Agile Software Life Cycle, Methodology, Examples – Spiceworks News and Insights

EXPLORE

Agile techniques drive software developers to deliver value in small increments and implement continuous feedback.

Agile is defined as an iterative software development approach where value is provided to users in small increments rather than through a single large launch. Agile teams evaluate requirements and results continuously, which leads to the efficient implementation of change. This article covers the meaning, life cycle, methodology, and examples of Agile.

Agile software development methodologies often called Agile, preach flexibility and pragmatism in the application delivery process. This iterative software development approach delivers value to users in small increments rather than through a single large launch. Agile teams evaluate requirements and results continuously, which leads to the efficient implementation of change.

Using Agile gives teams the ability to create value in the face of a dynamic market and fast-paced competition while maintaining speed and efficiency. Creating a pan-org collaborative work culture is a crucial tenet of Agile as it drives teams to work together with a deep understanding of individual roles within the system.

Agile also mandates testing throughout the development cycle. This allows teams to make changes whenever required, alert each other of potential problems, and consequently gives them the confidence to create and release high-quality applications.

The core values of Agile are embodied in the Agile Manifesto, which was created by a group of software development personnel in 2001. This manifesto outlines four key concepts that encourage lightweight development, outlined below.

Apart from these core values, the Agile Manifesto outlines 12 principles for development teams to improve their functioning:

Implementing Agile requires a shift in the culture of traditional companies as it drives the clean delivery of isolated components rather than an entire application at once. Today, Agile has replaced the Waterfall software development model in most companies. However, it may be replaced or merged with DevOps as the latter grows in popularity globally.

See More: What Is DevOps? Definition, Goals, Methodology, and Best Practices

The Agile life cycle sees developers strategically move the application from conceptualization to retirement.

Agile Software Development Life Cycle

Listed below are the steps of this cycle:

In the first step of the Agile life cycle, the product owner defines the project scope. In the case of multiple projects, the critical ones are prioritized. Depending on the organization’s structure, personnel may be assigned to more than one project at once.

This stage sees the product owner and the client discuss essential requirements and formulate basic documentation based on the finalized project goals. This documentation, perhaps in the form of a product requirements document (PRD), will include the proposed aim of the project and supported features. The time and cost of the project are also estimated at this stage.

The in-depth analysis carried out during conceptualization helps determine feasibility before work starts. Developers can aim to complete only the most critical requirements as one can add more in later stages.

Once the project is conceptualized, the next step is building the software development team. In this stage, the product owner checks the availability of team members and assigns the best available ones to the project. The product owner is responsible for giving these team members the required resources.

Once the team is set, it will begin the design process by creating a mock-up of the user interface and, perhaps, a few user flow and UML diagrams. The project architecture is also built at this stage. The designed elements are then shown to the stakeholders for further input.

All this lets the team fully establish the requirements in the design and figure out application functionality and how it will all fit into the existing system. Frequent check-ins by the business team will ensure that inception stays on track.

The construction phase, known as the iteration phase, is where most work happens. This is usually the longest phase, with the dev team and the UX designers collaborating closely to bring together the requirements and feedback and interpret the design into code.

The construction goal is to create the application’s basic functionality before the first iteration (or ‘sprint’, as described below) ends. Additional secondary features and minor modifications can occur in future iterations. The main goal is to swiftly create a working application and implement improvements for client satisfaction.

When the team enters this stage, the product should be nearly ready to release. However, before this can happen, the QA team must test the application and make sure it is fully functional according to the decided project goals. Testing also takes place to ensure that no bugs and defects exist in the code; if any are found, they must be reported swiftly and fixed by the dev team. Clean code is a cornerstone of this stage.

This phase also includes user training, the creation of the system, and user documentation to support it. Visualizing the code is helpful here. Once all the defects are ironed out, and user training is completed, the final iteration of the product can be taken live and released into production.

Once the application is released successfully and made available to end users, the team moves into maintenance mode. This phase sees the dev team providing continuous support to ensure smooth system operations and quash any newly found bugs.

The team will also be on call to offer additional training to customers and resolve post-live queries to ensure that the product is used as intended. Developers can also use the feedback collected during this stage to plan the features and upgrades for the next iterations.

The application may be slated for retirement for two reasons: replacement with a new version or the lack of a use case due to redundancy or obsolescence.

If an application enters this phase, the first step is to notify users of the impending retirement of the software. Next, one must ensure a smooth migration to the new system. Finally, the dev team must complete all the pending end-of-life activities and cease the support provided to the existing application.

Each Agile phase outlined above leads to the creation of numerous software iterations. These iterations are created as the dev team repeats its processes to refine the application and create the best possible version according to the determined project requirements. These iterations are ‘sub-cycles’ contained within the larger Agile software development life cycle.

The Agile life cycle divides work into ‘sprints’ to complete these iterations. The goal of each sprint is to produce a working application. A typical sprint should last for 10 business days (2 weeks).

Outlined below is the typical sprint workflow:

Sprint planning meetings are helpful, but the team should also meet regularly (if possible, daily) to take stock of the sprint’s progress and sort out any clashes. Collaboration and receptiveness to change are key components of the Agile life cycle and a proven way to keep the process moving effectively.

See More: What Are Microservices? Definition, Examples, Architecture, and Best Practices for 2022

Agile software development is not a singular framework of methodologies. Rather, it encompasses numerous project management frameworks.

Listed below are four well-known Agile methodologies:

Scrum is perhaps the most popular Agile project management methodology. Sprints define it, and it advocates maximizing application development time and achieving the product goal. This goal is a big-picture value objective that comes closer to realization with each sprint.

A team following the Scrum methodology begins its day with a 15-minute meeting to synchronize all activities and chalk out the best path for the day ahead. The product manager can take this opportunity to check on the ‘health’ of the sprint and the project’s progress.

Although Scrum is popularly associated with software development, one can use it successfully in most business contexts.

The term Kanban has Japanese origins and is associated with the concept of ‘just in time’. This method splits a ‘Kanban board’ (board or table) into columns. Each flow within the project is shown in columns as a ‘card’, and the information changes as developments move ahead. A new card is added whenever a new task is introduced.

Kanban drives transparency and communication by allowing members from across teams to see the project status at any given time. Its primary focus is team capacity, which is especially useful for iterations with multiple minor changes. Besides software development, Kanban is useful for business departments such as HR and marketing, as it drives visibility for all team tasks.

This typical Agile framework focuses on discovering the ‘simplest way to make it happen’ while deprioritizing the long-term product goal. Its core values include simplicity, communication, courage, respect, and feedback. XP’s highest priority is customer satisfaction, and it encourages the team to accept changes in project requirements even at later stages of the development process.

Teamwork is also a key component of XP, with customers, managers, and team members working closely to ensure the efficient creation of the best possible application. In XP, testing takes place from day one, and feedback is continuously collected to enhance quality. Activities such as pair programming are encouraged in this engineering methodology.

Directly adapted from Toyota’s Lean Manufacturing; this software development method pushes the team to mercilessly scrap every activity that does not add value to the product.

Its seven core principles are:

See More: What Is an API (Application Programming Interface)? Meaning, Working, Types, Protocols, and Examples

How does Agile work in the real world? Let’s look at an example of traditional software development using the Waterfall methodology versus Agile software development.

Designing a basic yet accurate wireframe of all application features would take around 20% of the project time (approximately 6.5 weeks).

Translating the design into code and testing it would take approximately 40% of the project time (13 weeks).

System and integration testing would take around 20% of the project time (another 6.5 weeks).

Developers would spend the remaining time on user acceptance testing by the marketing team.

For this example, let’s assume that the project is split into eight releases of 4 weeks each.

Instead of spending five weeks gathering and analyzing requirements, the business and development teams will work together to determine the essential features that are required by the end of the first iteration (or sprint).

The team will deliver a working application with the predetermined features by the end of the first sprint.

