RingCentral: Technicals Turn Less Bearish (NYSE:RNG) – Seeking Alpha

JHVEPhoto

JHVEPhoto

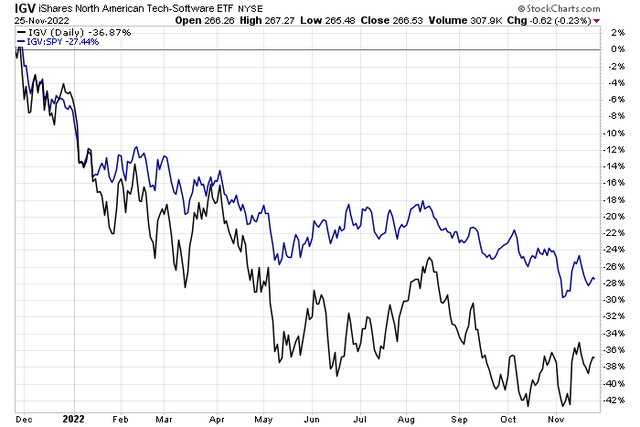

Are software stocks finding their footing? The iShares North American Tech-Software ETF (IGV) made new lows earlier this month, but relative to the S&P 500, a double bottom was notched, and a higher high was put in two weeks ago. There is still a lot of work for the bulls to do here, but one name rallied on big volume following its Q3 earnings beat and job layoff announcement.

Stockcharts.com

Stockcharts.com

According to Bank of America Global Research, RingCentral (NYSE:RNG) offers a cloud-based solution for business communications that replaces legacy and expensive on-premises communications systems. It is delivered as an application that follows the user regardless of device (office phone, smartphone, desktop, tablet). Features include team collaboration, voice, text, fax, audio conferencing, and integration with document and customer relationship management systems.

The California-based $3.4 billion market cap Software industry company within the Information Technology sector has negative trailing 12-month GAAP earnings and does not pay a dividend, according to The Wall Street Journal.

The embattled firm recently announced it would slash 10% of its workforce amid ongoing challenges in the tech sector. Interestingly, the stock traded higher following that news along with reporting a Q3 earnings beat, according to Seeking Alpha. That kind of price action, when it occurs on high volume, makes for an interesting long-side case. We will dive into the technicals later.

RNG provides cloud-based software solutions for the corporate world as a replacement for more cumbersome communications systems. The company generally benefits from the flexible work environment world, but a return to the office in a loosening job market could be a risk. Still, operating earnings are positive, and margins remain solid.

Downside risks include strategic partnerships taking longer to create cost savings and profits versus expectations. The management team must also carefully execute growth plans in what could be a particularly challenging 2023. Finally, its small and mid-sized business target market will feel macro pressures next year along with competitor offerings from Microsoft and Zoom Phone causing possible profitability issues.

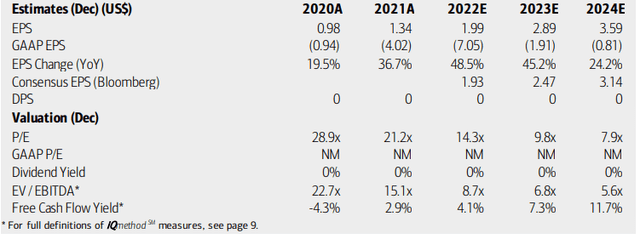

On valuation, analysts at BofA see earnings continuing to grow sharply in the years ahead. While the Bloomberg consensus EPS forecast is not quite as sanguine as BofA’s outlook, it still shows robust growth. GAAP per-share profits are seen as being sharply negative, though.

Using non-GAAP numbers, the P/E ratio turns very cheap given the growth forecast. Moreover, its EV/EBITDA on a look-ahead basis looks more attractive than it did a few quarters ago. What I also like is that RNG is free cash flow positive.

Overall, I like the GARP valuation now versus my bearish take during the summer. Seeking Alpha has an A rating on RingCentral’s forward PEG ratio – a good metric for this growth stock.

BofA Global Research

BofA Global Research

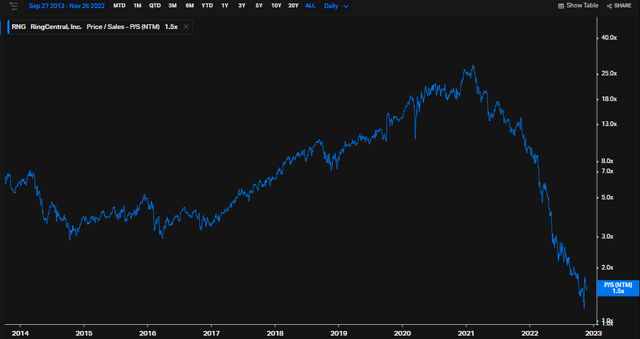

Another interesting look is RNG’s forward price-to-sales ratio, which is near 1.5, per Koyfin Charts. Seeking Alpha has it at 2.5. Either way, it is a far cry from the nosebleed-level 5-year average of 14.2.

Koyfin Charts

Koyfin Charts

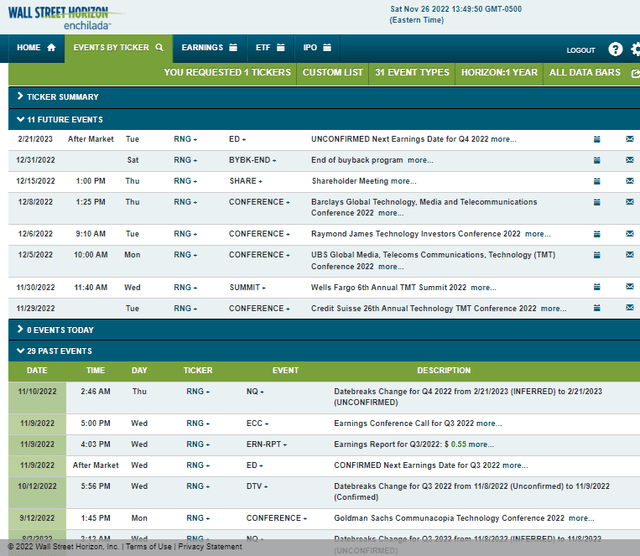

Looking ahead, there are several volatility catalysts in the coming weeks when looking at corporate event data from Wall Street Horizon. RNG’s management team presents at a pair of conferences this week and three more during the first full week of December. Then comes a shareholder meeting on December 14 before its share buyback program ends. Finally, RingCentral’s Q4 2022 earnings report is unconfirmed to take place on Tuesday, February 21 AMC. There are many volatility catalysts upcoming.

Wall Street Horizon

Wall Street Horizon

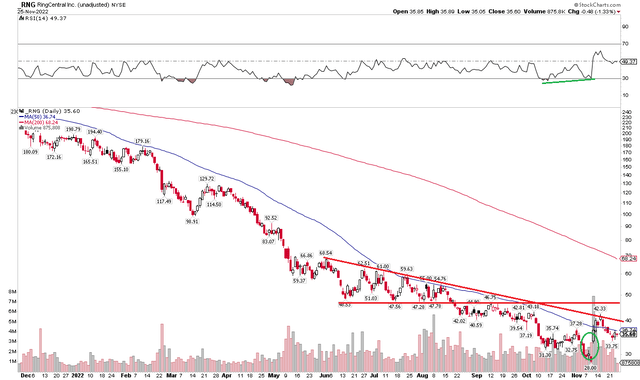

Back in August, I was bearish on RNG’s fundamentals and technicals. The situation has improved on both fronts. We have gone through how much better the valuation looks, but also notice some signs of life in the technical view below. Shares gapped higher post-earnings and after the job cut news in October. Now, the stock is going through what appears to be a bull flag pattern.

I see resistance in the $46 to $49 range, which would be an impressive gain from here. Also, take note of a broader downtrend resistance line that was first probed in October – that is still in play, but a bullish RSI divergence suggests it could be taken out before long as the sellers might be giving up their stranglehold on RingCentral. Overall, I think a tradeable low is in, but the bulls still have some work to do.

Stockcharts.com

Stockcharts.com

RNG has a much better valuation look now versus many months ago now that shares are down and better earnings are expected, at least according to BofA. I think the stock is at least a hold today. I will revisit later on to see if the stars are aligning for a buy call.

This article was written by

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

- Published in Uncategorized

Deque Systems, Inc. | U.S. GAO – Government Accountability Office

Deque Systems, Inc., a small business of Herndon, Virginia, protests the award of a contract to IronArch Technology, LLC, a small business of McLean, Virginia, under request for proposals (RFP) No. 36C10B22R0002, issued by the Department of Veterans Affairs (VA) for accessibility compliance software services. The protester challenges the agency’s evaluation of offerors’ proposals and alleges that the agency made an unreasonable best-value determination.

