CS TAs report systemic issues with overworking, Brown's HR system – The Brown Daily Herald

Unionizing was not the first solution explored by exasperated teaching assistants in the computer science department.

Facing what they saw as systemic issues within the department, such as overworking and inaccurate hour logs, the TAs sought department help. They communicated with and met department leaders and secured a raise for their colleagues. But they found that change insufficient.

Months after presenting their concerns, a group of computer science undergraduate TAs announced their intention to unionize in an Instagram post on Monday. Organizers described issues in the department in their announcement, including TAs frequently working overtime, underreporting hours and playing the “role of professors” by “writing handouts, rubrics and lecture slides,” according to the Teaching Assistant Labor Organization’s press release.

And these issues span courses across levels in the department and are persistent, The Herald found through interviews with organizers, other undergraduate TAs and department officials.

Before the union was officially announced, The Herald interviewed nine students involved in organizing TALO about departmental issues and TAs’ attempts to address them prior to unionization. They said TAs often work more hours than the University allows, are tasked with developing large portions of course material and have worked without official positions through Workday — the University’s human resources management system — which causes hours to be backlogged and has led to students choosing to work without Workday positions.

Working without Workday positions violates labor laws, said Tom Doeppner, associate professor of computer science in research and the department’s director of undergraduate studies.

Seven other TAs not involved with the union’s organizing committee had noticed many of the same problems but said issues vary between courses, and larger classes with fewer TAs feel a more intense burden.

TA workloads have “been a tough problem,” Doeppner said. “Many TAs felt that (their) course really needed them to work, and they would put in the time.”

Doeppner, who spoke to The Herald on behalf of the entire department, noted that the department has procedures in place meant to alleviate many problems that TAs and TALO described. But union organizers said that implementation of the guidelines varies across the department, and when problems arise there is no formal avenue for TAs to report concerns.

If TAs have an issue with a professor, Doeppner has encouraged them to reach out to him or Roberto Tamassia, professor of computer science and department chair. He added that when students bring him complaints, he will discuss them with the professor for those students’ courses and send the relevant faculty member the anonymized complaint.

Several TAs also noted that intense pressure and emotional burden comes from being overworked and bearing responsibility for course development.

“I feel like the CS department could not exist without the TA program,” said Parker Simon ’24, a head teaching assistant for CSCI 0330: “Introduction to Computer Systems.”

“Growing pains”: A rapidly expanding department

In 2011, 57 students graduated with degrees in computer science, including joint concentrators, Doeppner said. In the spring, 366 computer science concentrators graduated from the department.

This semester, CSCI 0150: “Introduction to Object-Oriented Programming and Computer Science” has 424 students enrolled, according to Courses@Brown. In 2016, the same course had 323 students.

The TA program has grown as well, with “about 400” TAs working for pay or course credit this semester, according to Doeppner. Those TAs are primarily undergraduate teaching assistants and HTAs, who manage and hire UTAs and help plan courses.

UTAs are primarily responsible for grading assignments and answering student questions during office hours and on Ed Stem, the department’s online forum for students to ask questions about courses. The role’s responsibilities are outlined in the UTA missive, a document written by department representatives and meta teaching assistants, who oversee the department’s hiring and physical space assignments.

“The department across the board is dealing with these growing pains,” said Daniel Ritchie, assistant professor of computer science and instructor of CSCI 1230: “Introduction to Computer Graphics.”

“A central question we’re dealing with (is) how do we scale to the demand we’re experiencing,” Ritchie said. To address issues in the past, “typically informal processes worked” because “the department was small.”

“As things scale up, you need to impose more structure sometimes,” he added.

Last spring, an open letter from UTAs and HTAs circulated within the department asking the department and University administration to work with TAs to change how they were treated. Signed by 44 people, including 33 who identified themselves as TAs, it called for clearer expectations for workloads and job descriptions, better compensation and reduced course material creation responsibilities after the start of the semester.

Eight TAs who spoke with The Herald said their work creates an emotional burden. The letter noted that “TAs have often felt personally responsible for a course’s success and operation.”

The open letter also called for “formalized reporting mechanisms,” which the department lacks, said Nick Young ’23, a five-time TA who was not involved in union organizing.

The letter was written after the first of four meetings last spring between nine TAs and three department representatives: Doeppner, Kathi Fisler — professor of computer science for research and the department’s associate director of undergraduate studies — and Ugur Cetintemel, professor of computer science and chair of the department at the time.

The meetings prompted some changes, said Colton Rusch ’23 and Eva Lau ’23, HTAs for CSCI 0320: “Introduction to Software Engineering” who helped write the letter and served on the union organizing committee. The union organizing committee and working group have overlap but are not the same.

This summer, the department received University permission to raise TA wages roughly 20% across the board, Doeppner said. UTAs are now paid $15.50 per hour, HTAs are paid $17.50 per hour and MTAs are paid $23 per hour, according to an August email sent to the department reviewed by The Herald.

The department also edited job descriptions and the missive for HTAs and UTAs, Rusch said.

“The old HTA missive said generally, ‘You should do whatever it takes to keep the course running smoothly,’ ” Ritchie said. Fisler added that the group designed a form meant to assign “key tasks” ahead of time to faculty course instructors and TAs that a “handful” of courses have used this fall, including Ritchie’s.

Still, TALO’s organizers felt the department’s decentralized structure prevents enforcement of guidelines, with some TAs still putting in too many hours and taking on course development well into the semester that is meant for breaks and TA camp — when TAs come back to campus early to put together key pieces of a course. Some also said they have continued to experience problems with their Workday positions.

Doeppner clearly outlined workload expectations for UTAs — and noted that TAs should be paid for all hours worked — in a 2021 all-TA email and a speech at an all-TA meeting during fall 2022 TA camp, both of which were reviewed by The Herald. He relayed a similar message to faculty members, he said, adding that he did not mention HTAs’ workloads to student staff but did to faculty.

On Oct. 20, Fisler reached out to members of the working group, many of whom had joined the organizing committee, to resume work, according to an email reviewed by The Herald. Rusch explained to The Herald that the working group decided not to respond because many of their broader concerns about the department had gone unaddressed in the spring. By then, members were instead focused on organizing the union.

Inaccurate timesheets and working without positions

Earlier this year, two courses entered TA camp with multiple student workers not having positions in Workday, according to multiple HTAs. Both incidents, which were in larger courses with more than 10 TAs and 125 students, were confirmed by Doeppner.

In the first instance, the course began work with UTAs who did not realize they weren’t yet registered in Workday, where TAs log their hours to be paid. Upon learning this, unregistered TAs stopped work until they were onboarded.

In the second, UTAs without positions initially were instructed not to work by their HTAs, but then were instructed to begin course development shortly after — despite not yet being in Workday’s system — in an effort to prevent extending work into the semester. They later backlogged those hours.

In an August meeting at the start of TA camp, Doeppner said students not in Workday were not allowed to work. He also said he received a “number of emails about TAs not having their positions,” according to a meeting recording reviewed by The Herald.

MTAs manage hiring for UTAs in consultation with Doeppner and Fisler, and professors hire HTAs, but it is the department’s responsibility to onboard TAs into Workday, Doeppner said. One administrative staff member is primarily responsible for enrolling the roughly 400 TAs in Workday and managing hours, Doeppner confirmed.

As an employer, the University is subject to the federal Fair Labor Standards Act, which requires employers to accurately log time worked by employees. Hourly workers are also required to record all time worked, according to University guidelines.