Once the application is ready, the teams will collaboratively determine whether the application is headed in the right direction. They will also decide what changes can be made and which features can be added in the subsequent iterations based on priority.

This methodology allows the marketing team to show a working application to the customer within just four weeks (compared to 8 months). Feedback can be collected and passed to the developers, who will implement it in future iterations.

In the example with the traditional Waterfall methodology, only after the 8-month process is complete does the customer experience the actual product. Also, if the need for significant changes arises, developers must push the release ahead by a few weeks.

It is clear why Agile is far more effective than Waterfall. In the Agile example, by the end of 8 months, the application will not only be ready and already in wide use but also significantly more refined than if produced using the Waterfall method.

See More: CI/CD vs. DevOps: Understanding 8 Key Differences

Agile drives continuous delivery and prioritizes customer satisfaction. This software development methodology delivers a working application with new features every few weeks. Customers can experience the latest iteration of the application and share their feedback, which is then processed by the development team in future iterations.

Frequent collaboration between the business and development teams is a core tenet of Agile. All stakeholders keep an eye on the project’s progress and fine-tune the requirements, thus ensuring the efficient delivery of a high-quality product at the end of each sprint.

While Agile has replaced the Waterfall model in most companies, it can become obsolete, or combined with DevOps, due to the growing popularity of the latter discipline.

Did this article help you gain an in-depth understanding of Agile software development? Share your thoughts with us on Facebook, Twitter, and LinkedIn!

Technical Writer

On June 22, Toolbox will become Spiceworks News & Insights

- Published in Uncategorized

FOX 13 Investigates: Response time data for every police department in Utah – FOX 13 News Utah

Menu

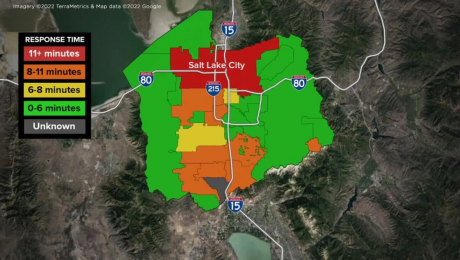

SALT LAKE CITY — For more than a year, FOX 13 News has been investigating slow response times within the Salt Lake City Police Department.

As part of our latest investigation, FOX 13 News compiled a statewide database to track response times for all Utah police departments.

The following data tracks average Priority 1 response times from September 2021 through September 2022 and was obtained through a series of approximately 100 individually-filed requests for public records under Utah law.

Definitions

For the purposes of this database:

“Priority 1” refers to the calls officers are dispatched to with the highest urgency, as defined by department policy.

Observations

Some departments indicated they treat all calls equally or do not use the Priority system. In such cases, FOX 13 News asked agencies to provide data for all calls.

Two of the 90 departments declined our request for public records. FOX 13 News is appealing both denials.

At least six of the 90 departments indicated they did not feel their own response time data was fully accurate.

More than a dozen agencies cited a technical issue with their software. Some have stated our request has prompted them to make changes within their departments.

Many departments asked for the ability to provide context to the numbers and responses they’ve provided. See below.

Alta Marshal’s Office

10:20

Goal: 5 min after dispatch

“(Our) goal is heavily influenced by weather and terrain in Little Cottonwood Canyon,” wrote Town Marshal Mike Morey. “For example, the seasonal Albion Basin Road is only accessible by emergency motor vehicles when it is not covered by deep snow. What may be a 5-minute response in the summer by vehicle, can be a 30-minute or more hike in during winter. The same is true for other mountainous terrain in Alta and Little Cottonwood Canyon.”

American Fork PD

20:54 (all calls)

Goal: N/A

“We do not typically run reports or compile information on our response times,” wrote Adam Ellison, a program manager for the department. “Our agency does not treat every call the same; obviously different calls will have a different level of urgency and priority. However, because our agency does not use a formally ranked priority system of calls, I have done my best to accommodate your request by running a report that shows the average respones time for ALL CALLS.”

“We may not consistently run reports that indicate, to the second, our average response times,” wrote Chief Cameron Paul. “However, we as senior leadership work often enough with our officers, monitor radio traffic and dispatched CAD calls sufficiently, and review individual response times on certain cases to such an extent that we know our officers are responding as quickly and as safely as possible to priority details.”

Aurora PD

9:50 (all calls)

Goal: N/A

“Our circumstance is unique in the state as we are a part-time police department serving just a bit over 1,016 residents,” wrote Chief Matt McLean. “A majority of our calls are also back-up for Salina City PD or the County Sheriff. We currently have two part-time employees with the police department including myself as Chief. When not in service the County Sheriff covers calls in Aurora.”

Blanding PD

anecdotally, within 2 minutes

Goal: N/A

“Blanding had 22 calls that I pulled our numbers from,” wrote Chief J.J. Bradford. “Moving forward with our new dispatch, getting more exact times will be something we can do much more efficiently.”

Bluffdale PD

Did not respond

Goal: N/A

Bluffdale PD is a precinct of Saratoga Springs PD.

“An average response time for priority 1 calls cannot be given,” wrote administrative assistant Cristy Soper. “As a department, we do not have a definition of a ‘priority 1’ response and have wrestled with this concept in the past without a solution.”

The department has not yet responded to our request for data encompassing all calls.

Bountiful PD

6:53 (all calls, Jan 2021 – Dec 2021)

Goal: 7 min

Bountiful PD handles dispatch services for the cities of Bountiful, Centerville, North Salt Lake, West Bountiful, and Woods Cross.

Chief Ed Biehler cited a deficiency with the department’s “outdated” software as a reason why it could not provide response time data from September 2021 through September 2022.

As a consolation, Biehler provided data from a report manually created by a Bountiful PD employee to track response times from January 2021 through December 2021.

He anticipates the department will implement new software in 2023 to fix the problem.

Brian Head Public Safety

13:30 or 19:05 **

Goal: 7 min if three deputies, 12 min if two deputies, 15 min if one deputy

“What we call ‘Priority 1 Calls’ is quite different than what many other agencies do,” wrote Dan Benson, the town’s director of public safety. “A Priority 1 call for us could be a utility problem (broken gas line, power outage, etc.) and we will respond to it, but it would be up to the deputy working to determine the urgency of the response.”

In response to the request, the agency provided two numbers. FOX 13 News is seeking clarification as to which figure is accurate.

Brigham City PD

4:55

Goal: 4 min

“(The request) ended up being more of a manual process than I had anticipated,” wrote Susie Zecca, a records clerk for the department. “It did show us, however, the need to clarify, within the system, what is a priority call, and what is not.”

Cedar City PD

14:30

Goal: < 5 min

Dispatch – 7:59

Travel – 6:31

The department believes “alarms” and “911 hangups” have lowered the average.

Centerville PD

anecdotally, within 4 minutes

Goal: N/A

Centerville PD said it could not retrieve data because of a technical deficiency with Bountiful PD’s software, which is expected to be replaced in 2023.

Bountiful PD handles dispatch services for the cities of Bountiful, Centerville, North Salt Lake, West Bountiful, and Woods Cross.

Clearfield PD

6:18

Goal: < 5 min

Clinton PD

2:29

Goal: N/A

Cottonwood Heights PD

3:41

Goal: 4 min

Cottonwood Heights PD also compiles and presents detailed monthly reports to the city council.

Draper PD

8:19

Goal: N/A

Dispatch – 2:49

Travel – 5:30

East Carbon PD

anecdotally, within 2-3 minutes of dispatch

Goal: N/A

“I was not able to get accurate information on our response times,” wrote Chief Sam Leonard. “The data was way off. I talked with our dispatch center and they were not able to help me with accurate response times. I also talked with our software provider Eforce, and they were not sure why the data was so far off… I do not have a response time goal because our response time has never been questionable. I have been with East Carbon Police Dept. for 32 years.”