DOCUMENT FOR PUBLIC RELEASE

The decision issued on the date below was subject to a GAO Protective Order. This redacted version has been approved for public release.

Decision

Matter of: Deque Systems, Inc.

File: B‑420969; B‑420969.2

Date: November 21, 2022

Amy Laderberg O’Sullivan, Esq., James G. Peyster, Esq., and William B. O’Reilly, Esq., Crowell & Moring LLP, for the protester.

Alexander B. Ginsberg, Esq., and Michael J. Anstett, Esq., Fried, Frank, Harris, Shriver & Jacobson LLP, for IronArch Technology, LLC, the intervenor.

Mary G. Courtney, Esq., Annemarie Drazenovich, Esq., and Reza Behinia, Esq., Department of Veterans Affairs, for the agency.

David A. Edelstein, Esq., and Alexander O. Levine, Esq., Office of the General Counsel, GAO, participated in the preparation of the decision.

DIGEST

1. Protest of agency’s evaluation of awardee’s technical proposal is denied where protester has not demonstrated that the agency’s evaluation was unreasonable.

2. Protest of agency’s evaluation of offerors’ past performance is denied where solicitation did not require agency to compare the relevance of past performance examples and protester has not demonstrated that the evaluation was otherwise unreasonable.

3. Protest that agency did not evaluate transition risk is dismissed where solicitation did not require such an evaluation.

DECISION

Deque Systems, Inc., a small business of Herndon, Virginia, protests the award of a contract to IronArch Technology, LLC, a small business of McLean, Virginia, under request for proposals (RFP) No. 36C10B22R0002, issued by the Department of Veterans Affairs (VA) for accessibility compliance software services. The protester challenges the agency’s evaluation of offerors’ proposals and alleges that the agency made an unreasonable best‑value determination.

We deny the protest.

BACKGROUND

The VA’s Section 508 Program Office provides accessibility services, conformance testing solutions, and innovative strategies for implementing the goals and objectives of section 508 of the Rehabilitation Act of 1973, 29 U.S.C. § 794d (section 508). Contracting Officer’s Statement (COS) at 1. This includes assessing the accessibility compliance levels of various VA information and communications technology products, such as websites, Adobe PDF documents, and eLearning courses. Id.

On February 3, 2022, the agency issued the solicitation as a small business set‑aside, seeking automated and manual testing, reporting, help desk activities, and training in support of the Section 508 Program Office’s accessibility compliance assessments. Id. The agency intended to award a single fixed‑price contract for a 12‑month base period and two 12‑month option periods. Agency Report (AR), Tab 5, RFP[1] at 7, 25.

Deque previously provided similar services to the Section 508 Program Office. COS at 11. Deque’s prior contract ended on November 7, 2021. Id.

The RFP included a performance work statement (PWS) describing the tasks the contractor would be expected to perform. RFP at 20‑78. Of relevance to this protest, the PWS included section 5.3, “section 508 accessibility compliance scanning tool,” which required the contractor to provide a commercial off‑the‑shelf[2] section 508 compliance tool, and which set forth a list of 91 requirements that the contractor’s tool would have to meet. Id. at 30‑39.

The RFP provided that award would be made on a best‑value tradeoff basis, considering four evaluation factors: technical, price, past performance, and veterans involvement. RFP at 116. The technical factor was significantly more important than price, price was slightly more important than past performance, and past performance was slightly more important than veterans involvement. Id.

With respect to the technical factor, the solicitation instructed offerors to “propose a detailed approach that addresses . . . [t]he [o]fferor’s technical approach to provide a commercial off‑the‑shelf [s]ection 508 accessibility compliance tool in accordance with [PWS] section 5.3 upon contract award.” Id. at 120‑21. Offerors were also required to address their approaches to the PWS’s required auditing services and help desk support, as well as their management methodology. Id.

The RFP stated that the agency would evaluate the technical factor as follows:

a. Understanding of the Problem–The proposal will be evaluated to determine the extent to which it demonstrates a clear understanding of all features involved in solving the problems and meeting and/or exceeding the requirements presented in the solicitation and the extent to which uncertainties are identified and resolutions proposed.

b. Feasibility of Approach–The proposal will be evaluated to determine the extent to which the proposed approach is workable and the end results achievable. The proposal will be evaluated to determine the level of confidence provided the [g]overnment with respect to the [o]fferor’s methods and approach in successfully meeting and/or exceeding the requirements in a timely manner.

Id. at 116‑17.

With respect to the evaluation of past performance, the RFP stated that the agency would “assess the relative risks associated with an [o]fferor’s likelihood of success in fulfilling the solicitation’s requirements as indicated by that [o]fferor’s record of past performance.” Id. at 117. The RFP stated: “[t]he [g]overnment will conduct a performance risk assessment based on the quality, relevancy, and recency of the [o]fferor’s past performance, as well as that of its major subcontractor(s), as it relates to the probability of successful accomplishment of the required effort.” Id.

The agency received three timely proposals, including proposals from Deque and IronArch.[3] COS at 6. The agency convened a source selection evaluation board (SSEB), consisting of a technical evaluation team (TET) and separate evaluation teams for price, past performance, and veterans involvement. See AR, Tab 14, SSEB Briefing Slides at 1. The TET performed an initial evaluation of offerors’ technical proposals. COS at 6. After this initial evaluation, the agency engaged in discussions with Deque and IronArch via notices referred to as “items for negotiation” (IFNs), and the TET evaluated the offerors’ revised proposals. Id.

The final ratings[4] and prices for Deque’s and IronArch’s proposals were as follows:

Evaluation Factor

Deque

IronArch

Technical

Good

Outstanding

Significant Strengths

1

3

Strengths

5

3

Price

$12,702,500

$13,812,341

Past Performance

Low Risk

Low Risk

Veterans Involvement

Some Consideration

Full Credit

Id.; AR, Tab 15, Source Selection Decision Document (SSDD) at 4‑7.

On June 29, the source selection authority (SSA) met with the SSEB to discuss its findings. AR, Tab 15, SSDD at 3; AR, Tab 14, SSEB Briefing Slides. The SSA concurred with the SSEB’s ratings and determined that IronArch’s proposal represented the best value to the government. AR, Tab 15, SSDD at 3‑4. In making this determination, the SSA first separately reviewed the strengths and weaknesses in Deque’s and IronArch’s proposals, then performed and documented a detailed comparison of the relative merit of the two proposals. Id. at 4‑9.

In evaluating proposals under the technical factor, the SSA identified specific “additional functionality” of IronArch’s section 508 scanning tool as compared to Deque’s tool. Id. at 8. This included the ability of IronArch’s tool to test a broader number of platforms than Deque’s tool, which “allows [the agency] to provide wider coverage without having to seek outside resources.” Id. The SSA found that “[IronArch]’s proposed scanning tool presented substantial additional benefits to the [g]overnment in comparison to [Deque]’s scanning tool and approach and warrants payment of a price premium.” Id. at 8.

The SSA found that Deque’s approach to the help desk requirement “presented some additional benefits” as compared to IronArch’s approach, because Deque proposed a highly capable team and a service-level achievement tracking system. Id.

With respect to management approach‑-also part of the technical factor‑-the SSA found that Deque’s proposal contained only “generalities,” whereas IronArch’s proposal “received a significant strength for its very detailed approach.” Id. at 9. The SSA considered this “a key difference in the proposals,” and determined that IronArch’s “approach to project management presented additional benefits to the [g]overnment in comparison to [Deque]’s project management approach and warrants payment of a price premium.” Id.

Ultimately, the SSA determined that IronArch presented a superior proposal to Deque on the technical factor as a whole. Id. The SSA wrote: “Although [Deque] proposed a help desk approach with some additional benefits, the combined benefits from [IronArch’s] proposed tool and its proposed project management approach is determined to provide more value and benefit to the Government.” Id.

With respect to the past performance evaluation factor, the SSA considered Deque and IronArch to be essentially equal. He wrote:

[Deque] and [IronArch] each received a rating of [l]ow [r]isk in the [p]ast [p]erformance [f]actor; however, [Deque] had three recent and relevant past performance instances whereas [IronArch] had a total of four recent and relevant instances. Furthermore, [Deque] received [DELETED] assessments indicating its performance was exceptional and [DELETED] assessments indicating its performance was satisfactory; whereas [IronArch] received [DELETED] assessments indicating its performance was exceptional and [DELETED] assessments indicating its performance satisfactory. While [Deque] has more [e]xceptional questionnaire responses, there is not a discernible difference, therefore, I considered [Deque and IronArch]’s [p]ast [p]erformance essentially equal in this factor.

Id. The SSA also noted that IronArch received “full credit” for the veterans involvement factor, whereas Deque received only “some consideration.” Id.