TAs who have been hired but do not yet have Workday positions over academic breaks or during TA camp often continue to work while waiting for their Workday positions, said Young, the five-time TA. When students do that work, it violates the University’s policy, Doeppner said.

Doeppner emphasized that the department aims to compensate TAs for every hour they work, regardless of if they were in the system — rhetoric that Young said he has noticed.

The department has implemented a new strategy to address previous administrative issues: onboarding TAs onto Workday immediately after they are offered a job, Doeppner explained. Previously, students were onboarded during or after breaks in the academic calendar. Hiring all TAs “by default” keeps the department from making errors, he added.

Course development and professor bandwidth

Course development was mentioned as a source of extra work for seven TAs interviewed, all of whom were involved in TALO.

Each TA said their respective professor took a different approach to course development. Because computer science is ever-evolving, courses constantly change to keep up, Young said.

This semester, Tim Nelson — assistant professor of computer science and the instructor for the course Lau and Rusch TA — has increased his role in course development, removing work that would have previously fallen upon HTAs.

Nelson did not respond to multiple requests for comment by press time.

“The problem is, that’s Tim’s decision,” said Galen Winsor ’22.5. Winsor, a CSCI 0320 UTA and socially responsible computing teaching assistant, meaning he is responsible for ethics-focused elements of the course, as well as a union organizing committee member, also helped write the letter. The department lacks standards to ensure all professors develop courses beyond lecturing, said Derick Toth ’23, a UTA for CSCI 1230.

Doeppner said CS professors face a “huge amount of pressure” to ensure TAs do not have excessive hours, and that management intervenes if there is concern TAs are overworked. Professors are accountable for their courses through feedback and course review and should be “familiar enough with the assignments to help students that might otherwise go to a TA,” he added.

Anika Ahluwalia ’23, HTA for CSCI 1300: “User Interfaces and User Experience,” said that while course instructor Jeff Huang, associate chair and associate professor of computer science, is involved in course development, HTAs were responsible for adding an assignment, changing the structure of a studio and creating a two-day “user interface camp.” This work stretched into the semester. She attended two union meetings but was not involved in its organization.

In response to questions about Ahluwalia’s workload for his course, Huang wrote in an email to The Herald that he appreciated his HTAs’ dedication and has spoken with them about managing their workload. One provision resulting from those conversations was a 15-hour work limit, after which “work should cease.”

Zack Cheng ’23, an HTA for CSCI 1230 who did not sign the letter but helped organize the union, said that he was polishing course materials — examples of completed assignments — through the beginning of the semester. Ritchie, the course’s instructor, said that he “inherited” the course with the intent to modify its curriculum while keeping high-level topics the same. While Cheng expected to make large changes, he said that work hours were greater than he expected.

“It’s hard to work to develop a course while you’re working on your own courses,” said Rusch, “and trying to be a person.”

Ritchie said that when he sees Cheng getting “overworked,” he has tried to intervene. But Cheng noted that Ritchie does not review materials unless Cheng asks.

Ritchie said he oversaw planning for course development and was happy to “take passes” on materials but does not have the “bandwidth” to write code because of his additional responsibilities in advising and research.

Other TAs, such as Paul Biberstein ’23, Simon and Harisen Luby ’23 — another HTA for CSCI 0330 — said their course development work primarily ended with TA camp. In CSCI 0330, HTAs planned the course’s logistics and wrote a script, but Doeppner is “very involved,” Simon said.

Last semester, TAs for CSCI 0200: “Program Design with Data Structures and Algorithms” struggled with work that began in summer 2021 to develop a course merging former classes CSCI 0160: “Introduction to Algorithms and Data Structures” and CSCI 0180: “Computer Science: An Integrated Introduction,” said UTA Harshini Venkatachalam ’23, a Herald illustrator.

Venkatachalam is a member of the organizing group, a UTA for CSCI 1810: “Computational Molecular Biology” and a former HTA for CSCI 0200. CSCI 0200 canceled its final two labs, a move TAs encouraged, Venkatachalam said.

This semester, most of CSCI 0200’s course content was “predeveloped,” Seth Sabar ’24 said, noting that the HTAs occasionally “touch up” labs and projects.

Ahluwalia said she often feels like the “face” of her course, a sentiment echoed by other TAs.

“Immense amount of pressure”: TAs working extra hours

In the spring, beyond the changes from the meetings, the working group distributed a survey reviewed by The Herald in which 65 TA respondents cited a culture in which extra work hours were expected. It also showed that a slight majority had underreported their hours when logging them.

Two TAs, who were involved with either the organizing committee or letter group, told The Herald that they had worked significantly more than their authorized 20 weekly hours in 2022 — Ahluwalia this fall and Joe Han ’22, a member of the spring’s working group, last semester.

Department guidelines state that UTAs should work no more than 10 hours each week, Doeppner said. The expectation for HTAs is less “spelled out,” he said, but HTAs should never work more than 20 hours weekly, the University’s recommended limit for undergraduate employees. TAs are allowed to work 40 hours per week during TA camp.

Ahluwalia worked an average of 29 hours per week for the two-week span between Oct. 23 and Nov. 5, according to a payslip reviewed by The Herald. Once she hits 15 work hours in a week, Ahluwalia now meets with Huang, the course instructor, to determine what to prioritize — but still typically works 20 to 25 hours each week, she said.

With 391 students enrolled in Ahluwalia’s course, work tends to exceed the capacity of the 15-person TA staff, she said. Because the course was smaller when it was last taught in 2020, it is understaffed in TAs, Doeppner said; as a rule, each course has one TA for every eight to 10 students. CSCI 1300 has a ratio of one TA to about 26 students.

Huang wrote that “if (TAs) end up working more” than the limit in his course, “they should be paid” for each additional hour.

Han said he logged 20 to 30 hours a week in the first half of the spring 2022 semester as an HTA for CSCI 0200. By the end of the semester, Han’s average dropped below 20 hours per week. Sabar, then a UTA for the course, said HTAs regularly logged more than 20 hours.

With a new course, “mid-semester adjustments” may be needed, Fisler, formerly one of two instructors for CSCI 0200, wrote in an email to The Herald.

This fall’s workload for CSCI 0200 has been different, said Sabar, now an HTA. This semester, he has consistently recorded about 15 hours weekly, aside from the first two weeks when his total was near 25. The class’s unusually high TA-to-student ratio helps keep his workload lighter, he said.

“We’re unhappy if you work more hours,” Doeppner said. “We’re even more unhappy if you don’t report the hours.” Students who work more than 40 hours in a week should receive overtime pay, he added.

Cheng, Simon and Luby separately said that their workload typically ranges from 15 to 20 hours per week, though Luby worked around 25 hours in the first weeks of the semester, she said. She partially expected to go over 20 hours. She enjoys the job, she said, and feels comfortable going to Doeppner with concerns.

“It becomes a problem when professors aren’t aware” of TAs’ extra work, Luby said.

“I feel an immense amount of pressure,” Luby explained. When things go awry, “it’s hard not to feel like it’s your fault.”

“In general, faculty members should be aware of other HTAs being overly stressed,” Doeppner said. “This is sometimes difficult because a student might be feeling a huge burden by the position, and they’re doing an amazingly good job of not letting it show.”

Han recalled one instance of working until 4 a.m. “A lot of people (were) counting on me,” he said, “and I can’t afford to let this go wrong.”