Enoch PD

6:58

Goal: < 5 min

Ephraim PD

Unknown

Goal: 3 min

“We appreciate your request because it has helped discover a current problem in our data entry process,” wrote Lynsey Zeeman, an administrative assistant for the department. “Because of your request allowing us to discover that data was entered manually into our officer’s reports, but not transferred to the system for electronic storage and retrieval, the data requested is not available electronically for this year in an accurate form… Sanpete County Dispatch provides the dispatching service for all the departments in Sanpete County, including Ephraim PD. The Dispatch supervisor explained to me that the way they report the response times are through the dispatch notes. So, the response time analysis report would be inaccurate, since they are using the notes to document all dispatch related notes.”

The department only has one officer working during the evening hours, according to Chief Aaron Broomhead.

Fairview PD

8:12

Goal: 5 min if on duty, 10 min if on call

Fairview PD does not have 24/7 coverage.

“There are a lot of times however when a call comes out and dispatch has to call out our officer but the neighboring agency (Mount Pleasant) Has someone on duty and sends them to hold the scene,” wrote Chief Steve Gray. “Their response is typically under 7 min on those calls.”

Farmington PD

2:05 or 7:08

Goal: N/A

The Davis County Sheriff’s Office, which handles dispatching services for Farmington PD, listed a 2:05 response time.

A record provided by Chief Eric Johnsen listed a 7:08 response time.

“Not sure what FPD used as parameters, but the official time is 2:05 minutes for priority one calls,” wrote Perry M. Koger, the DCSO administrator who compiled the data.

Granite School District PD

8:32

Goal: N/A

“Because our schools are also served by SROs from other agencies, our actual police response varies dramatically as a call might be responded to initially by an SRO from (for example) Unified Police or Taylorsville PD as opposed to an actual Granite Officer,” wrote Ben Horsley, a spokesperson for the district. “We don’t have the ability to track those times so our response times are simply for our officers responses to the various priority 1 calls we have or respond to.”

Grantsville PD

9:05

Goal: N/A

Gunnison Valley PD

UNKNOWN

Goal: has not responded

“I spoke with Neil Johnson at the Sanpete County Sheriff’s Department and he informed me that with the current CAD we have the response times are recorded in the ‘notes’ and there is no way to pull a report,” wrote Tammy Winegar, a records manager for the department. “They are currently working on making a change so that those reports can be accessed.”

Harrisville PD

3:11

Goal: 3 min

Heber City PD

3:12

Goal: 4-5 min

Helper PD

2:06

Goal: 3-5 min

Herriman PD

8:26

Goal: N/A

Dispatch – 2:53

Travel – 5:33

“Setting a specific (goal) time is not in the best interest of the community, as a safe arrival, based on varying circumstances, is of greater public service than an officer attempting to meet an expected time, leading to an unsafe or unrealistic response,” wrote Chief Troy D. Carr.

Hurricane PD

REQUEST DENIED

Goal: REQUEST DENIED

Hurricane PD denied the request, citing a number of reasons.

For example, the department believes the data is not public because it is “regarding security measures” and “because the disclosure of the information would jeopardize the life or safety of an individual.”

FOX 13 News has filed an appeal, noting that the statute cited by Hurricane PD is specifically intended to protect “security plans… to prepare for or mitigate terrorist activity.”

Kamas PD

Has not responded

“The amount of time it takes for this request is significant so I have not had time to process it,” wrote Chief Brad Smith. “To get these numbers I need to go through each call individually and look at the times. It could take hours. I am sorry that we are not staffed enough to process this timely.”

Kanab PD

anecdotally, under 5 minutes

Goal: 5 min

Chief Tom Cram described his response as “just off the cuff without thorough research.”

FOX 13 News asked why the department was not able to retrieve exact data but did not receive any further explanation.

“Sorry this is the best I can do at this time,” Chief Cram wrote. “It is pretty accurate.”

Kaysville PD

1:26

Goal: has not responded

The Davis County Sheriff’s Office, which handles dispatching services for Kaysville PD, listed a 1:27 response time.

A record provided by Kaysville PD listed a 1:26 response time.

La Verkin PD

7:07

Goal: N/A

Layton PD

3:15

Goal: N/A

“Normally I’m reluctant to provide a number that I don’t have full confidence in,” wrote Karl Kuehn, a communications manager for the city. “The problem with (our) report is that the software doesn’t display the underlying data that is used to derive the response time… There are some other situations that may cause a ‘Priority 1’ call to hold for a long time, because it’s classified one way, but the circumstances indicate it is not emergent and does not require an immediate response.”

Layon PD indicated it is looking into developing a custom report to track response times in the future.

“Regarding our data specifically, one of our practices is to change the priority of a call to a ‘9’ after it has been handled, but the officer will finish the call/investigation/documentation later. We do this frequently, and those calls are not included in this statistic, because they are no longer showing as a Priority 1,” Kuehn continued. “I do not have full confidence in this number.”

Lehi PD

8:37

Goal: 8:30

Lindon PD

5:13

Goal: N/A

Logan PD

7:34

Goal: 4:30

Lone Peak PD

5:50

Goal: N/A

Mantua PD

9:30

Goal: < 5 min

Mapleton PD

4:10

Goal: N/A

Moab PD

8:05

Goal: < 5 min

Moab PD spent several weeks working with FOX 13 News to overcome newly-identified deficiencies with its software. Ultimately, FOX 13 News calculated the average Priority 1 response time with data provided by the department.

“We are in the process of obtaining a new records management system which will give us better insight on how we are performing on response,” wrote Chief Jared Garica.

Mt. Pleasant PD

4:08 (all calls)

Goal: N/A

“Our system does not compile priority response time separately,” wrote police secretary Cari Bennett.

Murray PD

1:24

Goal: N/A

Naples PD

UNKNOWN

Goal: N/A

“I am working on this data. It isn’t specifically tracked in our area,” wrote evidence manager Kimberly Kay. “It’s more of a technical issue. I believe the data is somewhere, I just don’t have an answer for exactly how to get it. I have since reached out to a couple of sources to attempt to get the info. I apologize for both the delay and the confusion. I am the only data-type person at our agency, and I’ve never encountered this request before. I will hopefully be able to tell you something either way by (October) 31st.”

Nephi PD

13:53 (all calls)

Goal: N/A

“We do not have a definition of a priority 1 response. Each non-emergent, urgent, and emergent call for service is different and may dictate a varied response,” wrote Sgt. Joshua Morrow. “I understand that dispatch has a priority designation for POLICE, FIRE and EMS. However, these priorities do not match up with what we would consider priority calls. Reason being is because EMS and FIRE priority calls would differ from Law Enforcement priority.”

North Ogden PD

2:06

Goal: 5 min

North Park PD

10:02

Goal: 15 min

According to the provided data, North Park PD has the least-ambitious Priority 1 response goal in Utah.

North Salt Lake PD

UNKNOWN

Goal: N/A

North Salt Lake PD said it could not retrieve data because of a technical deficiency with Bountiful PD’s software, which is expected to be replaced in 2023.

Bountiful PD handles dispatch services for the cities of Bountiful, Centerville, North Salt Lake, West Bountiful, and Woods Cross.

Ogden PD

4:57

Goal: N/A

Orem PD

7:58

Goal: N/A

Park City PD

1:43

Goal: N/A

Parowan PD

13:46

Goal: N/A

“After speaking with dispatch I have been informed that these times are not completely accurate due to the different natures of priority 1 calls,” wrote Nicole Hynson, an administrative assistant for the department.

Hynson said she believes the 6:18 dispatch time listed in the report she provided should be “more like under 1 min” and that the 7:27 travel time should be “more like under 5 min.”

Payson PD

16:22

Goal: N/A

“We acknowledge that Central Utah 911 utilizes a priority designation for police through Spillman. However, these priorities do not match up consistently with what our agency would consider as priority calls,” wrote Lynette Mortensen, a senior executive assistant for Payson PD. “We feel this report does not reflect accurate response times, due to variables beyond our control. However, this is all we have to provide for you at this time.”