Considering price and the three non‑price evaluation factors, the SSA determined that IronArch’s technically superior proposal merited payment of IronArch’s price premium of 8.74%. Id. at 9‑10. The SSA stated:

[Deque and IronArch] are essentially equal in the past performance factor and [IronArch] is higher rated in the [v]eterans [i]nvolvement [f]actor. [IronArch] proposed a superior technical proposal and technical is the most significant factor. It is my opinion that [IronArch]’s superior technical proposal as discussed above justifies the premium the [g]overnment will have to pay to receive the superior technical benefits associated with [IronArch]’s proposal when compared to that of [Deque].

Id.

On July 21, the agency awarded the contract to IronArch. COS at 7. Deque requested and received a debriefing. Id. at 8; AR, Tab 17, Deque Debriefing. This protest followed.

DISCUSSION

Deque alleges that the agency unreasonably evaluated offerors’ proposals under the technical and past performance factors, did not evaluate the risk inherent in a transition from Deque’s scanning tool to IronArch’s scanning tool, and made a flawed tradeoff decision.[5] We have reviewed all of the protester’s allegations, and, as set forth below, find no basis to sustain the protest.

Technical Evaluation of IronArch’s Proposal

Deque contends that IronArch’s proposal did not meet several requirements of the solicitation, such that the agency should have found IronArch’s proposal to be unacceptable or, at a minimum, evaluated it less favorably under the technical factor.

The evaluation of technical proposals is generally a matter within the agency’s discretion, which our Office will not disturb unless it is shown to be unreasonable or inconsistent with the solicitation’s evaluation criteria. American Systems Corp., B‑413952.3, B‑413952.4, June 23, 2017, 2017 CPD ¶ 204 at 6‑7; NCI Information Systems, Inc., B‑412680, B‑412680.2, May 5, 2016, 2016 CPD ¶ 125 at 7. This includes determinations regarding the acceptability of an offeror’s proposed item or service; the procuring agency has primary responsibility for such determinations and we will not disturb them unless they are shown to be unreasonable. Knowlogy Corp., B‑416208.3, Dec. 20, 2018, 2019 CPD ¶ 47 at 6; TransAtlantic Lines, LLC, B‑411242, B‑411242.2, June 23, 2015, 2015 CPD ¶ 204 at 5.

Deque contends that IronArch’s proposal failed to meet the solicitation requirement that the section 508 compliance tool be available “24 hours a day, 7 days a week to all users, [g]overnment employees, and contractors.” RFP at 33. In this respect, IronArch’s proposal stated that its tool would be “available 24 by 7 except for planned downtime. [Service‑level agreement] shall include update authorization before any contractor updates take place and include coordinated support for VA patches.” AR, Tab 8, IronArch Technical Proposal at 6. Deque contends that IronArch’s stated intent to schedule downtime for updates and patches means that IronArch will not meet the solicitation’s availability requirements.

The agency counters that it is reasonable to assume that occasional downtime for maintenance purposes is allowable if coordinated with the agency. COS at 10. The contracting officer states that this is an industry standard practice, and that it is common to allow for security patches and routine maintenance activities that may require a tool to be offline during an authorized period of time. Id. The contracting officer also notes that, during performance of its prior contract, Deque received approved downtime to perform similar activities. Id. Deque does not challenge this assertion. Moreover, Deque’s proposal contained language allowing for “patches and updates” to its tool with “approv[al] in writing by the VA [program manager] prior to deployment.” AR, Tab 7, Deque Technical Proposal at 15. Under these circumstances, we find the agency’s interpretation of the solicitation, and its resultant determination that IronArch’s proposal met the PWS’s availability requirements, to be reasonable.[6]

Deque also challenges the agency’s technical evaluation based on the statement in IronArch’s proposal that its tool would need to be configured during deployment to comply with certain PWS requirements. Deque contends that this demonstrates noncompliance with the solicitation’s requirement for a section 508 tool that meets each of the PWS requirements “without any customizations.” RFP at 31.

Here, the contracting officer explains that “configuration” is not the same as “customization.” Supp. Memorandum of Law (MOL) at 11‑13. In this respect, the RFP specifically allowed for offerors’ tools to be “configurable out of the box” at the time of award, which the RFP defined as “accessible without further development.” RFP at 31. The agency explains that this PWS language was intended to clarify the agency’s requirement for a commercial off‑the‑shelf product rather than a customizable commercial item. Supp. MOL at 12. But, the RFP recognized that a commercial off‑the‑shelf product would require post‑award configuration and integration to work with VA’s systems. The PWS therefore required the contractor to develop a plan of approach, after award, that “identif[ied] methods for installation and configuration of the [t]ool as well as integration of [t]ools into business processes of the [g]overnment.” RFP at 29. The RFP allowed the contractor to obtain VA approval for its tool after award, and required the contractor to “conduct installation, configuration, and process integration of the [t]ool and any other required software” after receipt of these post‑award approvals. Id. at 29‑30.

Based on the text of the RFP, we agree with the agency that the RFP did not require a tool that met each and every one of the PWS requirements without configuration at the time of award. While Deque has pointed to statements in IronArch’s proposal that use words such as “design,” Supp. Comments at 9, we view these statements as consistent with the RFP’s allowances for‑-and explicit anticipation of‑-post‑award configuration and integration. Deque has not demonstrated that the agency unreasonably evaluated whether IronArch’s proposed tool violated the PWS’s prohibition on customization after award.

In addition to the downtime and customization issues, Deque identifies several technical requirements of section 5.3 of the PWS that IronArch’s proposal did not explicitly commit to meeting. These requirements include reporting metrics to two decimal places, restoring compromised data from backups within two days, and indicating whether specific Adobe PDF files were included in a scan. Deque contends that the agency considered all of the section 5.3 requirements to be material, and that the agency should have viewed IronArch’s failure to mention each of the requirements negatively. In support of this argument, Deque notes that its own proposal recited each of the 91 requirements of PWS section 5.3, and stated that Deque met (or exceeded) each requirement. See AR, Tab 7, Deque Technical Proposal at 13‑22. Deque also points to comments that the agency made to Deque during discussions, where the agency indicated concerns with Deque’s approach to certain section 5.3 requirements. See Protest, exh. 6, Agency IFN to Deque.

The agency responds that the RFP did not require offerors to list each of the 91 PWS section 5.3 requirements and confirm an intent to comply; rather, the RFP required offerors to describe their “approach to provide” a tool that meets these requirements. RFP at 120‑21. We agree. Where a proposal does not affirmatively demonstrate compliance with each and every requirement of the solicitation, but also does not take exception to any of those requirements, an agency may reasonably determine that a proposal demonstrates an adequate understanding of, and approach to, the agency’s needs. See Novartis Pharmaceuticals Corp., B‑285038.4, B‑285038.5, Feb. 1, 2002, 2002 CPD ¶ 33 at 7‑9; see also Caddell‑Nova, JV, B‑420892, B‑420892.2, Oct. 20, 2022, 2022 CPD ¶ 263 at 6‑7 n.4 (where “solicitation required offerors to explain their ‘approach’ [to solicitation requirements] we do not think it required offerors to affirmatively certify an intent to comply with each and every one of the . . . requirements, particularly where nothing on the face of the offeror’s proposal suggests an intent not to comply”).

Deque does not contend that anything in IronArch’s proposal indicated that IronArch took exception to or would not comply with the PWS section 5.3 requirements that IronArch’s proposal did not address; the protester merely alleges that IronArch’s proposal was “completely silent regarding” these requirements.[7] Comments & Supp. Protest at 7. Accordingly, Deque has not demonstrated that the agency’s evaluation of IronArch’s approach to providing a section 508 tool was unreasonable.

In sum, we have considered all of the protester’s challenges to the agency’s evaluation of IronArch’s technical proposal and see no basis to conclude that the evaluation was unreasonable or inconsistent with the RFP’s stated evaluation criteria. We therefore deny this aspect of the protest. American Systems, supra at 6‑7.

Adjectival Ratings

Deque also challenges the agency’s technical evaluation on the basis that the agency acted unreasonably when it in assigned Deque a rating of “good” rather than “outstanding” under the technical factor.[8] Protest at 16‑17. The protester contends that the agency has not explained why Deque‑-assessed five strengths and one significant strength‑-was rated “good” while IronArch‑-with three strengths and three significant strengths‑-was rated “outstanding.” Comments & Supp. Protest at 12.

