly 16,000 in-person and virtual attendees, and it was great to experience the energy and see firsthand how our community is growing and evolving. This was highlighted by the fact that this year's event has a large percentage of senior leaders, finance and IT attendees ever. One big takeaway from Rising is that our innovation story is resonating with customers as we evolve to be more open and connected. While we've traditionally targeted the offices of CHRO and CFO, we have placed increased focus recently on the office of the CIO, which presents another growth opportunity for us. One solution in particular that was a popular topic among IT attendees was Workday Extend. Workday Extend lets customers and partners build their own unique solutions on top of Workday, which is a huge point of emphasis for CIOs and, in their eyes, positions us even more as a true platform player. While we announced several availability at Workday Extend in 2020, we've continued to see accelerated demand for it over the last year as the need for organizations to quickly innovate and adapt in today's business environment increases. We also announced new more personalized UX enhancements that meet every type of Workday user in the natural flow of their work such as mobile devices, Microsoft Teams and Slack, which helps us to address another CIO priority as they are more focused than ever on driving increased employee engagement. And finally, we further reinforced our leadership in artificial intelligence and machine learning with the announcement of next-generation skills technology that allows customers to more easily and securely bring skills data in and out of Workday. This helps customers leverage the full power of machine learning to gain deeper insights into their workforce skills and deliver more personalized employee experiences. In closing, we once again delivered a solid quarter with strength across a number of key growth initiatives, showcasing why Workday is the backbone of digital business. And while we expect that the macro uncertainty will cause our growth to moderate in the near term, we continue to believe we are well positioned to navigate this environment and emerge even stronger. Driving constant innovation to address our customers' evolving needs has always been key to our success and will continue to be our focus in this environment. With that, I'll turn it over to our co-CEO, Chano Fernandez. Chano, over to you. ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [4] ——————————————————————————– Thank you, Aneel, and thank you to everyone for joining today's call. I want to start off by offering my sincere thanks to the more than 17,500 Workmates that help us deliver another solid quarter. Your relentless focus on the customer continues to push us and the broader Workday community forward. Great job, team. I've been on the road a lot the last few months, including Workday Rising in Europe which has wrapped up in Stockholm and Workday Rising in U.S. back in September. I've had the opportunity to spend time with hundreds of customers and prospects, and there are a couple of key themes emerging. First, despite all the challenges that companies are facing today, they increasingly realize the present need to modernize their HR and financial systems. The executives that I speak with have different viewpoints on what the macroeconomic climate will look like in the year ahead. But one thing they agree on is that the change is constant and it's nearly impossible to navigate with legacy systems. Second, there is a clear desire to consolidate and prioritize spend across a new organization's more strategic technology vendors. Given our positioning as the backbone of digital business across HR and finance, this trend has led to more and more companies going all in with Workday as they look to harness the power of their data across the enterprise. And when I look at our solid Q3 results across both the large and medium enterprise, it's a direct validation of these themes being seen across organizations of all sizes. From a geographic standpoint, we saw solid results across North America with a number of CoreHR and FINS wins that Aneel mentioned, in addition to several strategic expansions across the Fortune 500. APA also outperformed with wins at Bank of Queensland, Fletcher Building, [Ono] Pharmaceutical and Trip.com, to name a few. And in EMEA, we had a number of important wins and expansions, including SGS, [Allianz] Medical Group and Equiniti. Our customer base sales team once again saw outstanding growth, a direct reflection of the trust that customers are placing in us and a validation of our strategy. We drove very strong renewal rates in Q3, and we closed a number of strategic expansions at companies such as Accenture, University of Maryland, the state of Nebraska, Pick n Pay, Puma and VF Corporation. As we shared at our recent Analyst Day, our customer base momentum is being driven by our broad portfolio. Solutions such as Journeys, Help and Talent Optimization, for example, are seeing strong adoption as customers look to support employee experience, while our scheduling, time tracking and payroll solutions are all resonating as customers increasingly focused on labor optimization. And other products such as Planning, Extend, Accounting Center, VNDLY and our Spend Management solutions are all contributing to this quarter's strength across the customer base. Our industry focus continues to pay off. In Q3, nowhere was this more evident than the health care vertical where we had a strong growth in new ACV and where we surpassed $0.5 billion in annual recurring revenue. By far, the 2 largest costs for health care organizations are labor and materials. And by leveraging our full suite of HCM, FINS and supply chain solutions, they are able to help optimize spend across these critical areas. In fact, all of our larger Q3 health care wins were full suite and including Workday's supply chain management. We also saw healthy momentum within the professional services industry highlighted by the aforementioned expansion at Accenture as we continue to co-innovate across the Workday platform, including significant new developments in the skills cloud, public cloud and accessibility. Other strategic wins in the professional services industry included Novozymes and Reed Global, which was a full suite win. Our expanding partner ecosystem is also becoming an increasingly important driver of our growth. Key to our strategy is driving core innovation across the platform, which increases the differentiation of our solutions, enables even faster innovation to address real-time customer challenges and allows our partners to leverage their deep industry and solution insights to differentiate in the market. Examples of recent partner-driven innovation built on the Workday platform include Accenture's digital revenue operations solution, which integrates CPQ capabilities with Workday's billing and revenue automation to enable seamless quote-to-cash functionality for software and technology companies. Another great example is employee document management, built by partner Kainos on Workday Extend, which provides our customers with advanced document generation, access control storage and finely tuned document retention rules. These are just a few several solutions that were recently released by our partner ecosystem, and we have dozens more on the road map. As we move into our fourth quarter, the environment remains uncertain, which has led to increased scrutiny and the lengthening of certain sales cycles, particularly with the net new opportunities. While we aren't immune to this and see signs that it will persist into next year, we are confident in our diverse pipeline and are focused on executing in Q4 and laying a strong foundation for FY '24 and beyond. With that, I will turn it over to our CFO, Barbara Larson. Over to you, Barbara. ——————————————————————————– Barbara Larson, Workday, Inc. – CFO [5] ——————————————————————————– Thanks, Chano, and good afternoon, everyone. As Aneel and Chano mentioned, we delivered solid Q3 results in the face of continued economic uncertainty, a testament to strong execution across the company as well as the strategic and mission-critical nature of our solutions. Subscription revenue in Q3 was $1.43 billion, up 22% year-over-year, and professional services revenue was $167 million, up 7%. Total revenue outside of the U.S. was $394 million, representing 25% of total revenue. 