Additional reporting by Sam Levine and Alex Nadirashvili

Correction: A previous version of this article incorrectly stated that Cheng was remaking course materials and demos. The Herald regrets the error.

Clarification: A previous version of this article did not accurately reflect how Cheng asked Ritchie to review materials. The story has been updated.

Will Kubzansky is a University News editor from Washington, D.C. who oversees the admission & financial aid and staff & student labor beats. In his free time, he plays the guitar and soccer — both poorly.

The Brown Daily Herald, Inc. is a financially independent, nonprofit media organization with more than 250 students working across our journalism, business and web divisions.

Donations are integral to the continued success of the Brown Daily Herald. If you are able, please take one minute to make a tax-deductible contribution to support our student journalists and keep us online and growing. Thank you!

- Published in Uncategorized

New Document Management Tools Cure HR's Paperwork Blues – SHRM

96% of members agree: “SHRM’s information is very useful to me”

SHRM India has India-specific pricing and certification details.

Check out our recently added articles.

Do you need help with your HR questions? An HR Advisor is here to help by email, live chat, or phone.

Members may download one copy of our sample forms and templates for your personal use within your organization. Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organization’s culture, industry, and practices. Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRM’s permission. To request permission for specific items, click on the “reuse permissions” button on the page where you find the item.

When the human resource team at Impact Networking invested in a next-generation document management system, it shifted the department’s efforts to go paperless into overdrive. The new technology allowed HR to digitize myriad paper forms and documents, eliminate cumbersome e-mail threads, collaborate on documents, and track and store digital forms more efficiently and securely.

Mary Zellers, director of HR at Impact Networking, a managed services provider in Lake Forest, Ill., said the platform from vendor PandaDoc enabled her team to digitize offer letters to job candidates; compensation plans; and administrative documents like position changes, salary adjustments, leave requests and offboarding forms.

"We were able to accelerate the digitization of paper documents but also added important new efficiencies to how we organize, track, approve and store all of those forms," Zellers said.

The platform proved its mettle during the pandemic when Impact’s workforce started working remotely, she said. "We had to send a lot of documents out quickly to employees, like work-from-home contracts and other agreements and training resources. We were able to rapidly create those digitally and automatically send them to large groups. In the first three months of the pandemic, we sent out about 1,800 digital documents."

The system’s reusable templates and collaboration tools also have streamlined HR workflows, Zellers said. "Many of our documents require multi-employee sign off from finance, line managers and employees. We no longer need to send out individual versions to people because we can collect multiple e-signatures on the same document."

Zellers said the platform allows her to know at a glance who’s received and signed documents.

Value of Next-Generation Document Management Platforms

Experts say that while HR has made progress in digitizing the many forms and documents used in the department, it still lags other organizational functions in that effort. In its 2021 Global Enterprise Content Management survey, Forrester found that overall adoption of document and content management platforms rose steadily in the last year. The top three reasons for implementing these platforms were to digitize business processes, achieve cost-effective automation, and improve legal and regulatory compliance, the study noted.

Vendors have recently launched new applications designed specifically for employee file management, onboarding and contractor compliance, according to the study.

A 2020 study by Aberdeen Strategy and Research in Austin, Texas, found that one of HR’s top challenges is that the sheer volume of requests to the department is growing too fast for current technology solutions to handle. The study’s authors concluded now is the time to digitize processes that still have manual and paper-based steps.

The Aberdeen study found that HR functions using simple techniques such as e-signatures can improve employee productivity by up to 70 percent and allow organizations to be up to four times faster in time-to-hire for job candidates than those not using e-signatures.

Experts say document management systems also help HR avoid the headaches and time delays related to the still-common practice of sending out forms via e-mail to be reviewed and signed.

"In the past, important documents here would get stuck in e-mail inboxes and never make it to a personnel file," Zellers said. "With the digital storage, automated workflows and notifications provided by our new system, there’s a reassurance forms end up where they’re supposed to be. It’s extremely important in HR to have processes in place that ensure safe storage of documents and a clear audit trail if needed."

Innovations in Document Management Systems

Cheryl McKinnon, a principal analyst for Forrester, said innovations from document and content management vendors are helping to accelerate the move to "digital-first" HR documents, processes and file management.

Those innovations include a growing use of artificial intelligence and machine learning. "New, intelligent services are helping HR extract useful data and text more quickly from a broader range of less-structured document types and are helping to solve new problems," McKinnon said.

For example, this new technology is being used to auto-detect missing signatures on documents and ensure remediation quickly, rather than delaying a new hire or manager approval, she said. In addition, "intelligent data extraction" platforms no longer depend on human operators to define specific "zones" on a document to extract an employee ID number or address.

"New AI tools can find the relevant piece of data even if the documents are laid out differently, such as with resumes," McKinnon said.

Improvements to integration and search features on these platforms have allowed HR teams to better manage documents and forms alongside the employee data in human resource information systems and case management or service desk applications, she added. "That helps provide a more contextual view of an employee record or a transaction."

McKinnon said cross-repository or cross-application search ability also is increasingly essential for HR, particularly for those operating a mix of on-premises and cloud applications or who have a strategy of growing via merger and acquisition where there are multiple systems holding digital records.

Challenges of Digitizing HR Forms

Digital transformation doesn’t come without challenges and potential risks. Among the key challenges is integrating and creating a common interface when paper documents still exist alongside digital ones, experts say.

"There are some records management applications that do indeed support common search tools to find both types of documents or employee information," McKinnon said. "But it requires that an organization make the effort to import or otherwise capture relevant metadata on the physical folders, boxes or individual items."

For example, a search could return relevant digital items for viewing as well as provide information on where to go to retrieve the physical items by box number, shelf location or warehouse location, she said.

Digital records also can present long-term storage challenges that tend to be overlooked. McKinnon said employee records may have retention rules that span decades based on specific laws or regulations. Examples would be employee certification records, records pertaining to health or safety regulations, and documents about pension obligations.

"Long-term digital preservation is often an afterthought in enterprises," McKinnon said. "But after 10 or 20 years there is a risk of file formats becoming obsolete, as well as risks tied to underlying storage devices not being well-maintained or if a third-party storage provider or app exits the business."

Experts say planning for long-term readability, accessibility and trustworthiness of digital records should be a criterion when selecting HR document or content management platforms.

Dave Zielinski is a freelance business writer and editor in Minneapolis.

Members may download one copy of our sample forms and templates for your personal use within your organization. Please note that all such forms and policies should be reviewed by your legal counsel for compliance with applicable law, and should be modified to suit your organization’s culture, industry, and practices. Neither members nor non-members may reproduce such samples in any other way (e.g., to republish in a book or use for a commercial purpose) without SHRM’s permission. To request permission for specific items, click on the “reuse permissions” button on the page where you find the item.

You have successfully saved this page as a bookmark.

Please confirm that you want to proceed with deleting bookmark.

You have successfully removed bookmark.

Delete canceled

Please log in as a SHRM member before saving bookmarks.

Your session has expired. Please log in as a SHRM member.

Please purchase a SHRM membership before saving bookmarks.