We need not decide the merits of Deque’s challenge to the assigned adjectival ratings because the protester has failed to demonstrate that it was competitively prejudiced by the errors alleged. ICI Services Corp., B‑418255.5, B‑418255.6, Oct. 13, 2021, 2021 CPD ¶ 342 at 13. In this regard, the record reflects that the SSA did not rely on the offerors’ adjectival ratings when he found IronArch to be superior to Deque under the technical factor. Rather, the SSA found IronArch to be technically superior to Deque on this factor because of qualitative differences between the offerors’ proposals. Specifically, the SSA explained that IronArch’s advantages with respect to its proposed compliance tool and its project management approach outweighed Deque’s advantage with respect to its help desk approach. AR, Tab 15, SSDD at 9. This qualitative analysis is in accord with our consistently stated guidance that evaluation ratings, be they adjectival, numerical, or color, are but a guide to, and not a substitute for, intelligent decision‑making. See, e.g., NCI Info. Sys., Inc., B‑412680, B‑412680.2, May 5, 2016, 2016 CPD ¶ 125 at 9; Shumaker Trucking and Excavating Contractors, Inc., B‑290732, Sept. 25, 2002, 2002 CPD ¶ 169 at 8.

In sum, even assuming Deque had been assigned a rating of outstanding under the technical factor (or, conversely, had IronArch been assigned a rating of good), it would have had no impact on the agency’s best‑value determination. ICI Servs., supra at 13‑14. Competitive prejudice is an essential element of a viable protest, and we will sustain a protest only where the protester demonstrates that, but for the agency’s improper actions, it would have had a substantial chance of receiving the award. Technology & Telecomms. Consultants, Inc., B‑413301, B‑413301.2, Sept. 28, 2016, 2016 CPD ¶ 276 at 14. Consequently, we deny this allegation.

Past Performance Evaluation

Deque also protests the agency’s evaluation of offerors’ past performance.

An agency’s evaluation of past performance, which includes its consideration of the relevance, scope, and significance of an offeror’s performance history, is a matter of agency discretion which we will not disturb unless the agency’s assessments are unreasonable, inconsistent with the evaluation criteria, or undocumented. Protection Strategies, Inc., B‑416635, Nov. 1, 2018, 2019 CPD ¶ 33 at 9.

Deque contends that the agency failed to meaningfully consider and weigh the comparative relevancy of Deque’s past performance references against IronArch’s references. Protest at 18.

The agency counters that the RFP did not require it to compare the degree of relevance of each offerors’ past performance examples. We agree. Where, as here, the solicitation provides for an assessment of performance risk on the basis of past performance information, an agency is not required to further differentiate between past performance ratings based on a more refined assessment of the relative relevance of the offeror’s prior contracts, unless specifically required by the RFP. See Pro‑Sphere Tek, Inc., B‑410898.11, July 1, 2016, 2016 CPD ¶ 201 at 7.[9]

In Pro‑Sphere Tek, our Office found that the agency reasonably assigned performance risk ratings on the basis of its review of the relevance, recency, and quality of past performance references, and that the RFP “simply did not require the agency to conduct the type of comparative relevance analysis desired by the protester.” Id. at 6‑7.

The protester argues that Pro‑Sphere Tek is inapposite because the RFP in that protest provided an explicit definition of relevance, whereas the RFP here did not. Comments & Supp. Protest at 16. We do not find this argument accurate or persuasive. First, the RFP here defines specific “[a]reas of relevance” to which offerors’ past performance examples were required to relate. RFP at 122. Further, our Office’s decision in Pro‑Sphere Tek did not turn on the solicitation’s explicit definitions of relevance, but rather on the fact that the solicitation “did not advise [offerors] that the agency would consider various degrees of relevance on a comparative basis or that ‘more relevant’ past performance would be accorded more weight or evaluated more favorably.” Pro‑Sphere Tek, supra at 6. The same is true of the RFP here, and we similarly conclude that the agency was not required to comparatively assess the relevance of offerors’ past performance references.

The record here demonstrates that‑-with respect to both IronArch and Deque‑-the past performance evaluation team reviewed each past performance reference in detail, including the areas of relevance and periods of performance, to determine whether the reference was recent and relevant. See AR, Tab 11, Deque Past Performance Evaluation; AR, Tab 12, IronArch Past Performance Evaluation. The record further reflects that the SSA also reviewed the relevance, recency, and quality of both offeror’s past performance examples, ultimately concluding that there was “not a discernible difference” between the offerors. Deque has not established that this conclusion was unreasonable. Protection Strategies, supra at 9.

Evaluation of Transition Risk

In addition, Deque argues that the agency failed to evaluate the risk inherent in deploying IronArch’s proposed compliance scanning tool as opposed to continuing to use “Deque’s already‑deployed tool.” Protest at 15. Deque argues that the agency was required to evaluate the risk inherent in the installation and deployment of each offeror’s tool. We disagree.

We note that the RFP did not obligate the agency to evaluate the risks associated with the transition to a new contractor’s tool. In this respect, the RFP’s description of the technical evaluation factor does not mention installation or deployment, nor does it require an analysis of transition risk. RFP at 116‑17.

We also agree with the agency that the solicitation viewed installation and deployment as a contract administration matter, not an evaluation factor for award. See COS at 11. Specifically, while the RFP required technical proposals to address offerors’ approaches to complying with PWS section 5.3 (the section containing technical requirements of the section 508 compliance scanning tool), proposals were not required to address offerors’ approaches to PWS section 5.2 (the section describing planning, installation, and implementation of the compliance tool). RFP at 121; see RFP at 29‑30 (PWS section 5.2). In fact, PWS section 5.2 identified a “[p]lan of [a]pproach for installation and integration of the [t]ool or [t]ool [s]uite” as a contract deliverable, due from the contractor approximately one month after award.[10]

Agencies are required to evaluate proposals based exclusively on the evaluation factors stated in the solicitation. Seaward Servs., Inc., B‑420580, B‑420580.2, June 13, 2022, 2022 CPD ¶ 145 at 8. To the extent Deque argues that the agency should have evaluated the risk of IronArch’s transition plan, this fails to state a valid basis for protest since the RFP did not require such information to be included with proposals, nor did it require the agency to conduct such an evaluation. See Nexsys Electronics Inc. d/b/a Medweb, B‑419616.4, Jan. 7, 2022, 2022 CPD ¶ 26 at 4; see also Grove Resource Sols., B‑414746.2, Apr. 4, 2018, 2018 CPD ¶ 138 at 7 (denying protest that agency failed to evaluate risk of awardee’s technical approach, where the “solicitation . . . did not anticipate the assessment of each offeror’s technical approach”). To the extent Deque argues that the RFP should have contained a transition risk evaluation factor, this is an untimely challenge to the terms of the solicitation. See 4 C.F.R. § 21.2(a)(1).

Accordingly, we dismiss this protest allegation. See Nexsys Electronics, supra at 4.

Tradeoff Decision

Last, Deque challenges the agency’s best‑value tradeoff decision on the basis that it was “tainted by the flawed underlying evaluations upon which [the SSA] relied.” Comments & Supp. Protest at 24. This allegation is derivative of Deque’s challenges to the agency’s evaluation, all of which we have either dismissed or denied. Thus, we dismiss this allegation because derivative allegations do not establish independent bases of protest. Advanced Alliant Solutions Team, LLC, B‑417334, Apr. 10, 2019, 2019 CPD ¶ 144 at 6.

The protest is denied.

Edda Emmanuelli Perez

General Counsel

[1] The RFP was amended once. All citations to the RFP are to the conformed amended version, located at Tab 5 of the agency report.

[2] Commercial off-the-shelf items are those commercial items of supply that are sold in substantial quantities in the commercial marketplace and are offered to the government without modification in the same form in which they are sold in the commercial marketplace. Federal Acquisition Regulation 2.101.

[3] The third offeror was determined to be ineligible for award; thus, the agency conducted a further evaluation of the proposals of Deque and IronArch only. COS at 6.

[4] For the technical factor, the possible ratings were outstanding, good, acceptable, susceptible to being made acceptable, and unacceptable. AR, Tab 6, Evaluation Plan at 19. Past performance ratings were high risk, moderate risk, low risk, and unknown risk. Id. at 20. Veterans involvement ratings were full credit, partial credit, some consideration, and no credit. Id. at 20‑21.

[5] Deque withdrew a protest allegation relating to the agency’s evaluation of IronArch’s intent to comply with the RFPs “limitation on subcontracting” provision. Comments & Supp. Protest at 1 n.2.

[6] Deque also argues that if the agency believed planned downtime was acceptable, it was required to state this in the RFP rather than relax the requirement during evaluation. However, an agency may waive or relax a material solicitation requirement when the award will meet the agency’s actual needs without competitive prejudice to the other offerors. Engility Servs., LLC, B‑416588.3, B‑416588.4, Mar. 20, 2020, 2020 CPD ¶ 110 at 8. In this context, prejudice exists only where the protester would have altered its proposal to its competitive advantage had it been given the opportunity to respond to the altered requirements. Id. Deque has not stated what it would have done differently if the agency had explicitly permitted planned downtime; therefore it has not shown that it was prejudiced by any alleged relaxation of the availability requirement. See id.