Perry PD

5:47

Goal: 3 min

Pleasant Grove PD

5:56

Goal: has not responded

Dispatch – 1:14

Travel – 4:42

Pleasant View PD

3:46

Goal: N/A

Price PD

anecdotally, 2-3 minutes

Goal: 2-3 minutes

“Price Police does not keep records for response times, unless it is documented within the narrative of any such respective report,” wrote Chief Brandon Sicilia. “You may have better luck sending your request to the section 33 dispatch center. They dispatch for all of our first responder agencies within Carbon County and store records of all call times.”

FOX 13 News asked for clarification as to why Price PD would not have its own response time data from dispatch, but the question was ignored.

Provo PD

9:47

Goal: N/A

Richfield PD

6:48

Goal: N/A

Riverdale PD

3:30

Goal: 3 min

Riverton PD

9:12

Goal: N/A

Dispatch – 3:44

Travel – 5:28

“It would be contradictory and potentially dangerous to have a policy or procedure in place mandating a set response time as officers may drive unsafely in an attempt to arrive more quickly,” wrote Chief Don Hutson. “The numbers provided in the report were extrapolated from the Versaterm database and have not been edited to remove cases that may have been classified incorrectly or not input correctly, so there is a margin of error.”

Chief Hutson credited the Salt Lake Valley Emergency Communications Center (VECC) for their efforts in recently improving its dispatch times over the past year.

“We are committed to frequently evaluating our response strategies to identify opportunities to reduce the amount of time it takes to respond to emergency calls and we look forward to working with our partners and continuing that practice moving forward.”

Roosevelt PD

0:56

Goal: 1 min

Roy PD

5:17 (Jan 2021 – Dec 2021)

Goal: N/A

“I recently completed our annual report to the city council which included response times for the calendar year 2021,” wrote Chief Matthew Gwynn. “While not September through September like your request asks, I’m not inclined to believe that there would be a statistically significant shift in our response time from what we collected versus what you asked for. I hope this is okay.”

FOX 13 News asked if the department is also able to compile a report with the requested information, but Roy PD has not responded.

Salem PD

4:46 (all calls)

Goal: N/A

“The Salem Police Department does not define calls by a priority type response like the Central Utah 911 Dispatch,” wrote police secretary Stacy Bliss.

Salina City PD

14:04 (all calls)

Goal: N/A

“Salina City Police Department is a small agency and all our calls are prioritized the same. We don’t have a Priority 1 call,” wrote officer manager Hillary Anderson. “As an average response time goal Chief is planning on reviewing everything again and setting a goal for the department.”

Salt Lake City PD

11:58

Goal: 10 min

The Salt Lake City Police Department had a goal of 4-5 minutes in 2021, according to Sgt. Keith Horrocks.

The department has since disputed our reporting.

READ: Salt Lake City lowers the bar for police response times

READ: SLCPD response times lag amid officer shortage

Sandy PD

8:50

Goal: N/A

Santa Clara – Ivins PD

7:17

Goal: N/A

Santaquin PD

9:54

Goal: N/A

Saratoga Springs PD

7:34

Goal: 7 minutes

“Data concerning response times are available to us through research of dispatch center records but are often found to be questionable based on a variety of factors such as an error in reporting, specific call details changing the nature of the response, failure to record the arrival time, etc.,” wrote administrative assistant Cristy Soper.

Smithfield PD

anecdotally, 2.5 minutes

Goal: N/A

“For me to task an employee with going through a years’ worth of reports to obtain the information you are requesting takes a substantial amount of time,” wrote Chief Travis K. Allen.

South Jordan PD

9:11

Goal: N/A

Dispatch – 3:07

Travel – 6:04

South Ogden PD

4:01

Goal: 4 min

South Salt Lake PD

7:17

Goal: < 10 min

Spanish Fork PD

2:33

Goal: 4 min

Springdale PD

8:56

Goal: N/A

Springville PD

UNKNOWN

Goal: 5 min

“Unfortunately our system does not capture accurate time stamps on some of our calls for service,” wrote Chief Lance Haight. “Our Computer Aided Dispatch (CAD) system does calculate response times based on data entered, but response time stamps are dependent on officers and/or dispatchers making a manual entry. Amid the data, there are incidents when the time stamps are not entered in a timely manner, which skews the data. It would take extensive time to manually review all of our incidents. We can certainly look at specific incidents to determine our actual response time, but we do not have the resources to conduct that level of review for each and every incident. As a result, we are unable to give you an accurate response time average.”

Chief Haight stated he is also looking into the possibility of coding calls differently for active incidents versus incidents that are no longer active.

“We will audit calls to assess if we are meeting our response goal.”

St. George PD

19:22

Goal: N/A

According to the provided data, St. George PD has the slowest average Priority 1 response in Utah.

FOX 13 News has asked for clarification and plans to continue reporting.

Sunset PD

1:50

Goal: 3 min

Data provided by the Davis County Sheriff’s Office, which handles dispatching services for Sunset PD.

Syracuse PD

2:28

Goal: N/A

Data provided by the Davis County Sheriff’s Office, which handles dispatching services for Syracuse PD.

Taylorsville PD

8:33

Goal: N/A

Dispatch – 3:44

Travel – 4:50

Tooele PD

10:41

Goal: N/A

FOX 13 News calculated the average Priority 1 response time with data provided by the department.

“Please keep in mind that not all of these times are accurate, seeing as there are many times when dispatch doesn’t mark us as arrived,” wrote Cpl. Colbey Bentley. ”The calls where you are seeing a long wait time is due to an officer not being marked as arrived. This happens from time to time when our dispatch center is extremely busy.”

Tremonton PD

5:52

Goal: N/A

FOX 13 News calculated the average Priority 1 response time with data provided by the department.

“There are some calls that are a little out of the normal, like you will see where we had a stabbing/gun shot case and the response time was 31 minutes,” wrote Assistant Chief Brian Crockett. “Our first officers were there with in just a few minutes, but because people were called out from home and it took them 31 minutes to get there it messed up the time. So there are some weird numbers, but most of it looks pretty normal from my perspective.”

Unified PD

5:01

Goal: N/A

Dispatch – 2:02

Travel – 2:59

Vernal PD

anecdotally, 4 minutes

Goal: 3-5 min

“I’m trying to determine a way to track time for initial officer on scene,” wrote Chief Keith Campbell. “Our dispatch system tracks all officers that respond and averages them. Then reports average time overall per call. If an officer arrives 10 minutes later and checks out on the call it changes the numbers drastically. For example, initial officer on scene in under 2 minutes, 4 officers assisted on the case. It shows response time of 27 minutes. The second two officers arrived on scene way late to assist with vehicle tow and other issues.”

Washington City PD

7:53

Goal: < 10 min

Wellington PD

1:29:48 (all calls)

Goal: N/A

“We do not have just a priority 1 call. Our reporting system is fed through dispatch on times dispatched, arrived and cleared,“ wrote Chief Tom Kosmack. ”Because we don’t have a call volumes as some departments, we don’t have the need to distinguish calls as priority 1, 2, or 3.”

Chief Kosmack stated the department has recently hired a third officer to meet the city’s needs.

“This officer now has completed his first full week now,” he wrote. “My only goal would be to continue to represent Wellington Police as they have and always seek improvement as needed.

West Bountiful PD

UNKNOWN

Goal: 5 min

West Bountiful PD said it could not retrieve data because of a technical deficiency with Bountiful PD’s software, which is expected to be replaced in 2023.

Bountiful PD handles dispatch services for the cities of Bountiful, Centerville, North Salt Lake, West Bountiful, and Woods Cross.