An error has occurred

Give the Gift of Options with Uber for Business

Choose Your Certification

$(document).ready(function () {

var currentUrl = window.location.href.toLowerCase();

var currentLocation = getCookie(“SHRM_Core_CurrentUser_LocationID”);

if(currentUrl.indexOf(“/about-shrm/pages/shrm-china.aspx”) > -1) {

$(“span.current-site”).html(“SHRM China “);

}

else if(currentUrl.indexOf(“/about-shrm/pages/shrm-mena.aspx”) > -1) {

$(“span.current-site”).html(“SHRM MENA “);

}

});

if($(‘.container-footer’).length > 1){

$(‘.container-footer’).first().hide();

}

- Published in Uncategorized

Microsoft Cloud for Sovereignty: The most flexible and comprehensive solution for digital sovereignty – The Official Microsoft Blog – Microsoft

Jul 19, 2022 Corey Sanders, Corporate Vice President, Microsoft Cloud for Industry and Global Expansion Team

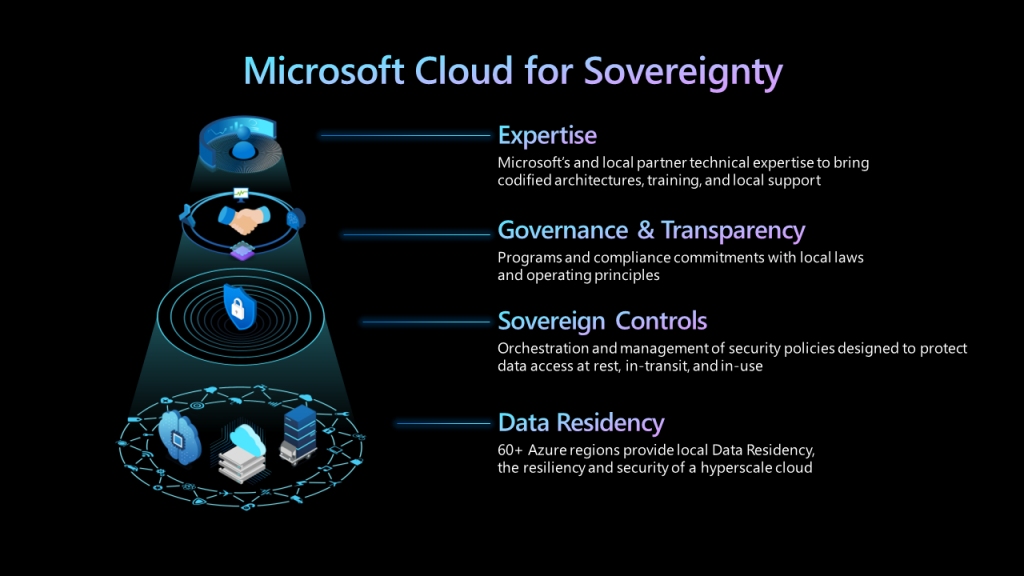

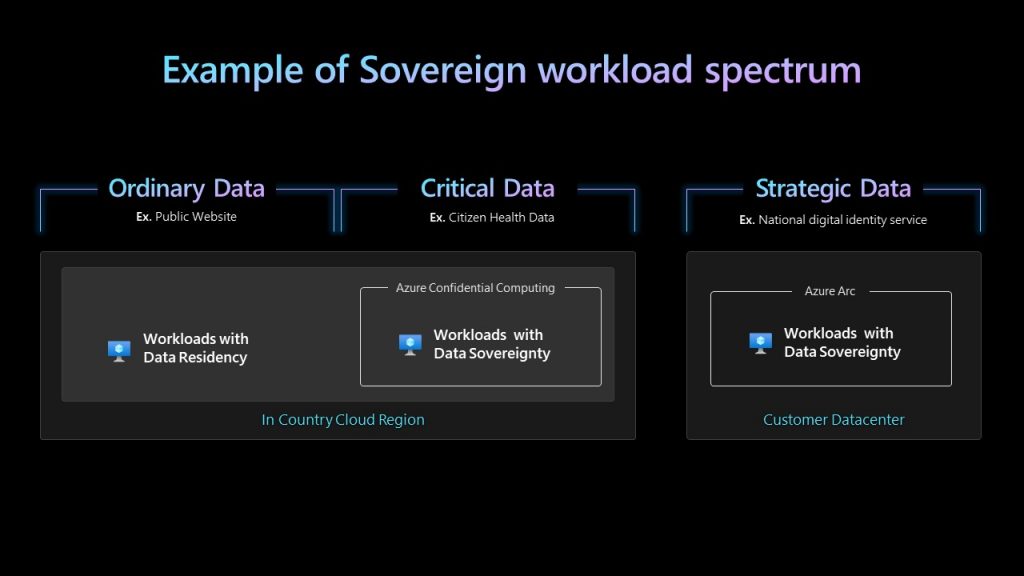

Governments and public sector customers around the world are looking to accelerate their digital transformation, creating opportunities for social and economic growth and enhancing citizen services. Today, I am excited to announce Microsoft Cloud for Sovereignty, a new solution that will enable public sector customers to build and digitally transform workloads in the Microsoft Cloud while meeting their compliance, security and policy requirements. Today, public sector customers can harness the full power of Microsoft Cloud, including broad platform capabilities, resiliency, agility and security. With the addition of Microsoft Cloud for Sovereignty, they will have greater control over their data and increased transparency to the operational and governance processes of the cloud.

Governments are obligated to meet specific requirements for varying data classifications including data governance, security controls, privacy of citizens, data residency, sovereign protections and compliant operations following legal regulations like the GDPR (General Data Protection Regulation). The Microsoft Cloud for Sovereignty — offering governance, security, transparency and sovereign technology — combined with strategic partners can support the digital transformation of government customers unlike any other cloud provider in the world.

Helping customers leverage the cloud while meeting their unique needs

Microsoft Cloud for Sovereignty is being built on the Microsoft public cloud to accelerate digital transformation while creating a customized experience adhering to government requirements. Government customers will have the power of the public cloud, addressing low cost, agility and scale expectations, with the full breadth of capabilities like modern developer services, agile infrastructure, secure DevOps, open-source platforms, modern collaboration and low-code development. Additionally, Microsoft Cloud for Sovereignty customers will continue benefiting from Microsoft’s global security signals, analyzing over 24 trillion signals every day to identify and help protect against local attacks.

Data residency

The foundation of Microsoft Cloud for Sovereignty will start with our Azure regional datacenters. Today, with 60-plus cloud regions, the Microsoft Cloud delivers the broadest capabilities and innovation with data residency and proximity in more locations than any other cloud provider, enabling residency options for the entire Microsoft Cloud including Microsoft 365, Dynamics 365 and Azure. Enabled by our industry-leading policy controls, customers today can meet many regulatory requirements and implement policies to contain their data and applications within their preferred geographic boundary. Customers can specify the country or region for most service deployments with the ability to satisfy industry, national, or global security, privacy and compliance requirements.

Microsoft has the most comprehensive compliance coverage of any cloud service provider with 100-plus offerings including more than 50 which are specific to global regions and countries. Microsoft engages with governments, regulators, standards bodies and nongovernmental organizations to understand emerging requirements and ensure a fast and effective enablement of critical compliance needs. Specifically in Europe, expanding on our data residency commitment, the forthcoming EU Data Boundary will ensure Microsoft not only stores but also processes customer data in the EU and European Free Trade Association.