[7] This is in contrast to Deque’s proposal. The contemporaneous record demonstrates that, where the agency questioned Deque’s compliance with the PWS section 5.3 requirements, it did so because of a concern that Deque’s proposal demonstrated an intent not to comply. For example, the PWS required that reports of defects “be sortable by type from most common to least common or vice versa,” and Deque originally proposed only “heatmap views where the most commonly occurring defects are clearly called out.” Protest, exh. 6, IFN to Deque at 1. The agency explained that it was “unclear whether [Deque’s proposed] heatmap is . . . sortable” and asked Deque to address this concern. Id.

[8] The protester does not challenge any specific technical evaluation finding that the agency made regarding Deque’s proposal.

[9] Notably, the relevant language of the RFP’s past performance evaluation factor here is identical to that discussed in Pro‑Sphere Tek. Compare RFP at 117‑18 with Pro‑Sphere Tek, supra at 3, 6.

[10] The plan of approach was due 14 calendar days after the post‑award kickoff meeting. RFP at 29. The kickoff meeting was to be held within 15 business days after award. Id. at 28.

Related

Related

Related

Related

Related

Related

Related

Stay informed as we add new reports & testimonies.

- Published in Uncategorized

HR Enterprise Performance Management Software Market Trend Analysis, Latest Revenues, Business Outline, Growth Insights, Industry Supply and Forecast to 2028 – openPR

- Published in Uncategorized

File Sharing And Document Management Software Market, Share, Growth Report Explores Industry Trends And Analysis 2030 – Taiwan News

密碼設定成功,請使用新密碼登入

Report Ocean released a report on the File Sharing And Document Management Software Market. The recovery-based survey for market price report includes crucial data on growth strategy, market dynamics, innovations, company possibilities, and the competitive environment for 2021.According to this study, over the next five years the File Sharing And Document Management Software Market will register a % CAGR in terms of revenue, the global market size will reach US$ million by 2024, from US$ million in 2019. In particular, this report presents the global revenue market share of key companies in File Sharing And Document Management Software Market, shared in Chapter 3.

Download Free Sample of This Strategic Report:-https://reportocean.com/industry-verticals/sample-request?report_id=33882

Market Overview

Based on appropriate market and geographical segmentation, a thorough estimate of this worldwide market includes its historical study and provides accurate and approximative timeline estimations up to 2030.With the help of this research report, stakeholders will be better able to create new strategies that concentrate on market prospects that will help them, ultimately making their business endeavors lucrative.

The report’s main goal is to impart industry knowledge and assist our clients in achieving organic growth in their specialized industries. For businesses and people interested in a certain industry or field, this research should be seen as a valuable source of information and guidance as it provides critical statistics on the global market status of the Market manufacturers. The primary accomplishment of this research is to provide strategic insight to businesses in this sector.

Get a Request Sample Report:https://reportocean.com/industry-verticals/sample-request?report_id=33882

Segmentation by product type: breakdown data from 2014 to 2019 in Section 2.3; and forecast to 2024 in section 10.7.

Cloud Based

On-Premise

Segmentation by application: breakdown data from 2014 to 2019, in Section 2.4; and forecast to 2024 in section 10.8.

Large Enterprise

SMEs

This report also splits the market by region: Breakdown data in Chapter 4, 5, 6, 7 and 8.

Americas

United States

Canada

Mexico

Brazil

APAC

China

Japan

Korea

Southeast Asia

India

Australia

Europe

Germany

France

UK

Italy

Russia

Spain

Middle East & Africa

Egypt

South Africa

Israel

Turkey

GCC Countries

The report also presents the market competition landscape and a corresponding detailed analysis of the major vendor/manufacturers in the market. The key manufacturers covered in this report: Breakdown data in in Chapter 3.

Wrike

PandaDoc

Backlog

EFileCabinet

PDFelement

Zoho

Cisdem

Samepage

Templafy

BizPortals 365

FileInvite

Bitrix

Dropbox

Google

Microsoft

WeTransfer

Citrix Systems

Hightail

Droplr

Synology

Request Sample Data To Learn More About This Report @https://reportocean.com/industry-verticals/sample-request?report_id=33882

In addition, this report discusses the key drivers influencing market growth, opportunities, the challenges and the risks faced by key players and the market as a whole. It also analyzes key emerging trends and their impact on present and future development.

Research objectives

To study and analyze the global File Sharing And Document Management Software market size by key regions/countries, product type and application, history data from 2014 to 2018, and forecast to 2024.

To understand the structure of File Sharing And Document Management Software market by identifying its various subsegments.

Focuses on the key global File Sharing And Document Management Software players, to define, describe and analyze the value, market share, market competition landscape, SWOT analysis and development plans in next few years.

To analyze the File Sharing And Document Management Software with respect to individual growth trends, future prospects, and their contribution to the total market.

To share detailed information about the key factors influencing the growth of the market (growth potential, opportunities, drivers, industry-specific challenges and risks).

To project the size of File Sharing And Document Management Software submarkets, with respect to key regions (along with their respective key countries).

To analyze competitive developments such as expansions, agreements, new product launches and acquisitions in the market.

To strategically profile the key players and comprehensively analyze their growth strategies.

What our reviews offer:

Request full Report-https://reportocean.com/industry-verticals/sample-request?report_id=33882

About Report Ocean:

We are the best market research reports provider in the industry. Report Ocean believes in providing quality reports to clients to meet the top line and bottom line goals which will boost your market share in today’s competitive environment. Report Ocean is a ‘one-stop solution’ for individuals, organizations, and industries that are looking for innovative market research reports.

Get in Touch with Us:

Report Ocean:

Email:sales@reportocean.com

Address: 500 N Michigan Ave, Suite 600, Chicago, Illinois 60611 – UNITED STATES

Tel:+1 888 212 3539 (US – TOLL FREE)

Website:https://www.reportocean.com

Updated : 2022-11-27 16:53 GMT+08:00

Taiwan News © 2022 All Rights Reserved.

- Published in Uncategorized

Microsoft Loop adds project management to 365 – TechTarget

Rawpixel.com – stock.adobe.com

Microsoft’s office productivity software Loop can double up as a lightweight project management tool for teams that don’t need the more robust feature set of applications like Jira or Trello.

Analysts and users said Loop, which Microsoft introduced earlier this month, will make it easier to follow a project from start to finish without switching between apps or downloading multiple copies of a single document. It will save time and cut down on inaccuracies while showing the project’s progress.

“[Loop] can be used as light project management for those companies looking for a less structured project management platform,” said Michael Goldstein, CEO of IT services company LAN Infotech in Fort Lauderdale, Fla. “Sometimes, traditional project management products are very structured and too disciplined for the average user.”

The Loop software breaks down apps like Excel, PowerPoint and Word into snippets that users can share across Teams, Outlook and OneNote, as well as the canvas-like Loop app. The snippets are updated in real time wherever they are shared, and the Loop app comes with a status tracker that teams can use to see how far along they are on a project.

Employees at managed services firm Synoptek in Irvine, Calif., don’t have to worry about whether the latest version of a proposal is in OneDrive, Teams or an email sent last night, according to David Ditsworth, regional CTO at Synoptek. The snippets they need will be in one place and updated in snippet form and the original document.

Ditsworth said Loop falls short as a project management tool because it lacks scheduling and resource management. “That said, someone could leverage it for project management in [a] bare-bones fashion like people use Excel or Word for manually tracking schedule, resources and tasks.”

Darrell Webster, a consultant at U.K.-based IT services firm WM Reply, pointed to Loop’s status tracker feature as a project management necessity. The status tracker lets a team track progress on a project by designating document owners, due dates and completion levels.

Other project management apps have more features, “but sometimes you want something quick, and you don’t want that challenge of [creating] a planning board,” Webster said.

Loop addressed many of the challenges companies faced when working on projects with distributed teams, according to Raul Castanon, an analyst at 451 Research.

A 451 Research on challenges to worker productivity found that among 491 companies, 35.4% said finding and sharing information was the biggest problem, 32.6% said it was reducing repetitive types of work, and 29.5% said it was better organizing work.

Those challenges previously necessitated project management software, according to Castanon. But organizing work and sharing it across teams can now be done in Loop.

Similar software, like project management app Notion, has been popular among small businesses for collaboration but doesn’t include the tracking capabilities of Loop and project management tools.

Mazin Ahmed, the United Arab Emirates-based founder of cyber security start-up FullHunt, said that while his team uses Notion to manage projects, Loop features like tracking due dates are not in Notion.

“It would be nice to have,” he said.

Maxim Tamarov is a news writer covering mobile and end-user computing. He previously wrote for The Daily News in Jacksonville, N.C., and the Sun Transcript in Winthrop, Mass. He graduated from Northeastern University with a degree in journalism. He can be found on Twitter at @MaximTamarov.