24-month backlog at the end of the third quarter was $8.62 billion, growth of 21%. The result was driven by solid new business sales and strong renewals, with gross and net revenue retention rates over 95% and over 100%, respectively. Total subscription revenue backlog at the end of Q3 was $14.10 billion, up 28%. Our non-GAAP operating income for the third quarter was $314 million, resulting in non-GAAP operating margin of 19.7%. Margin overachievement was driven by revenue outperformance, favorable cost variances across the business and the timing of certain expenses shifting into Q4. Q3 operating cash flow was $409 million, growth of 6%. Our cash flow this quarter was impacted by a $55 million semiannual interest payment associated with our Q1 debt offering. We also paid off the principal balance on our $1.15 billion convertible debt with cash in October, resulting in a reduction to our non-GAAP diluted share count of roughly 8 million shares. Given the late Q3 timing, this share count reduction will be fully reflected in our non-GAAP weighted average share count in Q4. During the quarter, we successfully added approximately 600 net new employees, ending Q3 with a global workforce of more than 17,500. We expect a strong moderation of hiring as we move into Q4, but we'll continue to add key talent across strategic growth areas of the business, notably go-to-market and product and technology. Overall, we're extremely proud of the strong company-wide performance in Q3, and we're focused on executing in Q4, our seasonally strongest quarter of the year. Now turning to guidance, which reflects both the continued momentum in our business while also balancing an uncertain macro environment. With that context, our guidance for FY '23 subscription revenue is now $5.555 billion to $5.557 billion, representing 22% year-over-year growth. We expect Q4 subscription revenue to be $1.483 billion to $1.485 billion, 21% year-over-year growth. We now expect professional services revenue to be $645 million in FY '23 with the slight reduction driven by the delay of a large project. For Q4, we expect professional services revenue of $147 million. We expect 24-month backlog to grow approximately 19% year-over-year in Q4. We expect Q4 non-GAAP operating margin of approximately 17.5%, which includes some expenses that shifted out of Q3. Our FY '23 non-GAAP operating margin guidance is now 19.2%. GAAP operating margins for both the fourth quarter and the full year are expected to be approximately 23 percentage points lower than the non-GAAP margins. This includes a change to our employee stock plan that will take effect in Q4 to provide more flexibility to our employees during the open trading window each quarter. Our vesting date will move from the 15th to the 5th of each month for all outstanding grants, resulting in an acceleration of stock-based compensation expense of approximately $30 million in Q4. This change will result in reduced stock-based compensation expense by the same amount over the next few years and has no impact on our dilution. The FY '23 non-GAAP tax rate remains at 19%. We are maintaining our FY '23 guidance for operating cash flow of $1.64 billion, but are reducing our capital expenditures outlook to approximately $375 million, reflecting the timing of certain data center and real estate investments being pushed out to future periods. And as Aneel mentioned, we are pleased to announce a share repurchase program with authority to repurchase up to $500 million in shares over an 18-month period. We will continue to prioritize allocating capital towards organic innovation, followed by targeted M&A, but given our strong balance sheet and free cash flow, we intend to use a portion of our capital towards the repurchase of shares, enabling us to partially offset future dilution from employee stock programs. This repurchase program is a direct reflection of our confidence in the business and our view that our shares are currently undervalued. While we are early in our planning cycle for next year and have an important Q4 ahead, we'd like to provide a preliminary view of FY '24. As discussed at our Financial Analyst Day, we have a significant long-term opportunity and multiple growth levers that drive our goal of sustaining 20% plus subscription revenue growth on our path to $10 billion in revenue. While this remains our multiyear goal, given the continued macro uncertainty, we believe it's prudent to provide a preliminary FY '24 subscription revenue range of approximately $6.5 billion to $6.6 billion or 17% to 19% year-over-year growth. This outlook takes into account the lengthening of sales cycles that we're currently seeing impact our net new business. From a margin standpoint, we currently expect FY '24 non-GAAP operating margin expansion of 150 to 200 basis points from FY '23 levels, placing us firmly on track to our target of 25% non-GAAP operating margin and 35% operating cash flow margin at $10 billion in revenue. The expected margin expansion is driven by the scalability of our model, a strong moderation of hiring and ongoing expense discipline. We plan to operate the business with agility, and we'll continue to appropriately balance growth investments based on what we see in the underlying market environment. And finally, I'll close by thanking our amazing employees, customers and partners for their continued support and hard work. With that, I'll turn it over to the operator to begin Q&A. ================================================================================ Questions and Answers ——————————————————————————– Operator [1] ——————————————————————————– (Operator Instructions) Our first question is from Kash Rangan with Goldman Sachs. ——————————————————————————– Kasthuri Gopalan Rangan, Goldman Sachs Group, Inc., Research Division – Analyst [2] ——————————————————————————– Fabulous, fabulous quarter given the macroeconomic conditions. I was wondering if you could give us some perspective. In some sense, this is a recession that everybody has been expecting, nobody's going to be surprised. I was wondering if you could offer some insights into how Workday has been able to execute so well during a tough time and other software companies are facing headwinds. And to the extent we get some relief next year, if the economy does improve, could you do even better considering that your results are actually quite impressive? ——————————————————————————– Aneel Bhusri, Workday, Inc. – Co-Founder, Co-CEO & Chairman of the Board [3] ——————————————————————————– Well, I don't think we'll comment next year just quite yet, Kash, but thank you for the kind comments. I think the value proposition of our products works in a downturn just as it does in a good market, just like we did in 2008, 2009 and every other downturn. Chano, do you want to add anything? ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [4] ——————————————————————————– No, I think I agree with what you said, Aneel. I believe the mission-critical applications of our solutions really resonates with our customers as they are modernized in their HR and finance solution. And as I said in my comments as well, Kash, there is a consolidation of spend across strategic (inaudible) vendors, and we clearly are being one of those these days. ——————————————————————————– Operator [5] ——————————————————————————– Our next question is from Kirk Materne with Evercore. ——————————————————————————– Stewart Kirk Materne, Evercore ISI Institutional Equities, Research Division – Senior MD & Fundamental Research Analyst [6] ——————————————————————————– I'll echo the congrats on a really nice quarter in a tough environment. I guess, Chano, you talked about some deal cycles extending. I was just wondering if you could talk a little bit about what you're seeing at the top of the funnel. Obviously, you guys sort of came out perhaps of the COVID recession a little bit later than some others. I think there's a fear out there that once we get through this current wave of deals in your pipeline, that there might be some sort of cliff in terms of net new billings. But it sounds like you guys feel pretty good about your pipeline. So I was wondering if you could just sort of expand on that. ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [7] ——————————————————————————– Thank you for your question, Kirk. Overall, companies continue to prioritize HCM and financials transformations, and we see ongoing momentum in important growth areas like our customer base team, what is a clear market trend, as I said, towards consolidation of vendors and as well the medium enterprise. There's good pipeline momentum, but maybe, Doug, you can add some color in terms of pipeline and deal dynamics overall. ——————————————————————————– Doug A. Robinson, Workday, Inc. – Co-President [8] ——————————————————————————– Yes. I think — well, you captured 2 of it, which is I describe, Kirk, as — we've got diversity of revenue streams. So as Chano mentioned, medium enterprise performed well. We've got the customer base motion. And that was a theme that I certainly heard at our customer conferences is our large customers wanting to consolidate, rationalize number of suppliers and expand their footprint with us. So I think that certainly helps. In terms of like top of the funnel sort of the core of your question, it's really interesting in that our Q3 pipeline build, so the pipe we're building now, which is largely about next year, met our internal targets. So we're seeing project formation. At the same time, we're seeing some projects elongate. I think Chano mentioned this, but they tend to be large enterprise net new. Those projects have extra steps to complete. At the same time, at the top end, the starting of projects is meeting the goals that we've established internally. ——————————————————————————– Operator [9] ——————————————————————————– Our next question is from Mark Murphy with JPMorgan. ——————————————————————————– Mark Ronald Murphy, JPMorgan Chase & Co, Research Division – MD [10] ——————————————————————————– Yes. And I'll add my congrats. I'm interested in whether it's possible that the volatility of this type of environment where you have so many vectors moving around inflation, interest rates, FX, supply chain issues. Is it possible that it's coming together in a way that really elevates the Workday value prop with integrated planning, cloud-based, maybe more so than in the smooth sailing environment that we had in the last decade? Because as Kash mentioned, you're navigating your way through this very well. I'm just wondering if you see any effect of that. Maybe it's increasing some of your win rates and maybe it builds up a little pent-up demand for some time in the future when the environment starts to improve. ——————————————————————————– Aneel Bhusri, Workday, Inc. – Co-Founder, Co-CEO & Chairman of the Board [11] ——————————————————————————– Well, I guess I'd start with I wish that was the case across the board. We definitely see some — you see — in a downturn, you see some movement to — well, I got to get on the right stuff to help me manage through these volatile environments. At the same time, there are other customers that are just cautious in making new decisions. And so I think they tend to balance each other out. I'm not sure there's a — I'm not sure it's a big boost for us or a big negative for us. We're all seeing the same environment. But there are definitely customers who are behind on making the transition. I feel like this is a catalyst to make that transition. And then there are others who already made the transition that maybe think, "Hey, let's be cautious on follow-on purchases." Chano, anything to add? ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [12] ——————————————————————————– Nothing to add. ——————————————————————————– Operator [13] ——————————————————————————– Our next question is from Keith Weiss with Morgan Stanley. ——————————————————————————– Joshua Phillip Baer, Morgan Stanley, Research Division – Equity Analyst [14] ——————————————————————————– This is Josh Baer on for Keith. I was hoping you could expand a bit on the macro assumptions that are embedded in that FY '24 subscription revenue guidance range. Just wondering what areas get worse, what stays the same when thinking about different geographies as well as new business from new logos or expansion and renewals from existing customers. ——————————————————————————– Barbara Larson, Workday, Inc. – CFO [15] ——————————————————————————– Josh, thanks for your question. So the guidance range that we provided is our best view at this time. It takes into account the continued momentum across important growth areas such as customer base, medium enterprise, but also balancing that with lengthening sales cycles that we're seeing impact our business, particularly our net new opportunities. So given the uncertain environment, we provided an estimated subscription revenue range with that low end of the range, assuming a larger impact to sales cycles than we're currently seeing today. ——————————————————————————– Operator [16] ——————————————————————————– Our next question is from Brad Zelnick with Deutsche Bank. Our next question is from Alex Zukin with Wolfe Research. ——————————————————————————– Aleksandr J. Zukin, Wolfe Research, LLC – MD & Head of the Software Group [17] ——————————————————————————– I'll extend my congratulations not only on the quarter, but on the prescriptiveness of the guide, both on top and bottom line, in what is clearly a very uncertain and tenuous environment. So I guess maybe just the first one, if we look at the patterns emerging in the sales cycles in the business, I guess, Aneel or Chano, can you guys compare and contrast this with — from a pipeline perspective going into 4Q, what are you expecting the impact to be in your biggest quarter on bookings, on new ACV growth, on — and maybe FINS versus HCM specifically where you feel a little bit better or compare and contrast that I think would be super helpful? ——————————————————————————– Aneel Bhusri, Workday, Inc. – Co-Founder, Co-CEO & Chairman of the Board [18] ——————————————————————————– Well, let me just offer a high-level commentary. I spent a lot of time with other CEOs, and this is not 2008, 2009. No one sees the world coming to an end like they did at that time. I think right now, we're in a world of caution, where no one's quite sure what's going to happen, but things don't feel really bad. And so — but caution and stopping can sometimes look the same. And so it's kind of hard to predict right now. Every CEO I talked to is still relatively feeling positive about their business, but worried about the economic underpinnings of what the fed is doing and the potential recession. And so I think the word that I keep coming back to is everybody is cautious. And I don't know how that — Chano, how do you think that reflects in the pipeline in Q4 and other quarters? But it's — this is not an end-of-the-world scenario, not at least yet, like '08, '09. ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [19] ——————————————————————————– Yes. Thank you, Alex, for your question. I would say, first, when it comes to HCM or FINS, we don't see any significant difference between one or the other. So they're proportionally impacted given the macro environment. When it comes to Q4, I would say we had the pipeline to execute on the quarter. Of course, that usually will not manifest as a prioritization because those projects have been already prioritized, but it may happen some lengthening of sales cycles as we said before, particularly on net new deals and opportunities that they're more scrutinized on those, right? And Doug already commented on the growth pipeline for next year. ——————————————————————————– Aleksandr J. Zukin, Wolfe Research, LLC – MD & Head of the Software Group [20] ——————————————————————————– Perfect. And then, I guess, if I think about what you're saying around net new and how well I think you're doing on renewals and selling into the base specifically, is it fair to assume that in the near term, there could be a bit more bookings concentration coming from existing customers? And kind of how well — how important is that dynamic that informs some of your margin commentary for next year, given it should be a little bit easier, it should be a little bit more predictable to sell into the base? ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [21] ——————————————————————————– Yes, Alex, it is fair to assume that there will be more concentration on the customer base and areas like medium enterprise, as we said before. And then hence, we'll put more focus on both marketing environments and sales go-to-market environment into those areas. Of course, that will potentially provide higher yield on these times. ——————————————————————————– Operator [22] ——————————————————————————– Our next question is from DJ Hynes with Canaccord. ——————————————————————————– David E. Hynes, Canaccord Genuity Corp., Research Division – Analyst [23] ——————————————————————————– Maybe building off Alex's last question there. I mean there's lots of interesting partner commentary in the script. I'm curious about the level of collaboration you have with partners on what they're working on with Extend or an industry accelerators. And assuming you have visibility there, maybe you could talk a bit about like where you draw the line on what Workday might own or build directly versus what you let go to partners. ——————————————————————————– Aneel Bhusri, Workday, Inc. – Co-Founder, Co-CEO & Chairman of the Board [24] ——————————————————————————– Pete, do you want to talk about the product side first? And then Chano can talk about the partner side. ——————————————————————————– Peter Schlampp, Workday, Inc. – Chief Strategy Officer [25] ——————————————————————————– Sure. Thanks again for that question. As you heard us talk about the momentum with Extend that we've seen recently has been great, we talked about that a lot, both in Stockholm and in Orlando at our user conferences this year, now over 750 applications in production. When it comes to where that momentum is coming from, it is customers and it is partners as well. Partners are beginning to build on the Extend platform and Extend Workday applications as well as build net new applications that connect with HCM and financials. So far, the — our customers have been getting value through both of those. The question of where do we draw the line between what is ours and what is our partners, I'll hand over to Chano. ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [26] ——————————————————————————– Yes, I think as I commented on some of my prepared remarks, I mean clearly driving co-innovation with our partners across the platform is very critically important. You would say, where you draw the line when something is kind of you would define or I would define the last mile in a particular industry or we need some more content-driven specific understanding of that value add in that industry with a partner, there's where we see an opportunity to collaborate with our partners. I mentioned some of these solutions that we're building with (inaudible) for different industries, like the revenue operation solution, again, that is very critical to the software and technology companies. There are others that would be a bit more, let's say, across industries like the document management, employee document management that I provided on. But honestly, we don't see that as a core, let's say, value add from us in terms of building that solution. But, of course, it's adding value to our customers there and partners take just advantage of the maturity of Extend to bring that value add that is resonating with our customers. So we're really pleased, as you can imagine, that customer partners can differentiate and bring additional offering to our customers. ——————————————————————————– David E. Hynes, Canaccord Genuity Corp., Research Division – Analyst [27] ——————————————————————————– Yes, makes sense. And then, Barbara, maybe I could sneak in a follow-up for you. The buyback is great to see as analysts always ask for more. Why not be more aggressive given where the stock is, the strength of the balance sheet, expected cash generation next year? Like what were the considerations there? ——————————————————————————– Aneel Bhusri, Workday, Inc. – Co-Founder, Co-CEO & Chairman of the Board [28] ——————————————————————————– I'll answer that one because I think Barbara probably wanted to do more. You just don't know what you're going into a tough economic environment and cash is king. And so we wanted to be conservative. And if we come out in a good market environment in the next 6 to 9 months, you definitely could see more, but there's just a balance of risk. ——————————————————————————– Operator [29] ——————————————————————————– Our next question is from Raimo Lenschow with Barclays. ——————————————————————————– Raimo Lenschow, Barclays Bank PLC, Research Division – MD & Analyst [30] ——————————————————————————– Chano, the one thing that we're seeing in the industry at the moment is that there seems to be more money in HR post pandemic with a great reshuffle, et cetera. Could that — are you seeing that in terms of like interest of pockets over customers are? And do you think that's kind of more a short-term thing and we're at the back part of that trend? Or do you think HR, HCM strategically is having a new position in the enterprise? ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [31] ——————————————————————————– Thank you, Raimo, for your question. I think both of them, to be honest, has some good tailwind out of the pandemic, but clearly, of course, that nets out or balance out with the macro environment we are living into. But I would say that some of the financial transformations, we see those in the market, and they are taking place as we speak. As a dynamic of companies having a tough time to just navigate through their finance modernization or honestly doing simple things like closing their books online in terms of many legacy platforms and in terms of a lot of manual processes that could just not happen once you were not in the office. Clearly, employee engagement as a whole in HCM, the skills area, all the machine learning and AI that we're bringing to those processes are obviously value add the companies do see and want to take advantage of and continue to be a great tailwind for the HCM value proposition as a whole. ——————————————————————————– Raimo Lenschow, Barclays Bank PLC, Research Division – MD & Analyst [32] ——————————————————————————– Yes. And then 1 follow-up is if you think about selling in this kind of slightly more tougher environment, can you talk a little bit maybe about the steps you're taking in terms of sales execution to kind of make sure you continue to deliver in this market? I'm thinking about higher pipeline coverage, kind of making sure you kind of — you time the deals better, et cetera. Like where are we on that journey of implementing these kind of recession handbook kind of selling kind of policies that we used to take out in the older days? ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [33] ——————————————————————————– Doug, do you want to add some color there on the sales strategy in the market? ——————————————————————————– Doug A. Robinson, Workday, Inc. – Co-President [34] ——————————————————————————– Yes, sure. I think Aneel or you, Chano, might have mentioned it after Q1, but we pivoted to our ROI-based and TCO-based way to engage with customers right at Q1. Of course, we've always done business cases with our customers. But entering tougher environments, it comes down to TCO, hard dollars that you can take out, system rationalization productivity. So I think it's showing up really focusing with our customers on the HR side. So there's no doubt, tight labor markets. And so that's driving, I think, the TCO on that side of it. And it was touched on earlier by Aneel. We had a really good Q3 as it relates to financials. So FINS+ performed well. And those are ROI-driven as well. And those are companies looking for — sure, it might start with an aging — retiring older systems, but it pivots pretty quickly when they engage with us through that plan, execute, analyze and offering up more business agility in an uncertain environment. So those are the things from a go-to-market, from a field deployed resources standpoint that we're spending a lot of time with customers on, on the business case. ——————————————————————————– Operator [35] ——————————————————————————– Our next question is from Brad Sills with Bank of America Securities. ——————————————————————————– Bradley Hartwell Sills, BofA Securities, Research Division – Director, Analyst [36] ——————————————————————————– I wanted to ask a question around backlog for next year. I think, Chano, you made some comments that you feel good about Q4 pipelines heading into Q4. And the question on everyone's mind is really what about next year. There's a lot of moving parts. In your conversations with office of CFO, office of HR, what are they saying with regard to budgets for next year? Do you feel pretty confident that you can sustain this kind of growth into next year as well? ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [37] ——————————————————————————– Well, Brad, thank you for your question. Right now, we're exactly on those discussions, right, where companies are going through their planning and budgeting cycles, and it is a question of prioritization of projects. And we're having those discussions that, that was commenting on that are really TCO- and ROI-based, right? So clearly, here where you see some different scenarios on our guidance, particularly depending on what happens on some of the new local sales cycles that might put some lengthening. And clearly, even though they might be building right now, maybe fall outside of next year or some of them that just may be pushing forward. But right now, we're having most of those discussions. Overall, we feel good given the momentum we have and given the momentum on the new pipeline build and the conversations we're engaging with and the strength of our customer base, our medium enterprise and the diversity of our business, as Doug has commented. But clearly, we are cautiously monitoring what's going on in the environment. ——————————————————————————– Bradley Hartwell Sills, BofA Securities, Research Division – Director, Analyst [38] ——————————————————————————– And then one more, if I may, please, just on the verticals. You called out some strength in financials, health care. Is there a case to be made that perhaps you guys have more exposure to more resilient verticals with those, in particular, public sector education kind of less affected by perhaps the macro? ——————————————————————————– Aneel Bhusri, Workday, Inc. – Co-Founder, Co-CEO & Chairman of the Board [39] ——————————————————————————– We're pretty diversified across all the industries and some have held up better than others. When I look at what's happening in Silicon Valley, we definitely have a bunch of tech companies, but we're not exposed to tech the way maybe a newer company might be where they got a huge amount of exposure to just tech companies. So — and our tech companies tend to be the mature large companies. So I don't think there's any particular sector that's held us up. I would say financial services is strong, though. The one beneficiary of rising interest rates is the financial services sector and they continue to grow, and we have a very strong presence there. ——————————————————————————– Operator [40] ——————————————————————————– Our next question is from Brent Thill with Jefferies. ——————————————————————————– Brent John Thill, Jefferies LLC, Research Division – Equity Analyst [41] ——————————————————————————– Aneel, just to follow up on the verticals. A number of the partners have been talking about strength in state and local government and higher ed. I'm curious if you could drill in on those 2 to give us a sense of what you're seeing right now in both those sectors. ——————————————————————————– Aneel Bhusri, Workday, Inc. – Co-Founder, Co-CEO & Chairman of the Board [42] ——————————————————————————– I may turn that one over to Doug to talk about. Doug, are you there? ——————————————————————————– Doug A. Robinson, Workday, Inc. – Co-President [43] ——————————————————————————– Yes, sorry about that. I was on mute. The question was around education, government. Is that correct? ——————————————————————————– Brent John Thill, Jefferies LLC, Research Division – Equity Analyst [44] ——————————————————————————– State and local and higher ed. ——————————————————————————– Doug A. Robinson, Workday, Inc. – Co-President [45] ——————————————————————————– Yes. So both performed well in the quarter. We had a number of student — Workday student deals, which for a while there, we were doing a number of financials, HCM on the higher ed side, but we took down some student deals in the quarter and showed really nice growth in Q3. And so we feel good about both of those verticals right now. ——————————————————————————– Brent John Thill, Jefferies LLC, Research Division – Equity Analyst [46] ——————————————————————————– Barbara, can I just follow up real quick on international? It was the lowest growth in 5 quarters. Is there anything to point out in Europe versus the U.S. kind of just the classic still over what we've been hearing? Or is there anything specific on an execution? Can you just compare and contrast what you're seeing? ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [47] ——————————————————————————– I would say, clearly, the environment is more uncertain in Europe. Obviously, on top of everything else going on in the world, we have energy as a big challenge. And where we see, let's say, an increase signs of deals and sell cycles lengthening that tends to happen in Europe. And I would say, in general, we are more cautious overall what's going there in the near relative terms than in other markets and other segments. ——————————————————————————– Operator [48] ——————————————————————————– We have time for 1 final question from Scott Berg with Needham. ——————————————————————————– Scott Randolph Berg, Needham & Company, LLC, Research Division – Senior Analyst [49] ——————————————————————————– I guess this one will be relatively straightforward as you all called out slowness in the enterprise segment a couple of different times. We talked about the mid-market being, I guess, relatively untouched. Can you help us kind of understand maybe what's going on in the mid-market to not really see any weakness today? I think that's an interesting kind of a change at least relative to what we're seeing out there. And then as we think about the guidance within the mid-market, is the slowness or maybe additional macro uncertainty that's impacting the low end of the guidance, do you have some sort of conservatism baked into any potential slowdown in the mid-market also impacting that guidance? ——————————————————————————– Luciano Fernandez Gomez, Workday, Inc. – Co-CEO & Director [50] ——————————————————————————– Yes. I guess we've not said that the mid-market is not impacted. What we said is that, of course, we had overall more strength in the medium enterprise and in the customer base. If you look at what it tends to happen more scrutiny around either the business case or additional approvals, clearly, those are on the larger deals and larger companies that we usually — we tend to see it more. Our value proposition is strong and resonates and quicker time to value fixed cost of implementations, very predictive ones across HCM and finance in the mid-market, brings good ROI, brings good total cost of ownership in terms of the financials and main transformation as a whole, and that is a value proposition that mid-market is taking the same on a faster clip as they are modernizing and they're assisting on their platforms. ——————————————————————————– Operator [51] ——————————————————————————– Ladies and gentlemen, thank you for your participation in today's conference. This will conclude Workday's Third Quarter Fiscal Year 2023 Earnings Call. Thank you again for joining us.