West Jordan PD

8:00

Goal: N/A

Dispatch — 4:00

Travel – 4:00

West Valley City PD

9:48 (median, Jan 2021 – Dec 2021)

Goal: has not responded

Roxeanne Vainuku, a spokesperson for the department, initially approved the request but then changed her mind when asked by FOX 13 News to provide a response within the deadline outlined in state law.

Instead, West Valley City PD provided a median response time from January 2021 through December 2021.

“I mistakenly asked for a record, which did not exist, to be created in an effort go above and beyond your request. I should not have done that. I will not do it again,” Vainuku wrote. ”I will certainly be careful not to try and assist beyond the specific requirements of GRAMA in the future.”

FOX 13 News is in the process of filing an appeal.

Willard PD

12:13

Goal: 8 min if on duty, 25 min if off duty

FOX 13 News calculated the average Priority 1 response time with data provided by the department.

“It’s hard for me to set a goal as we do not have an officer on 24 hours a day,” wrote Chief Theron Fielding. “Some of our calls are late and night and we get called out.”

Woods Cross PD

7:17

Goal: 6 min

The information in the attachment isn’t going to be 100 percent accurate due to some factors,” wrote Michelle Rowley, an administrative assistant and evidence technician for the department. “Our dispatch center does not have the same RMS system as we do. Dispatch’s Eforce system does not properly communicate with Spillman all the time. There have been times that we have arrived on scene and dispatch doesn’t show the officers as arrived for many minutes after.”

- Published in Uncategorized

The Worldwide Enterprise Content Management System Industry is Expected to Reach $53.2 Billion by 2030 – Benzinga

DUBLIN, Oct. 27, 2022 /PRNewswire/ — The "Enterprise Content Management System Market By Solution, By Deployment Mode, By Enterprise Size, By Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2020-2030" report has been added to ResearchAndMarkets.com's offering.

According to this report the enterprise content management system market was valued at $21.5 billion in 2020, and is estimated to reach $53.2 billion by 2030, growing at a CAGR of 9.8% from 2021 to 2030.

Enterprise content management is used to manage, capture, store, preserve, and deliver content to organizational processes. Enterprise content management reduces workload of organization by maintaining & processing the complex workflow, increase operational efficiency, and enhance customer experience. Furthermore, demand for enterprise content management system is increasing, owing to its features, including securing the stress content and integration of content with business intelligence & business analytics application.

The enterprise content management system market is expected to experience significant growth during the forecast period, owing to increase in need for digital content with the proliferation of online marketing and online customer relationship. Moreover, constant development of the e-commerce industry fuels the demand for enterprise content management systems to store, manage, create, and distribute digital content through online channels.

In addition, increase in adoption of cloud-based enterprise content management system is expected to boost the enterprise content management system market growth in the future. However, high initial costs of implementation and lack of awareness to implement the right solution for the specific needs among small and medium-sized enterprises (SMEs) hinder the growth of enterprise content management system market.

The enterprise content management system market is segmented on the basis of solution, deployment mode, enterprise size, industry vertical, and region. According to solution, it is fragmented into records management, case management, document management, mobile content management, imaging & capturing, web content management, digital asset management, and others.

On the basis of deployment mode, it is bifurcated into on-premise and cloud. By enterprise size, it is categorized into large enterprises and small & medium enterprises. As per industry vertical, it is classified into BFSI, IT & telecom, energy & utilities, government and public sector, healthcare and life sciences, retail and consumer goods, manufacturing, and others. Region wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the enterprise content management system market are Adobe, Capgemini, Fabasoft, Hyland Software, Inc., Lexmark International, Inc., Microsoft Corporation, M-Files, Inc., Oracle, Open Text Corporation, and XEROX Corporation.

Key Benefits For Stakeholders

Key Topics Covered:

CHAPTER 1: INTRODUCTION

CHAPTER 2: EXECUTIVE SUMMARY

CHAPTER 3: MARKET OVERVIEW

3.1. Market definition and scope

3.2. Key findings

3.2.1. Top investment pockets

3.3. Porter's five forces analysis

3.4. Top player positioning

3.5. Market dynamics

3.5.1. Drivers

3.5.2. Restraints

3.5.3. Opportunities

3.6. COVID-19 Impact Analysis on the market

CHAPTER 4: ENTERPRISE CONTENT MANAGEMENT SYSTEM MARKET, BY SOLUTION

4.1 Overview

4.1.1 Market size and forecast

4.2 Records Management

4.2.1 Key market trends, growth factors and opportunities

4.2.2 Market size and forecast, by region

4.2.3 Market analysis by country

4.3 Case Management

4.3.1 Key market trends, growth factors and opportunities

4.3.2 Market size and forecast, by region

4.3.3 Market analysis by country

4.4 Document Management

4.4.1 Key market trends, growth factors and opportunities

4.4.2 Market size and forecast, by region

4.4.3 Market analysis by country

4.5 Mobile Content Management

4.5.1 Key market trends, growth factors and opportunities

4.5.2 Market size and forecast, by region

4.5.3 Market analysis by country

4.6 Imaging and Capturing

4.6.1 Key market trends, growth factors and opportunities

4.6.2 Market size and forecast, by region

4.6.3 Market analysis by country

4.7 Web Content Management

4.7.1 Key market trends, growth factors and opportunities

4.7.2 Market size and forecast, by region

4.7.3 Market analysis by country

4.8 Digital Asset Management

4.8.1 Key market trends, growth factors and opportunities

4.8.2 Market size and forecast, by region

4.8.3 Market analysis by country

4.9 Others

4.9.1 Key market trends, growth factors and opportunities

4.9.2 Market size and forecast, by region

4.9.3 Market analysis by country

CHAPTER 5: ENTERPRISE CONTENT MANAGEMENT SYSTEM MARKET, BY DEPLOYMENT MODE

5.1 Overview

5.1.1 Market size and forecast

5.2 On-Premise

5.2.1 Key market trends, growth factors and opportunities

5.2.2 Market size and forecast, by region

5.2.3 Market analysis by country

5.3 Cloud

5.3.1 Key market trends, growth factors and opportunities

5.3.2 Market size and forecast, by region

5.3.3 Market analysis by country

CHAPTER 6: ENTERPRISE CONTENT MANAGEMENT SYSTEM MARKET, BY ENTERPRISE SIZE

6.1 Overview

6.1.1 Market size and forecast

6.2 Large Enterprises

6.2.1 Key market trends, growth factors and opportunities

6.2.2 Market size and forecast, by region

6.2.3 Market analysis by country

6.3 Small & Medium Sized Enterprises

6.3.1 Key market trends, growth factors and opportunities

6.3.2 Market size and forecast, by region

6.3.3 Market analysis by country

CHAPTER 7: ENTERPRISE CONTENT MANAGEMENT SYSTEM MARKET, BY INDUSTRY VERTICAL

7.1 Overview

7.1.1 Market size and forecast

7.2 BFSI

7.2.1 Key market trends, growth factors and opportunities

7.2.2 Market size and forecast, by region

7.2.3 Market analysis by country

7.3 IT and Telecommunication

7.3.1 Key market trends, growth factors and opportunities

7.3.2 Market size and forecast, by region

7.3.3 Market analysis by country

7.4 Energy and Utilities

7.4.1 Key market trends, growth factors and opportunities

7.4.2 Market size and forecast, by region

7.4.3 Market analysis by country

7.5 Government and Public Sector

7.5.1 Key market trends, growth factors and opportunities

7.5.2 Market size and forecast, by region

7.5.3 Market analysis by country

7.6 Healthcare and Life Sciences

7.6.1 Key market trends, growth factors and opportunities

7.6.2 Market size and forecast, by region

7.6.3 Market analysis by country

7.7 Retail and Consumer Goods

7.7.1 Key market trends, growth factors and opportunities

7.7.2 Market size and forecast, by region

7.7.3 Market analysis by country

7.8 Manufacturing

7.8.1 Key market trends, growth factors and opportunities

7.8.2 Market size and forecast, by region

7.8.3 Market analysis by country

7.9 Others

7.9.1 Key market trends, growth factors and opportunities

7.9.2 Market size and forecast, by region

7.9.3 Market analysis by country

CHAPTER 8: ENTERPRISE CONTENT MANAGEMENT SYSTEM MARKET, BY REGION

CHAPTER 9: COMPANY LANDSCAPE

9.1. Introduction

9.2. Top winning strategies

9.3. Product Mapping of Top 10 Player

9.4. Competitive Dashboard

9.5. Competitive Heatmap

9.6. Key developments

CHAPTER 10: COMPANY PROFILES

10.1 Oracle Corporation.

10.1.1 Company overview

10.1.2 Company snapshot

10.1.3 Operating business segments

10.1.4 Product portfolio

10.1.5 Business performance

10.1.6 Key strategic moves and developments

10.2 Hyland Software, Inc.

10.2.1 Company overview

10.2.2 Company snapshot

10.2.3 Operating business segments

10.2.4 Product portfolio

10.2.5 Business performance

10.2.6 Key strategic moves and developments

10.3 Xerox Corporation

10.3.1 Company overview

10.3.2 Company snapshot

10.3.3 Operating business segments

10.3.4 Product portfolio

10.3.5 Business performance

10.3.6 Key strategic moves and developments

10.4 Opentext Corporation

10.4.1 Company overview

10.4.2 Company snapshot

10.4.3 Operating business segments

10.4.4 Product portfolio

10.4.5 Business performance

10.4.6 Key strategic moves and developments

10.5 Alfresco Software, Inc.

10.5.1 Company overview

10.5.2 Company snapshot

10.5.3 Operating business segments

10.5.4 Product portfolio

10.5.5 Business performance

10.5.6 Key strategic moves and developments

10.6 Lexmark International, Inc.

10.6.1 Company overview

10.6.2 Company snapshot

10.6.3 Operating business segments

10.6.4 Product portfolio

10.6.5 Business performance

10.6.6 Key strategic moves and developments

10.7 M-Files Inc.

10.7.1 Company overview

10.7.2 Company snapshot

10.7.3 Operating business segments

10.7.4 Product portfolio

10.7.5 Business performance

10.7.6 Key strategic moves and developments

10.8 Microsoft Corporation

10.8.1 Company overview

10.8.2 Company snapshot

10.8.3 Operating business segments

10.8.4 Product portfolio

10.8.5 Business performance

10.8.6 Key strategic moves and developments

10.9 Adobe Systems Incorporated

10.9.1 Company overview

10.9.2 Company snapshot

10.9.3 Operating business segments

10.9.4 Product portfolio

10.9.5 Business performance

10.9.6 Key strategic moves and developments

10.10 Fabasoft

10.10.1 Company overview

10.10.2 Company snapshot

10.10.3 Operating business segments

10.10.4 Product portfolio

10.10.5 Business performance

10.10.6 Key strategic moves and developments

For more information about this report visit https://www.researchandmarkets.com/r/8nh4mb

Media Contact:

Research and Markets

Laura Wood, Senior Manager

press@researchandmarkets.com

For E.S.T Office Hours Call +1-917-300-0470

For U.S./CAN Toll Free Call +1-800-526-8630

For GMT Office Hours Call +353-1-416-8900

U.S. Fax: 646-607-1904

Fax (outside U.S.): +353-1-481-1716

Logo: https://mma.prnewswire.com/media/539438/Research_and_Markets_Logo.jpg

View original content:https://www.prnewswire.com/news-releases/the-worldwide-enterprise-content-management-system-industry-is-expected-to-reach-53-2-billion-by-2030–301661150.html

SOURCE Research and Markets

© 2022 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

- Published in Uncategorized

Asana vs Planner: Project management software comparison – TechRepublic

Register for your free TechRepublic membership or if you are already a member, sign in using your preferred method below.

We recently updated our Terms and Conditions for TechRepublic Premium. By clicking continue, you agree to these updated terms.

Invalid email/username and password combination supplied.

An email has been sent to you with instructions on how to reset your password.

By registering, you agree to the Terms of Use and acknowledge the data practices outlined in the Privacy Policy.

You will also receive a complimentary subscription to TechRepublic’s News and Special Offers newsletter and the Top Story of the Day newsletter. You may unsubscribe from these newsletters at any time.

All fields are required. Username must be unique. Password must be a minimum of 6 characters and have any 3 of the 4 items: a number (0 through 9), a special character (such as !, $, #, %), an uppercase character (A through Z) or a lowercase (a through z) character (no spaces).

Asana vs Planner: Project management software comparison

Your email has been sent

Asana and Microsoft Planner are both popular project management solutions. Compare the features to see which one will help you complete your work on time.

Both Asana and Microsoft Planner are fairly straightforward task management and project management tools. For those within the Microsoft ecosystem, Microsoft Planner provides many advantages in terms of integration. On the other hand, Asana is easy to use, popular and has an exceptional array of features and utilities. Asana and Microsoft Planner are two of the best project management tools on the market. Let’s compare the two project management tools to determine which is best for you and your organization.

Asana is an online task and project management suite. It includes most of the features users expect from their task management tools, enabling them to create subtasks, set deadlines and assign tasks to other people. Users can create multiple workspaces for their projects and even connect to multiple Asana deployments.

Microsoft Planner is an online application and part of the Microsoft Office 365 integrated ecosystem. Through Microsoft Planner, users can track tasks and projects. Features include task groups, swimlanes, deadlines, task assignments and notes.

Asana makes task management simple — and, as far as project management software goes, it’s fairly robust. Some of Asana’s best features include:

Asana does not have some of the more advanced features that Microsoft Planner has, such as task groups and swimlanes, but the Microsoft Planner suite also lacks some important features, such as subtasks.

SEE: How to build a successful project manager career (free PDF) (TechRepublic)

The biggest difference between Asana and Planner is the ecosystem that they are a part of. Asana is not part of the Microsoft ecosystem and does not integrate with other Microsoft products. But Planner is part of Office 365 and integrates with other Microsoft products, such as Outlook and OneDrive.

That being said, Asana does integrate with many third-party solutions, such as Salesforce, Dropbox, Gmail and Power BI.

Microsoft Planner’s integration with the Microsoft ecosystem is its biggest strength. Some of the best features of Microsoft Planner include:

Microsoft Planner lacks some of Asana’s features, such as the ability to create subtasks or easily integrate with third-party solutions.

SEE: Asana Software Review (TechRepublic)

Microsoft Teams is a platform built for both communication and collaboration. It includes chat, video conferencing, file sharing and task management features. Microsoft Planner is solely a task management application. It can be used side-by-side with Microsoft Teams.

SEE: Feature comparison: Time tracking software and systems (TechRepublic Premium)

Asana is typically used by offices that do not use Office 365, offices that operate remotely or offices just searching for a simple and affordable task management suite. Microsoft Planner is mainly used by businesses that are already using Office 365.

Asana integrates with many third-party solutions, such as Salesforce, Dropbox, Gmail and Power BI. Microsoft Planner integrates with other Microsoft products, such as Outlook and OneDrive. For organizations that need to integrate with third-party solutions that Microsoft does not produce, Asana has a substantial edge.

Asana offers a few support options, including a knowledge base, community forum and email support. Microsoft Planner provides support through the Office 365 support website. Asana’s support is more comprehensive than Microsoft Planner’s, but both platforms offer solid support and have active communities.

Asana has a free basic plan and several paid premium plans. Most employees will only need the basic plan. Microsoft Planner is part of Office 365, which has various subscription plans. The cheapest Office 365 plan that includes Microsoft Planner is $5 per user per month.

Asana is less expensive for individuals and teams who do not need the full suite of Microsoft products. For organizations using Office 365, the cost of Microsoft Planner is negligible.