Microsoft Loop crosses information silos in 365

One of the many tasks that come with maintaining a virtual environment is the testing and delivery of virtual apps and desktops. …

To compare Citrix vs. VMware for VDI pricing, organizations must understand how some of their features impact costs. Learn how …

With the help of different application delivery services, IT teams can deliver a quality user experience to workers, but these …

Tom Walat, SearchWindowsServer site editor, covers some of the news from Microsoft’s Ignite 2022 conference.

Organizations that were unable to uninstall their last Exchange Server from the on-premises environment can now do so if they …

Two Exchange Server zero-days discovered in September get security updates this month along with four Windows vulnerabilities …

All Rights Reserved, Copyright 2008 – 2022, TechTarget

Privacy Policy

Cookie Preferences

Do Not Sell My Personal Info

- Published in Uncategorized

Hi, what are you looking for?

By

Published

The latest study released on the Global Document Management System Market by Coherent Market Insights evaluates market size, trend, and forecast to 2028. It offers the most latest information and insightful analysis on the sector, allowing you to optimise your company plan and assure long-term revenue development. It explains existing and future market circumstances as well as the competitive dynamics of the Document Management System industry. The research report’s market segmentation analysis depicts the performance of several product segments, applications, and geographies in the market.

𝗥𝗲𝗾𝘂𝗲𝘀𝘁 𝗮 𝘀𝗮𝗺𝗽𝗹𝗲 𝘁𝗼 𝗼𝗯𝘁𝗮𝗶𝗻 𝗮𝘂𝘁𝗵𝗲𝗻𝘁𝗶𝗰 𝗮𝗻𝗮𝗹𝘆𝘀𝗶𝘀 𝗮𝗻𝗱 𝗰𝗼𝗺𝗽𝗿𝗲𝗵𝗲𝗻𝘀𝗶𝘃𝗲 𝗺𝗮𝗿𝗸𝗲𝘁 𝗶𝗻𝘀𝗶𝗴𝗵𝘁𝘀 𝗮𝘁-

https://www.coherentmarketinsights.com/insight/request-sample/3115

The study assesses the global Document Management System market’s drivers, restrictions, challenges, and opportunities, providing comprehensive and up-to-date data on the segments and geographies that interact with it. This file provides an in-depth examination of the company’s prospects. A rigorous analysis of product categories and leading companies helps to illustrate the study’s depiction of the crucial regions’ present market and forecast information. The industry’s behaviour is described in the report. It also gives out a strategy for the future that will assist businesses and other stakeholders in making well-informed decisions that will result in excellent returns for years to come. To assist reader in making educated decisions regarding market developments, the research gives a realistic overview of the worldwide market and its changing environment. This study focuses on the market’s potential possibilities, which allow it to extend its operations in current markets.

Competitive Outlook:

A complete analysis of the size and expansion of the Document Management System market, as well as potential development opportunities. The study includes a thorough analysis of the market and its development as well as in-depth analyses of the macroeconomic conditions and trends affecting the sector. This section goes into a number of crucial factors that may affect market potential in the future, such as geographic restrictions and governmental actions. With an emphasis on collaborations, product extensions, and acquisitions, it analyses the product portfolios and business strategies of significant companies.

𝗧𝗼𝗽 𝗖𝗼𝗺𝗽𝗮𝗻𝗶𝗲𝘀 𝗜𝗻𝗰𝗹𝘂𝗱𝗲: Atlassian, OpenText Corporation, Xerox Corporation, IBM Corporation, eFileCabinet Inc., SpringCM, Oracle Corporation, Hyland Software Inc., Ricoh USA, Inc., Open Document Management System S.L., Microsoft Corporation, Synergis Technologies, R2 Technologies Limited, and Zoho Corporation.

𝗗𝗲𝘁𝗮𝗶𝗹𝗲𝗱 𝗦𝗲𝗴𝗺𝗲𝗻𝘁𝗮𝘁𝗶𝗼𝗻:

𝗥𝗲𝗴𝗶𝗼𝗻𝗮𝗹 𝗔𝗻𝗮𝗹𝘆𝘀𝗶𝘀:

» 𝗡𝗼𝗿𝘁𝗵 𝗔𝗺𝗲𝗿𝗶𝗰𝗮: United States, Canada, and Mexico

» 𝗦𝗼𝘂𝘁𝗵 & 𝗖𝗲𝗻𝘁𝗿𝗮𝗹 𝗔𝗺𝗲𝗿𝗶𝗰𝗮: Argentina, Chile, Brazil and Others

» 𝗠𝗶𝗱𝗱𝗹𝗲 𝗘𝗮𝘀𝘁 & 𝗔𝗳𝗿𝗶𝗰𝗮: Saudi Arabia, UAE, Israel, Turkey, Egypt, South Africa & Rest of MEA.

» 𝗘𝘂𝗿𝗼𝗽𝗲: UK, France, Italy, Germany, Spain, BeNeLux, Russia, NORDIC Nations and Rest of Europe.

» 𝗔𝘀𝗶𝗮-𝗣𝗮𝗰𝗶𝗳𝗶𝗰: India, China, Japan, South Korea, Indonesia, Thailand, Singapore, Australia and Rest of APAC.

𝗚𝗲𝘁 𝗣𝗗𝗙 𝗕𝗿𝗼𝗰𝗵𝘂𝗿𝗲: https://www.coherentmarketinsights.com/insight/request-pdf/3115

Dynamic Analysis of the market:

Industry trends, demand, regional overviews, sales channels, marketing channels, distributors, and consumers are among the key factors driving market growth highlighted in Document Management System Market research. Emerging market trends, growth drivers, opportunities, dangers, and prospective entry points for the sector are all discussed in this research. Analysts acquire data to produce relevant market projections during the reporting period as part of the research approach. All of the main firms in this research are concerned about extending their operations into new areas.

Research Methdology:

The report’s foundations are firmly planted in comprehensive tactics devised by skilled data analysts. The research approach entails analysts gathering data, then extensively studying and filtering it in order to make meaningful market projections for the review period. Interviews with key market influencers are also part of the research process, making the primary research relevant and useful. The secondary technique provides a direct view of the demand-supply relationship. The report’s market techniques give exact data analysis as well as a tour of the whole industry. The data was collected using both primary and secondary methods. In addition, data analysts have used publically available sources such as annual reports to gain an in-depth view of the Document Management System market.

Key takeaways from the report:

• Estimation of the Document Management System Market Size: The market size in terms of value and volume is accurately and trustworthily estimated in the study. Additionally, it emphasises issues for Document Management System including production, supply chain, and revenue.

• Document Management System Market Trends Analysis: The future developments and market trends have been covered in this part.

• Opportunities for Growth in Document Management System : Customers can get in-depth information about the significant opportunities in the Document Management System Market in this study.

• Regional Analysis of Document Management System : This section provides clients with a thorough study of the potential countries in the global Document Management System industry.

• Analysis of the Key Market Segments for Document Management System : The end-user, application, and product type segments, as well as the major variables influencing their growth, are the main topics of the report.

• Document Management System Vendor Landscape: Businesses will benefit from being better prepared to make wise business decisions thanks to the competitive landscape presented in the research.

𝗚𝗲𝘁 𝟮𝟬𝟬𝟬 𝗨𝗦𝗗 𝗗𝗶𝘀𝗰𝗼𝘂𝗻𝘁 𝗼𝗻 𝗕𝘂𝘆𝗶𝗻𝗴 𝘁𝗵𝗶𝘀 𝗥𝗲𝗽𝗼𝗿𝘁: https://www.coherentmarketinsights.com/promo/buynow/3115

FAQ’S:

➤ What is the predicted growth rate for the Document Management System Market for the forecast period 2022–2028?

➤ How big will the Document Management System market be during the predicted time frame?

➤ What are the main factors influencing the Document Management System market’s future throughout the forecast period?

➤ Who are the main market suppliers, and what are their successful tactics for gaining a firm presence in the Document Management System market?

➤ What are the key market trends impacting the growth of the Document Management System industry in various geographies?

➤ Which significant risks and difficulties are most likely to prevent the Document Management System market from expanding?

➤ What are the main avenues for success and profitability that the market leaders in the Document Management System may take advantage of?

➤ What are the main findings of the five-point study of the worldwide Document Management System Market?

Table Of Content:

1. Research Objectives and Assumptions

Research Objectives

Research Objectives

Assumptions

Assumptions

Abbreviations

Abbreviations

2. Market Purview

Report Description

Report Description

– Market Definition and Scope

Executive Summary

Executive Summary

– Market Snippet, By Type

– Market Snippet, By Application

– Market Snippet, By Region

Coherent Opportunity Map (COM)

Coherent Opportunity Map (COM)

3. Market Dynamics, Regulations, and Trends Analysis

Market Dynamics

Market Dynamics

– Drivers

– Restraints

– Market Opportunities

Continue…

About Coherent Market Insights:

Coherent Market Insights is a global market intelligence and consulting organization that provides syndicated research reports, customized research reports, and consulting services. We are known for our actionable insights and authentic reports in various domains including aerospace and defense, agriculture, food and beverages, automotive, chemicals and materials, and virtually all domains and an exhaustive list of sub-domains under the sun. We create value for clients through our highly reliable and accurate reports. We are also committed in playing a leading role in offering insights in various sectors post-COVID-19 and continue to deliver measurable, sustainable results for our clients.