Sovereign controls

With Microsoft Cloud for Sovereignty, we will deliver capabilities that will provide customers with additional layers to protect and encrypt sensitive data. These capabilities span the entire Microsoft Cloud from cloud infrastructure, platform services and Software as a Service (SaaS) offerings like Microsoft 365, Dynamics 365 and Power Platform. Customers can leverage Azure Confidential Computing, an innovative technology offering sovereign protection with Confidential Virtual Machines and Confidential Containers. Our unique offering utilizes specialized hardware to create isolated and encrypted memory called Trusted Execution Environments (or TEEs). Customer-owned encryption keys are confidentially and securely released directly from a Managed HSM (Hardware Security Module) into the TEEs executing on customer encrypted data. This secures customer keys, even while in-use, and ensures data is encrypted while at rest, in transit, and in use, helping protect data and keys against numerous security risks and operator access. Customers can benefit from this capability without having to change their application, creating an easy opportunity to leverage the power and scale of the public cloud while still ensuring their data is encrypted at all times. Confidential Compute capabilities extend into purpose-built platform services such as Azure SQL Always Encrypted with secure enclaves and Azure Confidential Ledger.

SaaS solutions like Double Key Encryption allow users in Microsoft 365 to classify emails and documents as “sensitive,” encrypting the customer data using customer-provided keys to protect data from both security risks and operator access. Furthermore, the Customer Lockbox for Microsoft 365, Customer Lockbox for Microsoft Azure, Customer Lockbox for Power Platform, and the forthcoming Customer Lockbox for Dynamics 365, all ensure that Microsoft will only access customer data to execute service operations when given explicit customer approval.

For customer workloads that require additional proximity, physical/operator control and separation, Azure Arc extends our Azure cloud services, management and governance capabilities into an existing or new on-premises environment. With this, customers can already secure and govern infrastructure and apps anywhere, build cloud-native apps faster with familiar tools and services to run them and modernize their data estate for consistent cloud operations.

To simplify the complexity of the spectrum of data classification requirements, Microsoft Cloud for Sovereignty will include a Sovereign Landing Zone, a solution to simplify the architecture, deployment workflow and provide intelligent tools to orchestrate operations of our various security services and policy controls in a streamlined manner. The Sovereign Landing Zone is being built upon the enterprise scale Azure Landing Zone to recommend and enforce regulatory compliance using Infrastructure-as-Code (IaC) and Policy-as-Code (PaC) capabilities built into Azure, which make deployments automatable, customizable, repeatable and consistent. This landing zone will also extend into Azure Information Protection (AIP), enabling policy and labeling for access control and protection on email and document data. This landing zone will be flexible enough to allow customers to define custom policies to meet specific industry and regulatory requirements. The landing zone will span the Microsoft public cloud, with tools to maintain data residency, deploy sovereign controls, protect data classification and extend into hybrid deployments, creating a single solution for all application needs.

Governance and transparency

Microsoft Cloud for Sovereignty will increase cloud transparency by expanding the Microsoft Government Security Program (GSP) to critical elements of our cloud offering, starting with key Azure infrastructure components. The GSP provides participants with the confidential security information and resources they need to trust Microsoft’s products and services. GSP participants currently include over 45 countries and international organizations represented by more than 90 agencies. Eligible participants receive controlled access to source code, engage on technical content about Microsoft’s products and services, and have access to five globally distributed Transparency Centers. Microsoft Cloud for Sovereignty will also enable audit rights to examine Azure’s compliance processes and evidence under non-disclosure agreements and available audit terms.

Expertise

From the outset, Microsoft Cloud for Sovereignty is being designed as a partner-led and partner-first solution. In-country partners will play a pivotal role in enabling customer success and delivering on government requirements. Back in May, we shared a set of new European Cloud Principles to guide our business in Europe, which includes a focus on providing cloud offerings that meet European government sovereign needs in partnership with local trusted technology providers. This includes working closely with partners like Arvato, Capgemini, Minsait, Orange, SAP, Telefonica and many more, to deliver upon the unique sovereign requirements of each government. This approach of working with local partners to deliver on the needs of public sector organizations is a cornerstone of our approach with the Microsoft Cloud for Sovereignty.

Public sector customers worldwide are increasingly looking for customized cloud solutions that offer additional choice, flexibility and control. With the Microsoft Cloud for Sovereignty, customers will work with in-country partners that have industry and technical experience to help them plan, onboard, govern and operate their cloud environments with capabilities including data residency, confidential computing, document classification and hybrid deployments. Partners will also add value by working with customers to customize the Sovereign Landing Zone, assisting with the audit programs mentioned above, and providing extra readiness, support and transparency. We recognize that our public sector customers have valued relationships with local technology providers and that every country has unique needs. Microsoft Cloud for Sovereignty will offer the tools, the innovation, the processes and the transparency to put the power into the hands of knowledgeable and trusted partners that will support local governments on their digital transformation journey.

For example, in Italy we are working with Leonardo to build a solution that meets the national government’s data classification standards and supports the country’s digital transformation goals with public cloud-based solutions, controls, policy governance and hybrid management.

“Institutions and critical national infrastructures need the modeling, building and management of resilient-by-design Secure National Clouds able to guarantee data integrity, availability and protection in line with country-systems guidelines. Thanks to our extended research and innovation capabilities we can leverage the best from Microsoft Cloud with our capabilities in the cyberspace and in protecting national assets. Our long-term collaboration comes together in a solution that helps ensure the sovereignty of data while at the same time benefiting from the innovation of the public cloud.”

— Gennaro Faella, Senior Vice President Innovation, Leonardo

YouTube Video

Another example is the work we are doing with Proximus in Belgium, where we are collaborating to help meet the privacy and sovereignty challenges of companies and organizations in public and regulated sectors.

“Together, Microsoft’s Azure hyperscale capabilities and Proximus’s hybrid capabilities have the ability to meet many of today’s sovereignty needs. Customers are able to use the most powerful public cloud capabilities while benefiting from the ultimate sovereign and privacy controls relying on our own Proximus infrastructure or the upcoming Microsoft datacenter region in Belgium.

This is building on technical innovations from Microsoft like Azure Confidential Computing, combined with the local anchoring and expertise of Proximus as a trusted cloud service provider. Proximus and Microsoft have a long existing partnership in place, and with today’s announcement will be able to further deliver safe, connected and secure solutions to our shared customers in Belgium, Luxembourg, and The Netherlands.”

— Guillaume Boutin, CEO Proximus Group

We are beginning the initial private preview of Microsoft Cloud for Sovereignty in select locations, and we will share further details over time. As we continue to roll out and expand our solution footprint across our datacenter regions, we look forward to working closely with partners throughout the world to help government customers digitally transform, leveraging today’s powerful capabilities of the Microsoft Cloud.

Tags: Government, Microsoft Cloud for Sovereignty, Security

Jul 13, 2022 Mikhail Parakhin, President Web Experiences, Microsoft

Jun 15, 2022 Judson Althoff

Jun 15, 2022 Charlotte Vuyiswa McClain-Nhlapo, Global Disability Advisor of the World Bank Group, and Jenny Lay-Flurrie, Microsoft Chief Accessibility Officer

May 31, 2022 Çağlayan Arkan

Follow us:

- Published in Uncategorized

Document Outsourcing Services Market is slated to increase at a CAGR of 6.3% to reach US$ 11.74 Bn by the end of 2030 – Future Market Insights

FMIBlog

Future Market Insights Blog

Prominent market research company Future Market Insights infers that the global document outsourcing services market shall expand at a CAGR of 6.3% between 2022 and 2030.