Asana and Microsoft Planner are both simple project management tools, although Microsoft Planner may be less intuitive for users who are not familiar with the Microsoft ecosystem. Those familiar with Microsoft products should be able to begin using Microsoft Planner immediately.

Asana and Microsoft Planner are different enough that an answer should immediately become apparent. When choosing the best project management software, consider:

The benefits of Microsoft Planner somewhat wane if you aren’t already using Office 365. And if you are already using Office 365, it only makes sense to use a product already included and integrated.

Discover the secrets to IT leadership success with these tips on project management, budgets, and dealing with day-to-day challenges.

Asana vs Planner: Project management software comparison

Your email has been sent

Your message has been sent

TechRepublic Premium content helps you solve your toughest IT issues and jump-start your career or next project.

Windows 11 gets an annual update on September 20 plus monthly extra features. In enterprises, IT can choose when to roll those out.

Edge AI offers opportunities for multiple applications. See what organizations are doing to incorporate it today and going forward.

This is a complete guide for Apple’s iPadOS. Find out more about iPadOS 16, supported devices, release dates and key features with our cheat sheet.

Discover data intelligence solutions for big data processing and automation. Read more to explore your options.

Whether you are a Microsoft Excel beginner or an advanced user, you’ll benefit from these step-by-step tutorials.

Edge computing is an architecture intended to reduce latency and open up new applications. The terms around it can be fluid, but are helpful to know. From the glossary’s introduction: Edge computing is an architecture which delivers computing capabilities near the site where the data is used or near a data source. In an idealized …

This document helps make sure that you address data governance practices for an efficient, comprehensive approach to data management. This checklist from TechRepublic Premium includes: an introduction to data governance, a data governance checklist and how to manage a data governance checklist. From this checklist’s introduction: Data governance is the process by which an organization …

Recruiting a Scrum Master with the right combination of technical expertise and experience will require a comprehensive screening process. This hiring kit provides a customizable framework your business can use to find, recruit and ultimately hire the right person for the job. This hiring kit from TechRepublic Premium includes a job description, sample interview questions …

Knowing the terminology associated with Web 3.0 is going to be vital to every IT administrator, developer, network engineer, manager and decision maker in business. This quick glossary will introduce and explain concepts and terms vital to understanding Web 3.0 and the technology that drives and supports it.

- Published in Uncategorized

Comparing Microsoft Loop vs. SharePoint for businesses – TechTarget

Since the COVID-19 pandemic began, remote and hybrid workplaces have become popular. Many interactions and collaboration between team members quickly became and still remain virtual.

During the pandemic, Microsoft promoted its 365 product suite as the go-to platform for virtual interactions. The vendor also saw its customers embrace services like Teams and SharePoint for remote work and collaboration. Then, in 2021, Microsoft introduced a new app for remote work and collaboration called Microsoft Loop.

But what is Microsoft Loop, and how different is it from SharePoint for content management and collaboration?

Organizations consider SharePoint an intranet service that supports enterprise content storage and management. Features like file sharing, versioning, delivery and custom list creation have helped employees access corporate data from anywhere using a browser or a mobile app.

SharePoint offers several components to support collaboration, including the following:

Sixteen years after the birth of SharePoint, the need for real-time collaboration brought forth Teams, Microsoft’s team collaboration software. Teams incorporates video and audio conferencing, real-time chat and SharePoint to store content.

After organizations increased their adoptions of SharePoint and Teams amid the pandemic, Microsoft introduced a product called Loop in an attempt to better fit remote work and collaboration needs.

With Loop, users can interact with and update content in different Microsoft platforms, like Outlook, Teams, SharePoint, OneNote and Word. Those platforms then reflect the changes, as Loop maintains one version of the content, regardless of the platform.

Loop has three main features: pages, workspaces and components.

Some users may view the pages feature as similar to OneNote. However, Loop pages enable users to insert live data and components from different sources in real time, which OneNote doesn’t.

Elements within Loop pages include files, links or data from Dynamics 365 and other Microsoft 365 platforms.

Loop workspaces act like Microsoft’s content explorer. They let users store critical documents and Loop components in one place. Users can see the content they work on for specific projects, and Loop workspaces enable them to interact, share ideas and collaborate on different content asynchronously and synchronously. This feature can help organize all the items teams work on together.

Loop components can be tables, bulleted lists, checklists, paragraphs or task lists that users can edit, and the components stay up to date in connected tools, like Word, Outlook or Teams. Components’ real-time updates mean users can see the same information in the components across platforms.

Loop components are also interactive, as users can view them to see who authored the content and update them in real time.

Microsoft Loop may seem to perform the same activities as SharePoint in regard to content storage, but Loop introduces a new collaboration experience where content — regardless of its location or format — can cross into multiple Microsoft 365 apps.

The key differences between Loop and SharePoint are the following:

While it is still too early to tell how successful Loop’s adoption might be, Loop’s current components seem to give enough functionality for users to take advantage of it.

Part of: Introduction to Microsoft Loop

Microsoft plans to release Loop this year as the long-awaited information-sharing tool across 365 apps. The software reduces the time spent searching for vital data.

As most organizations now have hybrid workers, virtual collaboration is a priority. Here’s how integrating Microsoft Teams with Loop components can enable effective collaboration.

Microsoft’s announcement of Loop came with various questions — in particular, how the new product compares to legacy products, like SharePoint. Here, find out how the two differ.

While Microsoft Loop is not yet generally available, Microsoft has released details about how Loop can connect users and projects across the Microsoft 365 service.

The combination of the analytics vendor’s NLP-based platform with the spreadsheet is designed to help joint customers derive …

Data analytics pipelines bring a plethora of benefits, but ensuring successful data initiatives also means following best …

The analytics vendor plans to use the capital to build up an ecosystem for analytics through new integrations and develop …

The startup’s technology aims to help enterprises liberate data from applications where it can be locked so users can more easily…

InfluxData updated its InfluxDB Cloud database service with a new engine, new storage and real-time data capabilities, and …

Data quality challenges pose a threat to organizations’ decision-making. Inaccurate, inconsistent, missing and duplicate data …

In this Q&A, Stephen Keys of IFS discusses why sustainability projects for organizations are complex undertakings, but the data …

Some companies may require CRM software in addition to their ERP system. Learn more about CRM vs. ERP and whether your company …

The industrial sector has a massive carbon footprint. That’s why some companies are working to clean up steel and cement and find…

With its Cerner acquisition, Oracle sets its sights on creating a national, anonymized patient database — a road filled with …

Oracle plans to acquire Cerner in a deal valued at about $30B. The second-largest EHR vendor in the U.S. could inject new life …

The Supreme Court ruled 6-2 that Java APIs used in Android phones are not subject to American copyright law, ending a …

SAP Multi-Bank Connectivity has added Santander Bank to its partner list to help companies reduce the complexity of embedding …

Over its 50-year history, SAP rode business and technology trends to the top of the ERP industry, but it now is at a crossroads …

Third-party support providers make a pitch that they can provide greater flexibility at a lower cost, but customers should think …

All Rights Reserved, Copyright 2011 – 2022, TechTarget

Privacy Policy

Cookie Preferences

Do Not Sell My Personal Info

- Published in Uncategorized

What is IT transformation: Benefits, challanges, examples – Dataconomy

There must always be a base from which to innovate. With the underlying analysis, shifting funds from infrastructure to innovation is possible. If not, your infrastructure is at risk. In many situations, innovation may necessitate new corporate investment.

IT transformation is the comprehensive review and reworking of an organization’s IT infrastructure to increase effectiveness and delivery in a digital economy. Business leaders, such as the CIO, are in charge of IT transformation, which is the cornerstone of an organization’s overall digital transformation plan. It may entail updating and changing network infrastructure, hardware, software, IT service management, and the methods used to store and retrieve data. Informally, the motto “rip and replace” may be used to describe IT transition.