Related Quotes

With U.S. stocks down more than 20% so far this year, investors are looking for some good news – and it may be coming from a prominent Wall Street analyst who says the current bear market could come to an … Continue reading → The post Top Morgan Stanley Strategist Says This Is When the Bear Market ‘Will Be Over Probably' appeared first on SmartAsset Blog.

Dividend stocks. They’re the very picture of the reliable standby, the sound defensive play that investors make when markets turn south. Div stocks tend not to show as extreme shifts as the broader markets, and they offer a steady income stream no matter where the markets go. And it’s not just retail investors who move into dividend stocks. Recent regulatory filings show that billionaire Steve Cohen has bought big into high-yield dividend stocks. Cohen has built a reputation for success, and his

Want the recipe for a wildly successful investment? Take a large measure of market leadership, add a smidgen of secular tailwinds, and top it off with a large addressable market.

PayPal Holdings, Inc (NASDAQ: PYPL) shares shed over 61% year-to-date. The shares have lost 5.5% in the last month and over 11% over the previous six months. On November 29, Deutsche Bank analyst Bryan Keane said Salesforce, Inc's (NYSE: CRM) new data shows Apple Inc (NASDAQ: AAPL) Pay growing at an "extremely rapid pace," up 52% Y/Y month-to-date in November globally and 59% Y/Y in the U.S. while, over the same period, PayPal adoption has fallen 8% globally and 4% in the U.S. Also Read: PayPal

The Chinese EV maker has surged more than 50% despite an earnings miss and slashed guidance

Yahoo Finance Live examines Boeing shares after United Airlines orders dozens of 787 Dreamliner jets.

A major energy company that pledged to sell its interests in Russia has yet to do so.

Boeing could be close to a major win over rival Airbus amid reports of a big 787 Dreamliner order by United Airlines.

What happened Costco Wholesale (NASDAQ: COST) investors were in the red on Friday. The retailer's stock fell 2% by 3 p.m. ET compared with a 0.6% decline in the S&P 500. That drop pushed the stock down further in 2022, although shares are modestly outperforming the market's 13% loss so far this year.

After this year’s mauling, you can finally get a steady stream of retirement income from Treasury inflation-protected securities, or TIPS

The burgeoning EV industry is seeing demand for lithium soar to previously unseen levels. These three lithium mining stocks are positioned well for the future — and also pay regular dividends.

“The problem was, he took our money. And so he needs to get prosecuted,” says Novogratz, whose Galaxy Digital disclosed $76.8 million exposure to FTX.

Apple (NASDAQ: AAPL), Nvidia (NASDAQ: NVDA), and Advanced Micro Devices (NASDAQ: AMD) have each proven themselves as excellent growth stocks, with their share prices seeing triple-digit growth in the last five years despite declines this year. As the most valuable company in the world by market cap, it's hard to argue against investing in Apple. For instance, people who buy an iPhone are more likely to choose Apple again when looking for a laptop, smartwatch, or tablet in the future, thanks to the effortless connectivity between its products.