The COVID-19 outbreak has compelled business organizations to institute remote working arrangements, requiring remote communication, preparation of paperless documents, tax filings and payroll processes. All these procedures have compelled companies to shift to virtual platforms, resulting in an uptake of document outsourcing services.

Besides the pandemic, a general requirement to streamline business operations has prompted small, medium and large scale corporations to invest a major chunk of their revenue in document outsourcing services. All these factors are acting as growth catalysts for the market during the forecast period.

The banking, financial services and insurance (BFSI) sector has effectively adopted document outsourcing services, owing to the voluminous nature of its operations. Looking at the nature of its operations, adoption of document outsourcing services has risen exponentially in the past, and will continue to do so across the forecast period.

Request Sample Report@ https://www.futuremarketinsights.com/reports/sample/rep-gb-256

List of Key Players Covered in Document Outsourcing Services Market are:

Key Takeaways from FMI’s Document Outsourcing Services Market:

Browse Detailed Summary of Research Report with TOC @ https://www.futuremarketinsights.com/reports/document-outsourcing-services-market

Document Outsourcing Services Market: Key Trends

Document Outsourcing Services Market: Region-wise Analysis

Document Outsourcing Activities Market: Competitive Analysis

The document outsourcing activities market is composed of a handful of players, which include: Symcor, Hewlett-Packard Co., Max BPO, Lexmark International, Inc., Ricoh Co. Ltd., Fuji Xerox Co., Ltd. and Iron Mountain Incorporated.

The abovementioned market players concentrate on developing and launching new solutions. This is primarily driven by the BFSI industry. Besides, they are also forging partnerships with cloud service providers in the wake of the pandemic crisis to offer remote working solutions. For example, Indigenous Link and Symcor are jointly providing to monitor, track and calibrate document management process in real-time across Canada while collecting data of the indigenous population.

Order a Complete Research Report @ https://www.futuremarketinsights.com/checkout/256

Detailed Table of Content:

TOC Continued…

Speak to our Research Expert @ https://www.futuremarketinsights.com/ask-question/rep-gb-256

Related Link :

https://globalsocials.mn.co/posts/29913242

https://drujrake.mn.co/posts/29913249

https://cigarbook.mn.co/posts/29913263

https://howtolive.tribe.so/post/visitor-identification-software-market-key-players-applications-outlook-swo–6392d29e507e1bca5137b8c2

https://hackmd.io/@GIMvuahJRQum99QNHVR2-A/SJICM8eOj

About Us

Future Market Insights (ESOMAR certified market research organization and a member of Greater New York Chamber of Commerce) provides in-depth insights into governing factors elevating the demand in the market. It discloses opportunities that will favor the market growth in various segments on the basis of Source, Application, Sales Channel and End Use over the next 10-years.

Contact Us:

Future Market Insights,

Unit No: 1602-006,

Jumeirah Bay 2,

Plot No: JLT-PH2-X2A,

Jumeirah Lakes Towers,

Dubai,

United Arab Emirates

For Sales Enquiries: sales@futuremarketinsights.com

Website: https://www.futuremarketinsights.com

LinkedIn| Twitter| Blogs

Your email address will not be published. Required fields are marked *

- Published in Uncategorized

Document Management Market to Witness Growth Acceleration | eFileCabinet, Zoho Corporation, Microsoft – Digital Journal

Hi, what are you looking for?

By

Published

New Jersey, N.J., July 19, 2022 The Document Management Market research report provides all the information related to the industry. It gives the outlook of the market by giving authentic data to its client which helps to make essential decisions. It gives an overview of the market which includes its definition, applications and developments, and manufacturing technology. This Document Management market research report tracks all the recent developments and innovations in the market. It gives the data regarding the obstacles while establishing the business and guides to overcome the upcoming challenges and obstacles.

Document management is a system or process used to capture, track, and store electronic documents such as PDF files, word processing files, and digital images of paper content. Document management can save you time and money. The emergence of paperless offices and the need for increased efficiency is driving the growth of the market. Moreover, high scanning requirements to save space further fuel the growth.

Get the PDF Sample Copy (Including FULL TOC, Graphs, and Tables) of this report @:

https://www.a2zmarketresearch.com/sample-request/659738

Competitive landscape:

This Document Management research report throws light on the major market players thriving in the market; it tracks their business strategies, financial status, and upcoming products.

Some of the Top companies Influencing this Market include:eFileCabinet, Zoho Corporation, Microsoft, Google, Ascensio System SIA, Dropbox Business, Box, Adobe Systems, Evernote, M-Files, Office Gemini, Salesforce, Kofax, LSSP, Ademero, Konica Minolta, Lucion Technologies, Speedy Solutions, Blue Project Software, Templafy, SutiSoft, LogicalDOC, DocuXplorer Software, Laserfiche,

Market Scenario:

Firstly, this Document Management research report introduces the market by providing an overview which includes definition, applications, product launches, developments, challenges, and regions. The market is forecasted to reveal strong development by driven consumption in various markets. An analysis of the current market designs and other basic characteristics is provided in the Document Management report.

Regional Coverage:

The region-wise coverage of the market is mentioned in the report, mainly focusing on the regions:

Segmentation Analysis of the market

The market is segmented on the basis of the type, product, end users, raw materials, etc. the segmentation helps to deliver a precise explanation of the market

Market Segmentation: By Type

On-premise

Cloud-based

Market Segmentation: By Application

Government

Healthcare

BFSI

Others

For Any Query or Customization: https://a2zmarketresearch.com/ask-for-customization/659738

An assessment of the market attractiveness with regard to the competition that new players and products are likely to present to older ones has been provided in the publication. The research report also mentions the innovations, new developments, marketing strategies, branding techniques, and products of the key participants present in the global Document Management market. To present a clear vision of the market the competitive landscape has been thoroughly analyzed utilizing the value chain analysis. The opportunities and threats present in the future for the key market players have also been emphasized in the publication.

This report aims to provide:

Table of Contents

Global Document Management Market Research Report 2022 – 2029

Chapter 1 Document Management Market Overview

Chapter 2 Global Economic Impact on Industry

Chapter 3 Global Market Competition by Manufacturers

Chapter 4 Global Production, Revenue (Value) by Region

Chapter 5 Global Supply (Production), Consumption, Export, Import by Regions

Chapter 6 Global Production, Revenue (Value), Price Trend by Type

Chapter 7 Global Market Analysis by Application

Chapter 8 Manufacturing Cost Analysis

Chapter 9 Industrial Chain, Sourcing Strategy and Downstream Buyers

Chapter 10 Marketing Strategy Analysis, Distributors/Traders

Chapter 11 Market Effect Factors Analysis

Chapter 12 Global Document Management Market Forecast

Buy Exclusive Report @: https://www.a2zmarketresearch.com/checkout

Contact Us:

Roger Smith

1887 WHITNEY MESA DR HENDERSON, NV 89014

[email protected]

+1 775 237 4157

Related Reports:

Biodegradable Bubble Wrap Market to Witness Growth Acceleration | Automated Packaging Systems, AP Packaging, Dana Poly

Utility Locator Market with Tremendous growth by 2029 Vivax-Metrotech, The Charles Machine Works, Radiodetection

Communications-based Train Control (CBTC) Market See Huge Growth for New Normal | Thales, Hitachi, Alstom

Intelligent Driving Solutions Market Scope and overview, To Develop with Increased Global Emphasis on Industrialization 2029 | Mobileye, Nvidia, Huawei

Pedestrians AEB System Market Report Covers Future Trends with Research 2022-2029 | ZF TRW, Continental AG, DENSO Corporation

Neuromuscular Stimulators Market to Witness Growth Acceleration | Medtronic, Boston Scientific, St. Jude Medical

Pancreatic Stone Protein Testing Market Is Booming Worldwide RayBiotech, Inc., Thermo Fisher Scientific

Cardiac Catheter Sensors Market to See Booming Growth GE Healthcare, Medtronic PLC, Honeywell International

Sperm Analysis System Market Growing Massively by QingHua TongFang, Hamilton Thorne Inc, Stormoff

Biodegradable Bubble Wrap Market to Witness Growth Acceleration | Automated Packaging Systems, AP Packaging, Dana Poly0

COMTEX_410512915/2769/2022-07-19T08:22:27

Social Media platforms’ competition for attention with short-form content has been the epicentre of 2022 and will continue to be the focus in 2023.