Contact Us:-

Mr. Shah

Coherent Market Insights

1001 4th Ave, #3200

Seattle, WA 98154

Phone: US +12067016702 / UK +4402081334027

Email: [email protected]

The post Document Management System Market Strategic Insights of Developing Industry by Emerging Trends, Driving Factors, Growth Dynamics, and Opportunities by 2028 | Atlassian, OpenText Corporation, Xerox Corporation, IBM Corporation, eFileCabinet Inc., SpringCM appeared first on Gatorledger.

Oxford Research reveals high blood glucose reprograms the metabolism of pancreatic beta-cells in diabetes.

The CDC revealed Friday it is now tracking a new COVID-19 variant of concern around the U.S. known as XBB.

AI can replace you guys, too. All it needs is a script, you know.

Avian flu wiped out 50.54 million birds in the United States this year, making it the country’s deadliest outbreak in history.

COPYRIGHT © 1998 – 2022 DIGITAL JOURNAL INC. Sitemaps: XML / News . Digital Journal is not responsible for the content of external sites. Read more about our external linking.

- Published in Uncategorized

Enterprise Content Management System Market Is Booming Worldwide IBM, Oracle, Microsoft – Digital Journal

Hi, what are you looking for?

By

Published

New Jersey, United States, Nov 02, 2022 /DigitalJournal/ The Enterprise Content Management System Market research report provides all the information related to the industry. It gives the markets outlook by giving authentic data to its client which helps to make essential decisions. It gives an overview of the market which includes its definition, applications and developments, and manufacturing technology. This Enterprise Content Management System market research report tracks all the recent developments and innovations in the market. It gives the data regarding the obstacles while establishing the business and guides to overcome the upcoming challenges and obstacles.

Enterprise content management (ECM), sometimes referred to as document management or records management, manages the entire lifecycle of an organizations content, including documents, spreadsheets, contracts, and scanned images. The goal of an ECM solution is to reduce risk and improve productivity, efficiency, and customer experience by eliminating paper-based tasks and improving process visibility. The main factors driving the enterprise content management market are frequent audits, increasing security risks, and regular compliance policies. Commercial companies must maintain multiple documents and data necessary during audits and protect information from fraud and cyber attacks.

Get the PDF Sample Copy (Including FULL TOC, Graphs, and Tables) of this report @:

https://a2zmarketresearch.com/sample-request

Competitive landscape:

This Enterprise Content Management System research report throws light on the major market players thriving in the market; it tracks their business strategies, financial status, and upcoming products.

Some of the Top companies Influencing this Market include:IBM, Oracle, Microsoft, SAP, OpenText, Xerox, Atlassian, Newgen Software, Veeva, Fabasoft, Ascend Software, Alfresco, Laserfiche, M-Files, Hyland, Everteam, Nuxeo, Systemware, DOMA Technologies, SER Group, GRM Information Management, Adobe

Market Scenario:

Firstly, this Enterprise Content Management System research report introduces the market by providing an overview that includes definitions, applications, product launches, developments, challenges, and regions. The market is forecasted to reveal strong development by driven consumption in various markets. An analysis of the current market designs and other basic characteristics is provided in the Enterprise Content Management System report.

Regional Coverage:

The region-wise coverage of the market is mentioned in the report, mainly focusing on the regions:

Segmentation Analysis of the market

The market is segmented based on the type, product, end users, raw materials, etc. the segmentation helps to deliver a precise explanation of the market

Market Segmentation: By Type

Cloud-Based

On-Premise

Market Segmentation: By Application

SME (Small and Medium Enterprises)

Large Enterprise

For Any Query or Customization: https://a2zmarketresearch.com/ask-for-customization

An assessment of the market attractiveness about the competition that new players and products are likely to present to older ones has been provided in the publication. The research report also mentions the innovations, new developments, marketing strategies, branding techniques, and products of the key participants in the global Enterprise Content Management System market. To present a clear vision of the market the competitive landscape has been thoroughly analyzed utilizing the value chain analysis. The opportunities and threats present in the future for the key market players have also been emphasized in the publication.

This report aims to provide:

Table of Contents

Global Enterprise Content Management System Market Research Report 2022 – 2029

Chapter 1 Enterprise Content Management System Market Overview

Chapter 2 Global Economic Impact on Industry

Chapter 3 Global Market Competition by Manufacturers

Chapter 4 Global Production, Revenue (Value) by Region

Chapter 5 Global Supply (Production), Consumption, Export, Import by Regions

Chapter 6 Global Production, Revenue (Value), Price Trend by Type

Chapter 7 Global Market Analysis by Application

Chapter 8 Manufacturing Cost Analysis

Chapter 9 Industrial Chain, Sourcing Strategy and Downstream Buyers

Chapter 10 Marketing Strategy Analysis, Distributors/Traders

Chapter 11 Market Effect Factors Analysis

Chapter 12 Global Enterprise Content Management System Market Forecast

Buy Exclusive Report @: https://www.a2zmarketresearch.com/checkout

Contact Us:

Roger Smith

1887 WHITNEY MESA DR HENDERSON, NV 89014

[email protected]

+1 775 237 4157

Related Reports:

Immune Health Supplements Market will touch New Level in Upcoming Year by 2027 | Alticor Inc. (Amway), Koninklijke DSM N.V., Cellderm Technologies Inc.

New Report Unveils more details about Planetary Thread Rolling Dies Market by 2028 | Heroslam, Rolling Tools, TANOI MFG.

Future Highlighting Report on Bordeaux Mixture Market by 2028 | Krishidoot Bio-Herbals, Suryakiran Chemicals, Prayug Agto

Electronic Percussion Instrument Market by Product, Applications, Geographic and Key Players: Roland, Yamaha, Alesis

Metal-enclosed Switchgear Market See Huge Growth for New Normal| Powell Industries, Eaton, Penn Panel & Box Co

Cellular Machine To Machine Market Recovery and Impact Analysis Report – Gemalto, Huawei, iWOW Technology

New Report Unveils more details about Chest Cancer Molecular Diagnostics Market by 2028 | Roche, Qiagen, Illumina

Technical Nitrates for Explosives Market to witness Robust Expansion by 2027 | Baowu Steel Group, Rain Industries (RUTGERS), JFE Chemical

Terbium Fluoride Market Size Current and Future | Dow Inc., Wacker Chemie AG, Sherwin-Williams

Immune Health Supplements Market will touch New Level in Upcoming Year by 2027 | Alticor Inc. (Amway), Koninklijke DSM N.V., Cellderm Technologies Inc.0

COMTEX_417919396/2769/2022-11-02T08:23:52

Oxford Research reveals high blood glucose reprograms the metabolism of pancreatic beta-cells in diabetes.

The CDC revealed Friday it is now tracking a new COVID-19 variant of concern around the U.S. known as XBB.

AI can replace you guys, too. All it needs is a script, you know.

Avian flu wiped out 50.54 million birds in the United States this year, making it the country’s deadliest outbreak in history.

COPYRIGHT © 1998 – 2022 DIGITAL JOURNAL INC. Sitemaps: XML / News . Digital Journal is not responsible for the content of external sites. Read more about our external linking.

- Published in Uncategorized

Inventory Sheet Template With Examples – Forbes Advisor – Forbes

- Published in Uncategorized

The Best Electronic Signature Software for Small Businesses – The Motley Fool

If you’re on a Galaxy Fold, consider unfolding your phone or viewing it in full screen to best optimize your experience.

Credit Cards

Banks

Brokers

Crypto

Mortgages

Insurances

Loans

Small Business

Knowledge

Every company executes signatures for contracts and other forms. Electronic signature software streamlines this process, accelerating the speed of business. Several services deliver solutions, each unique in its own way. Consider these top offerings to find the one that best fits your company’s needs.

Electronic signature software is experiencing strong adoption. Forecasts estimate the market to expand at a compound annual growth rate of 25% over the next decade.

This isn’t surprising. E-signature processes are faster and easier than traditional wet signatures, delivering numerous business benefits.

Several vendors are meeting the demand for electronic signature software. The number of vendors and the broad range of offerings can prove overwhelming. The Ascent dug into the choices, and we distilled them down to a handful of top e-signature software solutions.

Each e-signature option on this list delivers unique value. Define your company’s electronic signature needs, then identify a compelling choice from this list.