(Bloomberg) — Stock investors’ optimism around a cooling labor market and a Federal Reserve pivot is overdone, according to Bank of America Corp. strategists, who recommend selling the rally ahead of a likely surge in job losses next year.Most Read from BloombergMusk’s Neuralink Hopes to Implant Computer in Human Brain in Six MonthsGoldman Jolts Traders With Bonus Warning After Bumper HaulMusk Suspends Ye From Twitter After Offensive Image PostBeverly Hills Cop Was California’s Highest-Paid Mun

Capitulation occurs when investors give up because of despair, the last emotional stage of bear market grief.

Weaker demand for lumber has weighed on prices, making it one of the biggest commodity price decliners this year. The outlook isn’t good, either.

Thanks to a mild obsession with so-called “cash stuffing” — which has racked up more than 700 million views on TikTok — Gen Z has made an old-school money hack a viral sensation. Cash stuffing is a technique that encourages people to pay for things with cash, and as a result, they should end up saving more of their money. If this sounds familiar, that’s because it is: Cash stuffing mimics a strategy used by Dave Ramsey, known as the envelope system.

When people think of the players that dominate the Las Vegas Strip, their thoughts generally turn to Caesars Entertainment and MGM Resorts International , which dominate the south and central parts of the Strip. Caesars owns its namesake Caesars Palace, Harrah's, Planet Hollywood, the Cromwell, the Flamingo, Bally's (soon to be Horsehoe), the Linq, and Paris Las Vegas. After that, thoughts turn to other players like Wynn Resorts , the brand new Resorts World International, and the Venetian, which is operated by Apollo Global Management .

Telecom giant AT&T (NYSE: T) has been dead money for years. Its share price is down 25% over the past decade. But AT&T's recent success in getting out of the entertainment business and growing its wireless business could change the stock's trajectory.

Bionano Genomics, Inc. (BNGO) witnesses a hammer chart pattern, indicating support found by the stock after losing some value lately. This coupled with an upward trend in earnings estimate revisions could mean a trend reversal for the stock in the near term.

- Published in Uncategorized

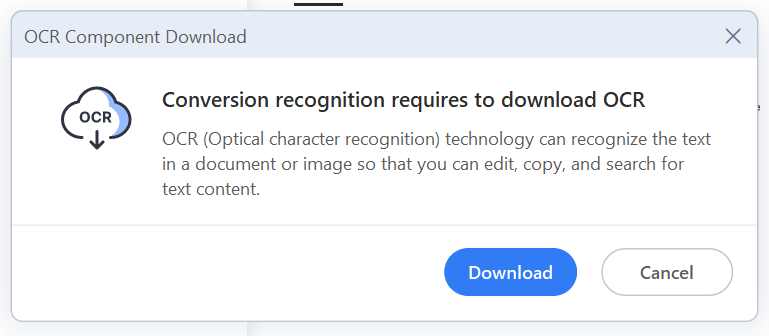

Wondershare PDFelement: A Powerful and Affordable PDF Editor – SitePoint

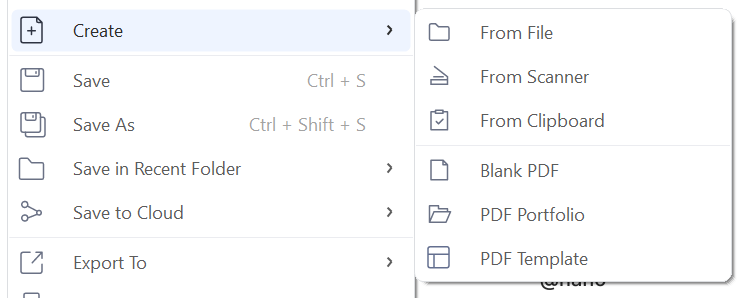

In today’s market, many PDF editors can perform multiple tasks, from editing PDFs to converting a range of file formats into PDFs. With the number of PDF editors available today, it can be difficult to choose the best one tailored to your needs and budget. Options like Adobe Acrobat (the original PDF Editor) are quite expensive.