Dozens of scientists, experts and campaigners called for a ban on the release of genetically-edited organisms into the wild.

The same vulnerabilities, threats and risks apply to chatbots as they do to other customer-facing online applications.

A 60-140-meter asteroid is approaching Earth, and the ESA challenges amateur astronomers to help them find it.

COPYRIGHT © 1998 – 2022 DIGITAL JOURNAL INC. Sitemaps: XML / News . Digital Journal is not responsible for the content of external sites. Read more about our external linking.

- Published in Uncategorized

Global Laboratory Informatics Market Report 2022 to 2032 – Decreasing Cost Due to Increasing Use of Cloud-Based Systems Presents Opportunities – ResearchAndMarkets.com – Business Wire

DUBLIN–(BUSINESS WIRE)–The “Laboratory Informatics Market – A Global Market and Regional Analysis: Focus on Type, Offering, Component, Deployment, End User, and Region Analysis – Analysis and Forecast, 2022-2032” report has been added to ResearchAndMarkets.com’s offering.

The global laboratory informatics market was valued at $4,341.2 million in 2021 and is anticipated to reach $12,677.0 million by 2032, witnessing a CAGR of 10.27% during the forecast period 2022-2032.

The growth in the global laboratory informatics market is expected to be driven by the increased efficiency of laboratories due to their usage and better data management. Additionally, it saves time and money.

Laboratory informatics plays an essential role in laboratories fulfilling quality standards, eliminating transcribing mistakes, shortening the time it takes from specimen receipt to results reporting, and improving patient outcomes. Over the last decade, technical developments in laboratory equipment have resulted in increasing specimen numbers, as well as a growing need for and dependence on laboratory data to support clinical and public health demands.

These advancements indicated that paper-based record keeping and results reporting were impractical and could not serve the laboratory’s commercial demands. As a result, there has been a significant increase in the need for laboratory informatics adoption at all levels. This expanded usage of laboratory informatics has enabled end customers to describe particular system requirements, prompting suppliers to design more appealing and practical products and feasible laboratory informatics choices.

Recent Developments in the Global Laboratory Informatics Market

Market Dynamics

Drivers

Challenges

Opportunities

Companies Mentioned

Market Segmentation

Segmentation 1: by Type

Segmentation 2: by Offering

Segmentation 3: by Component

Segmentation 4: by Deployment

Segmentation 5: by End User

Segmentation 6: by Region

For more information about this report visit https://www.researchandmarkets.com/r/nn7nu3

ResearchAndMarkets.com

Laura Wood, Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

For U.S./ CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900

ResearchAndMarkets.com

Laura Wood, Senior Press Manager

press@researchandmarkets.com

For E.S.T Office Hours Call 1-917-300-0470

For U.S./ CAN Toll Free Call 1-800-526-8630

For GMT Office Hours Call +353-1-416-8900

- Published in Uncategorized

New to The Street / Newsmax TV Announces its Line-up for Episode #412, Nine Interviews, Airing Sunday, December 4, 2022, 10-11 AM ET – GlobeNewswire

December 02, 2022 09:30 ET | Source: FMW Media Works Corp FMW Media Works Corp

New York City, New York, UNITED STATES

NEW YORK, Dec. 02, 2022 (GLOBE NEWSWIRE) — New to The Street / Newsmax TV announces the broadcasting line-up of its nationally syndicated 1- hour TV show this Sunday, December 4, 2022, airing time 10-11 AM ET.

New to The Street’s 412th TV episode line-up, features the following nine (9) corporate interviews:

1). Quantum Computing- Quantum Computing, Inc.’s (NASDAQ: QUBT) ($QUBT) interviews with Robert Liscouski, President, CEO, and Chairman, and Hunter Gaylor, Industry Expert/Advisor

2). American Made Product – American Rebel, Inc.’s (NASDAQ: AREB) ($AREB) interview with Andy Ross, Chairman, and CEO.

3). Ecological Solutions- The Sustainable Green Team (OTC: SGTM) ($SGTM) and VRM BioLogik Group (VRM) presentation by Ken Bellamy, Founder VRM BioLogik.

4). Cryptocurrency – Volt Inu’s (CRYPTO: VOLT) ($VOLT) interviews with Community Leaders, Pablo Cro, Ozzy, and Power Wright.

5). Hemp Cigarettes – Hempacco Co., Inc.’s (NASDAQ: HPCO) ($HPCO) interviews with Sandro Piancone, Co-Founder/CEO, and Jorge Olson, Co-Founder/ Chief Marketing Officer.

6). Cryptocurrency- Apotheosis Investments Global, Inc.’s ($OSIS) (“OSIS”) interviews with Co-founders Chris Tabaro and Jalal Ibrahimi.

7). Email/Messenger Privacy Solutions – Sekur Private Data, Ltd.’s (OTCQX: SWISF) (CSE: SKUR) (FRA: GDT0) interview with Alain Ghiai, CEO.

8). Super Food- GMSacha Inchi’s (OTC: QEDN) ($QEDN) interview with Kate Bahnsen, CEO.

9). “Sekur Privacy & Sekur Security Segment” interview with internet privacy expert Mr. Alain Ghiai, CEO, Sekur Private Data Ltd. (OTCQX: SWISF) (CSE: SKUR) (FRA: GDT0) (Sekur®).

From the Nasdaq MarketSite studio, New to The Street’s Co- Host Jane King and Hunter Gaylor have a conversation about the significance of Quantum Computing, Inc. (NASDAQ: QUBT) ($QUBT) (“QCI”). Hunter, who is an industry expert/advisor to QCI, and podcast host of “Hunting Opportunities to Consider,” believes that Quantum Computing, Inc.’s software and hardware solutions can democratize the computer industry, which can solve everyday problems faster and more efficiently. Robert ‘Bob’ Liscouski , President, CEO, and Chairman of Quantum Computing, Inc., appears on set with Jane King, explaining further about the Company. As a leader in quantum computer software products, QCI’s ecosystem offers end-users easy access to quantum solutions for mainstream uses. Robert explains that current and classical technologies are in every aspect of our lives. QCI has a full stack of quantum software/hardware solutions to bring quantum computations to a new evolution beyond classical technology. Bob explains the significance of the Company’s June 2022 acquisition of QPhoton, Inc., a quantum photonics innovation company that has developed a quantum photonic system (QPS). AI, new drugs, energy, and many other industries can quickly deploy a QCI software solution ready-to-run. Quantum’s flagship product Qatalyst™ is a first of its kind for the marketplace, which does not involve substantial operational and human resource expenses to deploy. The on-screen QR code is available during the show; download or visit Quantum Computing, Inc. – https://www.quantumcomputinginc.com/.