Table of Contents

The majority of consumers in the modern market want to feel exactly the same way when using technology for work as they do when using it for personal interests. However, a firm may find it challenging to accomplish this. Because of this, businesses are calling for more hybrid IT solutions that will ensure that customers receive the best possible service.

The ultimate goal of every corporate CEO is to increase staff productivity and effectiveness. This justifies the necessity of IT transformation. It offers significant solutions for crucial corporate processes, including finance and human resources.

Join the Partisia Blockchain Hackathon, design the future, gain new skills, and win!

Businesses must take action to keep up with a market that is becoming more digital and competitive by not just improving their current systems but also developing and acquiring new applications and services that provide deeper insights into their operations, industry, and clientele. IT transformation frequently seeks to transition the IT department from a reactive, rigid organization to a proactive, adaptable component of the company that can react fast to shifting digital business requirements and make better-informed decisions.

The ultimate objective of these efforts, according to Deloitte, is to “reimagine IT development, delivery, and operating models, and to enhance IT’s ability to collaborate effectively within the enterprise and beyond its traditional boundaries.”

Making substantial changes to the way a corporation or organization operates is referred to as “business transformation.” Personnel, procedures, and technology are all included in this. Organizations that undergo these changes are better able to compete, become more efficient, or completely change their strategic direction.

Business transformations are large-scale, seismic adjustments that firms implement to spur development and change beyond the bounds of incremental improvements. The focus is broad and strategic, including changing to new operational or commercial models.

Business transformations are undertaken by organizations to increase value. To maximize the potential of the business, it can be necessary to optimize personnel potential, harness intellectual property and proprietary technology for other uses, or improve efficiency.

All businesses need an inclusive approach to their data HQ

Application transformation is the process used to analyze old software in a firm and evaluate whether applications can be modernized or moved to the cloud. The apparent first step is to take stock of what you already have, but for larger firms, some legacy systems contain layers of out-of-date languages with lost KT.

Plotting the application depending on its complexity and importance to the client and the organization’s future can therefore be the first step. From there, your “initial wave” efforts toward modernization will be those that are high-value and low-effort. The discovery process for application transformation makes it possible to choose the most appropriate course for modernization.

In order to supply automated services, cloud computing, and new operating models, successful IT transformation creates a strong core infrastructure. Additionally, it streamlines and quickens the deployment of IT services while lowering deployment risk. IT transformation paves the way for more affordable, flexible, and innovative IT as a service delivery.

Organizations may free their IT budget from operational costs and allocate more money for digital transformation by optimizing existing IT cost models. Better business-IT alignment is another benefit of IT transformation.

Since many firms were not founded in the digital era, they lack the freedom to quickly and totally take out and replace all current IT systems. These businesses must contend with outdated business models, software, and systems that limit their ability to transition while planning how to adopt contemporary techniques and methods. This involves diverting funds and resources from established programs to fresh IT transformation projects.

Like any significant organizational change, IT transformation has an impact on corporate culture, business standards, and workflow. In order to successfully convert an organization into a digital business, CIOs must first successfully navigate culture, according to research firm Gartner. In addition to organization-wide communication and training about new IT processes and technology, having a shared vision of the organization’s future state is crucial.

Streamlining a machine learning process flow: Planning is the key

If you’ve ever seen The Office, you’ve already witnessed (a drawn-out and undoubtedly imperfect) digital revolution over the course of 10 seasons. Although the purpose of this humorous example from pop culture was not to impart knowledge, it is a great illustration of how a traditional company and its workforce handled the transition to digital. Mike was not a strong supporter of the shift, but we shouldn’t dwell on that for too long; instead, we should move on to other examples of IT transformation in action.

One of the sectors affected most significantly by the development of digital technology is unquestionably logistics. UPS is a supply chain management and worldwide shipping business. Given that it was established in 1907, we believe that the digital revolution was simply one change in a lengthy series of changes. Although UPS shows it is not always true, established businesses often have greater trouble implementing IT transformation.

They created a fleet management solution in 2012 that employed machine learning to plan the most efficient delivery routes. The device markedly enhanced driver productivity while lowering fuel costs and carbon emissions. Software development is thought to be saving UPS $300M to $400M annually.

The implementation of numerous data-driven solutions to improve UPS’ internal operations is another illustration of the company’s IT transformation efforts (such as sorting packages, loading trucks, etc.).

UPS never stops and consistently takes on new tasks associated with its IT transformation. The company has saved hundreds of millions of dollars and is still one of the biggest shippers in the world since it actively adopted the shift.

The international behemoth Ikea creates and markets ready-to-assemble furniture and home decor. Ikea made the decision to go digital in 2018 after operating an analog business for over 80 years and becoming one of the most recognizable brands in the world.

The business made a choice to bring on board a digital guru to guide it through the procedure. At the beginning of 2018, former Google and Samsung advisor Barbara Martin Coppola joined the Ikea team as the Chief Digital Officer.

Ikea made the decision to modify its stores and use them as fulfillment centers in order to adapt to the new business model. They employed algorithms to manage the supply chain in order to run two businesses concurrently from the same location (from thousands of locations, including Ikea shops and delivery centers). Additionally, they concentrated on creating analytics and incorporating them into decision-making.

Ikea has the same clientele, both in-store and online. The business made the decision to link in-person and online contacts with customers in order to improve customer experience and maintain consistent branding across all channels. For instance, one may begin planning their new kitchen on the Ikea website before visiting the shop. They can locate themselves by connecting to a remote customer meeting location in the store.

Ikea, a retailer, concentrated on growing its online business. Running a traditional store and an internet store are completely different tasks. Running both at once is a very different matter. It is impossible to define the boundary between one phase of the IT transformation and another.

13 marketing automation tools that can help you boost your sales

IKEA must incorporate digital into every facet of its business, as stated by Barbara Martin Coppola. While the company’s ideals remain constant, the methods of operation change to reflect the evolving business and lifestyle environments.

American software business Adobe was established in 1982. Photoshop, Adobe Acrobat Reader, and Illustrator are some major products you have definitely used.

Adobe Systems, the company’s previous name, offered boxed software back then. The business took a big risk by switching from a license-based approach to a subscription-based model when the 2008 financial crisis hit. It reorganized its service portfolio into three cloud-based solutions: Experience Cloud, Document Cloud, and Creative Cloud. This is how Adobe evolved into a cloud business using the now-ubiquitous SaaS (software-as-a-service) model.

In the meanwhile, they bought an e-commerce platform and a web analytics firm (Omniture) as part of their IT transformation (Magento) efforts. The business also understood that only with the top talent would they be able to accomplish their objectives. As a result, Adobe concentrated on ensuring employee satisfaction and made investments in developing an employer brand and employee-focused work culture. In order to keep track of the company’s health, they also used a data-driven operation model.

Rethinking and changing business models while keeping the client at the forefront of our attention is a part of digital transformation. The practice of utilizing digital technology in all business domains to either develop new processes and customer experiences or adjust existing ones will fundamentally enhance how firms provide value to their consumers.

It is essential to comprehend what digital transformation is not in order to have a greater understanding of what it is. Digital transformation does not just entail boosting your social media presence and engagement but also means overhauling your current business procedures. Every aspect of the business is affected by digital transformation, which goes beyond processes and products to affect the organization’s culture as well. This includes how decisions are made, who is hired, how post-sales service is provided, and even how employees interact with one another internally.

It’s wise to clarify right away that IT transformation is distinct from digitization, which is the process of converting anything from analog to digital, and distinct from digitalization, which is the efficient use of data to streamline tasks. The CTO and the CIO are typically in charge of leading digital transformation, and they may collaborate with suppliers to partially or wholly outsource their transformation process.

These two names are frequently confused with one another and used interchangeably. Let’s examine the distinctions between the two so that you may develop a digital transformation strategy that is appropriate for your company.

The overall approach for digital transformation must include IT change. This simply suggests that IT transformation is necessary for digital transformation to occur. A digital transformation’s foundation is formed through IT transformation.