Each vendor packages its offerings into various subscription tiers. Buy the subscription containing the features you want, or craft a custom combination with the software’s enterprise options.

Still have questions? Dive into the full reviews to learn more about each solution.

DocuSign is a leader in the e-signature space, and for good reason. As one of the oldest electronic signature services, its long history allowed it to build an extensive feature set. Its broad capabilities enable DocuSign to fulfill nearly any business need.

DocuSign is well designed, giving you several options to create digital signatures while maintaining efficiency and simplicity. These aspects coupled with its vast functionality make DocuSign top-rated software, and allow it to meet the needs of many companies, from individual entrepreneurs to large corporations.

DocuSign guides you through each step of the document preparation process with a clean, intuitive interface. For frequently used documents, streamline the process further by performing the setup once then saving them as templates. Templates are ready-to-send documents accessible to others in your organization.

Easily drag and drop signature fields and other required info onto a document. Image source: Author

DocuSign is thorough in its signing functionality, but that’s not all. The company offers a suite of document life cycle management capabilities such as automated document workflows. These additional products require a separate purchase, but they give your business room to grow as your document management needs evolve.

DocuSign pricing starts at $10/month for an individual account billed annually. Its business subscription plans begin at a monthly $25/person for up to five users when paying annually.

Separate pricing exists for real estate firms and businesses that want to use DocuSign’s API (application programming interface) to build custom solutions.

The beauty of eversign lies in its simplicity. If you want a service to knock out e-signatures quickly and easily, eversign is an ideal choice.

eversign’s strength resides in its singular focus around speed and efficiency over a large swath of features. It doesn’t try to do more than help you effectively execute e-signatures, making eversign a good fit for companies seeking a basic, uncomplicated electronic signature service.

The software gives you the tools, such as templates, to execute digital signature collection. But if you don’t have time to prepare a document for signing, eversign lets you skip this step entirely.

Check document status and take the appropriate action with the click of a button. Image source: Author

Enter a recipient’s email address, then use eversign’s Quick Send option and the software automatically appends signature fields to the document. It’s that quick and simple.

eversign’s elegant design tucks its toolset into easily accessible locations, but out of your way until you need them. Editing options are a right mouse click away. A document’s appropriate next step is conveniently presented based on document status. Other features include templates and an API.

eversign is priced well compared to competitors. It offers a free version while paid options begin at a low $7.99/month when billed annually.

For a streamlined e-signature service, check out HelloSign. It features an elegantly simple interface delivering intuitive functionality perfect for non-technical users.

It’s owned by Dropbox, the digital document storage company, so naturally the two solutions are integrated. Easily pull in documents from Dropbox for e-signature setup. If you don’t use Dropbox, HelloSign integrates with other popular third-party apps such as Google’s Gmail to sign an emailed document.

Like its peers on this list, HelloSign delivers time-saving templates, straightforward document tracking, and the ability to create custom solutions with its API. It offers a nice balance of features and simplicity, making it suitable for technical novices and companies of all sizes.

HelloSign’s interface is clean, intuitive, and beautifully simple. Image source: Author

The one area where HelloSign’s simple feature set proves limiting is its mobile app. Use it to sign docs on the go or for in-person signatures, but it lacks the ability to track document status and perform follow-up.

HelloSign offers a free version with limited features. Its paid subscriptions start at $13/month when billed annually. HelloSign’s enterprise capabilities and API come with custom pricing, so call for a quote.

Adobe Sign comes from Adobe Systems, the company that spearheaded digital document software with innovations such as its PDF (portable document format) software file type. The organization’s history with electronic documents makes Adobe Sign a popular option in the e-signature space.

Adobe Sign can work for any type and size of business, but Adobe targets the product toward larger companies. Individual entrepreneurs are directed toward another Adobe product with an e-signature feature.

Adobe Sign’s strength lies in its broad feature set. It handles e-signature basics, then adds features such as the ability to automatically detect fields to fill out in your document, saving you time from manually marking them.

You have granular control over every detail of the electronic signature process. Define the font size and color of fields you mark in a document, or set rules to determine when to hide these fields.

Options abound when preparing documents. Image source: Author

The options are so vast, it can prove overwhelming. That’s one reason Adobe Sign is best for large companies with exacting needs around e-signature collection.

Adobe Sign also complies with many industry-specific regulatory and legal requirements. If you work in a highly regulated field such as healthcare or financial services, Adobe Sign easily meets industry compliance standards.

No free version is available, and pricing is at $29.99/month, per user, for the small business subscription. Adobe Sign caps the number of signature transactions, but if you choose an enterprise account, you can avoid the cap through transaction-based pricing.

PandaDoc has created a robust, free e-signature solution. Where rivals cap your usage, PandaDoc’s free version provides unlimited electronic signatures for several users.

PandaDoc can do this because its paid versions extend beyond online signatures, focusing on the broader document management life cycle. PandaDoc possesses capabilities such as tools to build professional documentation containing images and videos and the ability to collect payments.

These features make PandaDoc ideal for sales teams. It’s why PandaDoc specifically targets this audience in its positioning strategy although the software is appropriate for any size and type of business.

PandaDoc supports inserting images, videos, pricing tables, and other content. Image source: Author

PandaDoc offers the most extensive suite of tools to build compelling documents from scratch on our list. If document presentation is among your key criteria, PandaDoc deserves serious consideration.

Its free version is great for businesses with light e-signature requirements or those just starting out since PandaDoc’s capabilities can grow with your organization. Beyond its free option, PandaDoc’s paid versions start at $19/user, per month, when billed annually.

Every e-signature vendor provides a secure technology infrastructure to protect your documents, data, and personal information. The software must also comply with electronic signature laws around the world.

These are the minimum requirements to operate in the e-signature space. Beyond that, here are key attributes inherent in all good e-signature software, including those on this list.

No one wants to spend time tinkering in an e-signature interface. The software should streamline the end-to-end signature collection process.

The solutions on this list do just that, incorporating features to make e-signature execution quick and simple. Easily prepare a document by flagging the fields requiring signatures and other info such as the signer’s title. Define the recipients, email it, and you’re done.

Each uses templates to save time and ensure efficiency. Set up your e-signature document once, then save it as a template for reuse by you and others in your organization. Templates not only save time, they ensure consistency in the collected information.

The same easy-to-use experience is presented to document recipients. A request for signature arrives via email. From there, recipients click a link to go directly to the form. The software guides them through the document and where to sign.

Every solution provides tools to manage and track e-signature execution. You can conveniently see which documents are still pending, and send reminders with the click of a button or have the system automatically send them on a predefined schedule.

Each provides a clean, easy-to-use interface, making it simple to immediately jump into the product. But if you get stuck, an online self-service help portal aids you in finding answers.

Work is increasingly performed on mobile devices, but the ability to execute e-signature tasks on the go is particularly important. Many signatures are still performed in person. For example, a notary needs to verify an individual’s identity before collecting signatures.

For these instances, electronic signature software must work across the devices you use whether that’s smartphones or tablets. The options on this list support cross-device use through your mobile device’s web browser, and most come with a free stand-alone mobile app.

Third-party integrations extend the functionality of the e-signature software by connecting it to external apps. The solutions on this list offer integrations with third parties such as Box and Salesforce.

These integrations make it convenient to bring in documents stored elsewhere or to use your CRM software to import contacts. If you require a custom integration, all offer access to an API, allowing you to build your own e-signature solution.

Electronic signature software’s benefits are many, and they amplify for larger companies or if multiple people are involved in signature collection, such as when a document needs to undergo an approval process. Here are some of electronic signature software’s top benefits.

Whether you’re signing up a new client or performing HR paperwork for a recent hire, e-signature services speed the process along. Agreements are easier to complete. A recipient simply needs to perform a few mouse clicks and the signing is done. This leads to faster document completion rates.

According to DocuSign, up to 82% of agreements are typically completed within a day, allowing new customers or employees to start with your company sooner. Thanks to in-person e-signing capabilities, you can collect digital signatures when meeting with clients.

Collecting signatures electronically is a time saver. Frequently-used documents saved as templates allow staff to repeatedly use them with minimal preparation time.

After defining recipients, the software takes care of sending documents out for signatures. Follow-up reminders are easily sent with the click of a button, or automated based on your preferences.

Need to present documents for signatures in person? Save time there, too. Use a mobile device to immediately capture and file signed documents on the go.

E-signing eliminates the onerous manual steps involved in collecting signatures, improving productivity. Your team no longer needs to prepare documents. They just grab a template and send.

Need to know if a document has been signed? Simply check the status in the software. Use the built-in tracking tools to view who signed and who needs a reminder. This affords greater accountability without burdensome processes.

Leverage third-party integrations to further boost productivity. Many of these vendors provide integrations although more advanced options, such as a CRM, require an enterprise account.