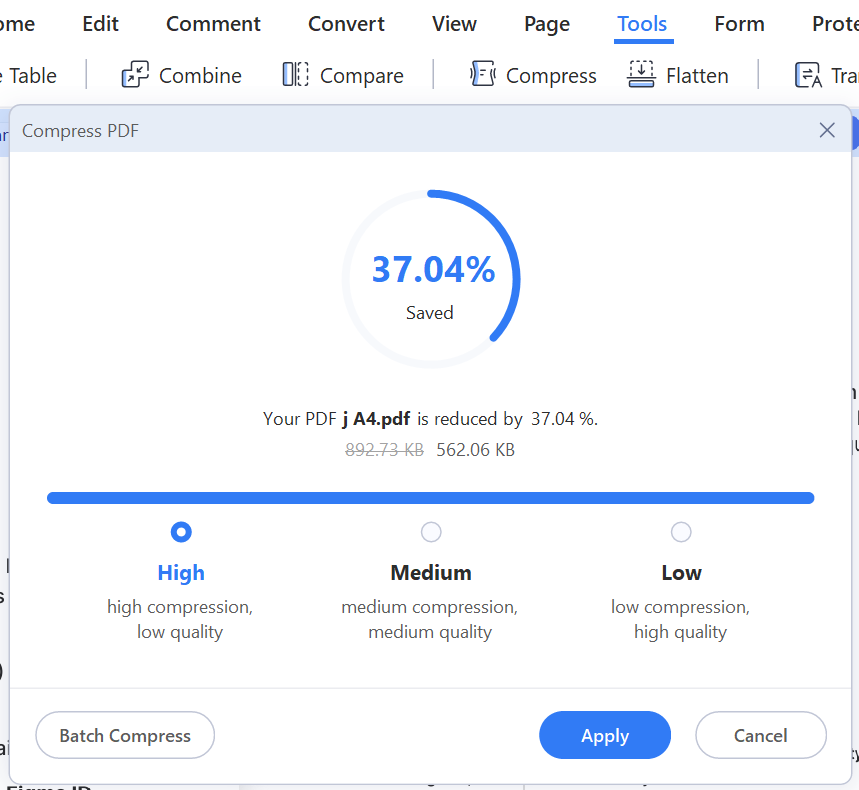

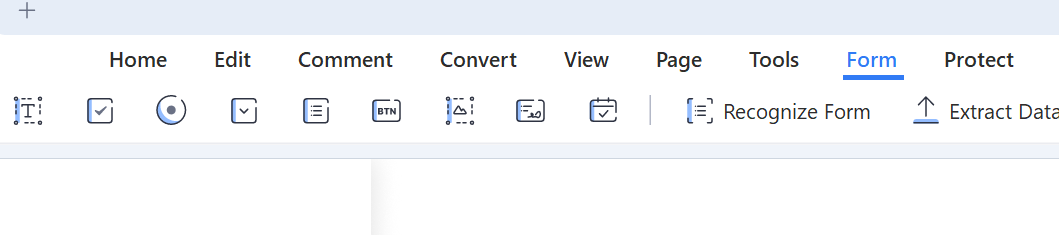

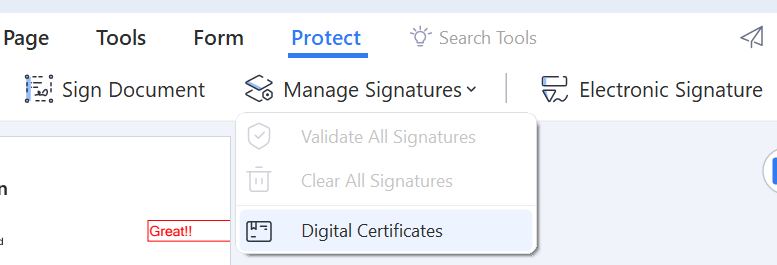

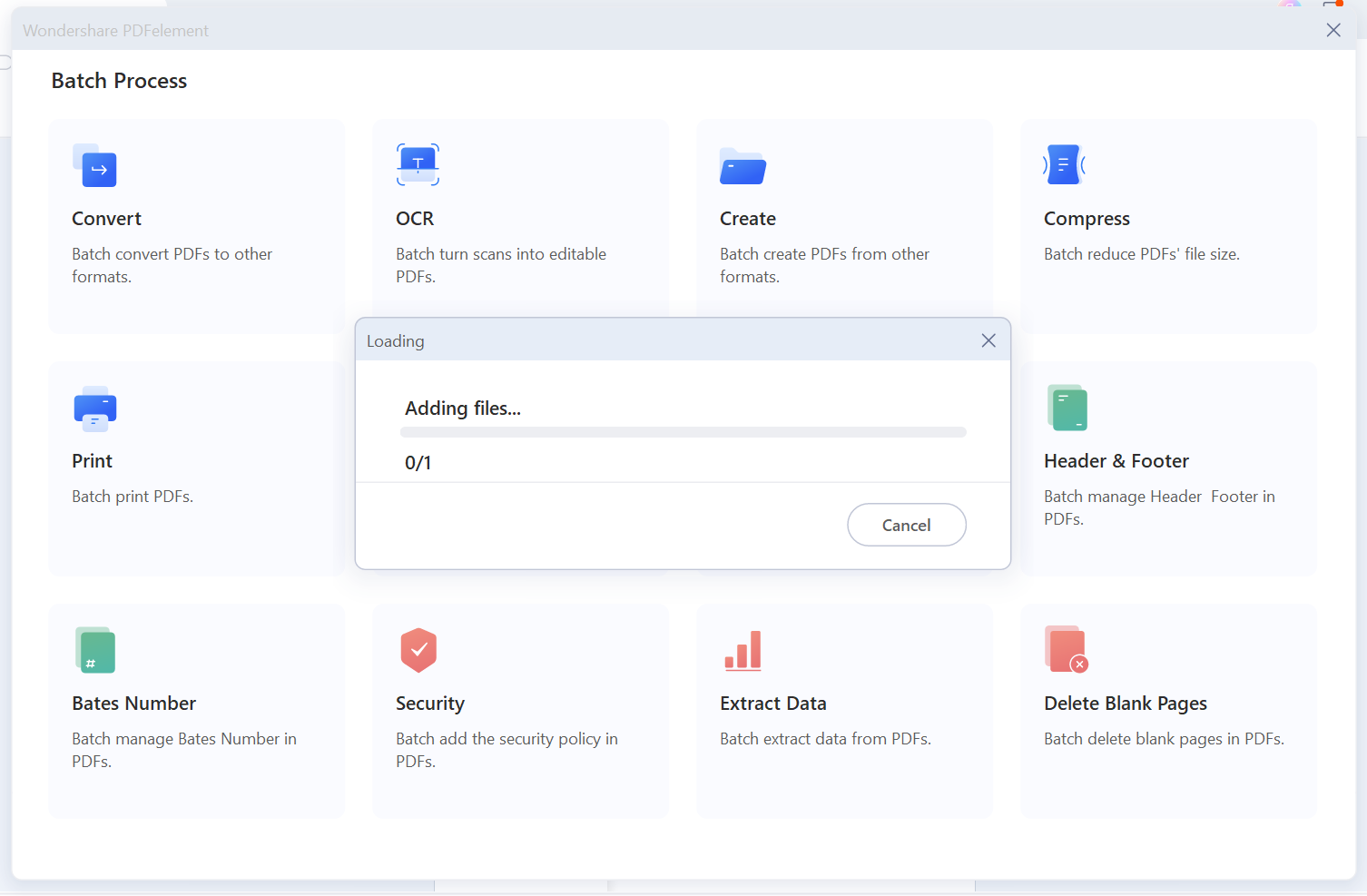

In this article, we’ll introduce you to Wondershare PDFelement, a great option for PDF editing with great pricing options for both businesses and individuals.