New to The Street’s TV Host Jane King from the Nasdaq MarketSite studio welcomes Andy Ross, Chairman/CEO of America Rebel, Inc. (NASDAQ: AREB) ($AREB). Inspired by the song “American Rebel,” the Company started in 2015, making American-made safes and concealed carry weapons (CCW) apparel and backpacks. Andy passionately explains the Company’s mission, branded as “America’s Patriotic Brand.” The Company owns eight retail locations selling its products. Additionally, consumers can find products at 400 other retailers and sporting goods stores. The full stand-alone safes are the Company’s flagship product, and along with its CCW apparel/backpacks and weapon lockers, the Company continues to grow. The Company will soon release its e-Bike into the market. Andy talks about his music career. His inspiration when he hosted an Outdoor Channel show evolved into his current position with American Rebel, Inc. The Company will feature its products at the upcoming SHOT trade show in Las Vegas in January 2023. As a patriotic Company – “Made in America,” Andy explains that demand is growing for American-made products, and he is excited about the Company’s future. With a strong social media presence, and websites, www.americanrebel.com and www.andyross.com, viewers can learn more about the Company’s mission and products. The on-screen QR code is available during the show; download or visit America Rebel, Inc. – http://www.americanrebel.com/.

The Sustainable Green Team (OTC: SGTM) ($SGTM) and VRM BioLogik Group (VRM), an Australian Company, are in collaboration to bring VRM’s HumiSoil product into the US Market. Airing on New to The Street, Ken Bellamy, VRM’s founder, explains the hydrosynthesis science which manufactures water. Ken explains how sunlight absorbs solar energy into panels that convert light into usable energy. Plants capture sunlight, too, and convert the sun’s energy using carbon dioxide to create carbohydrates and water. After a couple of decades, Ken was able to figure out this relationship between sunlight and plants. The hydrosynthesis process is a hydrogen oxidization process that brings nutrients and water back into the soil. The more water and nutrients in the soil, plants, and crops yield high amounts of food. VRM’s hydrosynthesis can occur anywhere on the planet, day and night. Taking organic byproducts and stimulating the naturally occurring biological processes creates water. Soil has amazing water storage capability, and VRM developed a successful technique to increase crop yields and soil hydrations. Taking green wastes and food byproducts and converting them using VRM’s hydrosynthesis technology in “Growing Water” can create sustainable solutions for worldwide food production. The documentary gives views on the ecological visions of both entities and shows the practical solutions now available. Websites: VRM BioLogik Group – https://www.vrm.science/ and The Sustainable Green Team – https://www.thesustainablegreenteam.com/.

Volt Inu’s (CRYPTO: VOLT) ($VOLT) Community Leaders, Pablo Cro, Ozzy, and Power Wright join New to The Street’s TV Host Jane King from the Nasdaq MarketSite studio to discuss the Company’s DeFi products. Since its inception in December 2021, Volt Inu is a one-stop shop for DeFi products, with its generated profits going back to burning its native token, $VOLT. The burn rate is deflationary to its token supply, a Company objective. Community Leader, Pablo Cro, informs viewers that Volt has a uniqueness that other crypto companies don’t have, their ability to succeed during bear markets. The Company was formed during a bear market, giving attention to many details perhaps not accomplished during a boom cycle. Ozzy, also a Community Leader, talks about the relationships established within Volt’s community ecosystem and how they continue to grow and mature. The success of some of the largest crypto entities, including Bitcoin and Etherium, all have a common attribute, their communities. Community Leader, Power Wright, explains the importance of communicating effectively with Volt’s community, giving update details and transparency on products and operations. Volt is considered a meme coin with real-life utilities with everyday purchases using the $VOLT token. All three community leaders work diligently to enhance the ecosystem, ensuring community awareness and focusing on growing Volt’s brand name recognition. The on-screen QR code is available during the show; download or visit Volt Inu – https://voltinu.in/.

New to The Street’s TV Host Jane King interviews Hempacco Co., Inc.’s (NASDAQ: HPCO) ($HPCO) Sandro Piancone, Co-Founder/CEO, and Jorge Olson, Co-Founder/Chief Marketing Officer. From the Nasdaq MarketSite studio, viewers learn about the Company’s hemp Disrupting Tobacco™ products. Jorge explains the Company’s goal in Disrupting Tobacco™ products with hemp cigarettes. The tobacco industry is a $1T global industry, while the hemp and cannabis industry is only at $25B. The growing market share for hemp-based smokable products provides opportunities. Jorge explains the different types of cannabinoid infusions that the Company uses to create other effects, from sleep to energy. Sandro discusses its successful celebrity joint venture partnerships with Cheech & Chong and Rick Ross. The Company makes smokable hemp products and wrapping, rolling papers that cater to celebrities’ fans. Management continues to sign-up master distribution agreements, looks for new technological advancements, and will look at accretive acquisitions to grow its hemp-based product footprint. Hempacco owns its production facility, has vending machine locations, and has private-label products. The growth in their herb and hemp-based alternatives to nicotine cigarettes by manufacturing and marketing herb, spice, and cannabinoid smokables and rolling papers continues. It took the Company two years to create its unique smokable hemp product line. Now, with patents and proprietary intellectual property (IP), the Company is positioned to gain more market share out of the $1T tobacco marketplace. The 2018 US Farm Bill allows hemp products to be sold legally in all 50 states and without special taxes. Displayed on countertops, merchants sell CBD-infused cigarettes. The on-screen QR code is available during the show; download or visit Hempacco Co., Inc. – https://hempaccoinc.com/ & https://realstuffsmokables.com/. The segment is an updated version that originally aired on November 6, 2022.

New to The Street airs from the Nasdaq MarketSite studio TV Host Jane King’s interview with Chris Tabaro, President / Co-Founder, and Jalal Ibrahimi, Vice-President/ Co-Founder of Apotheosis Investments Global, Inc. ($OSIS) (“OSIS”). OSIS offers an ecosystem for end-users who like to tokenize their assets, goods, and services. The Company focuses on getting everyday people involved with Web 3.0, using simple applications to create NFTs, tokens, and “Smart Contracts.” Jalal has a finance and accounting background and talks to viewers about his responsibilities to the Company’s business operations. Chris talks about his vision; seeing a world that lacks trust in financial transactions, he saw an opportunity with blockchain technology to secure and verify assets and transactions. Chris shows viewers his 1,500-page, 50-month road map for the Company’s future. Together Chris and Jalal started the OSIS platform with a 5-year plan to be one of the largest tokenized ecosystems where industries, governments, businesses, and individuals can utilize “Smart Contracts” for all transactions. The on-screen QR code is available during the show; download or visit Apotheosis Investments Global, Inc. ($OSIS) (“OSIS”) – https://osisplatform.com/.

Mr. Alain Ghiai, CEO of Sekur Private Data, Ltd. (OTCQX: SWISF) (CSE: SKUR) (FRA: GDT0), joins New to The Street’s TV Host Jane King from the Nasdaq MarketSite studio. Sekur Private Data, Ltd. offers Sekur, a Swiss secure email and messenger communication application available on any mobile device, tablet, and desktop. Subscribers get cybersecurity protections not available with open-source programs for reasonable pricing, a complete and affordable cybersecurity solution for individuals and businesses. Many banks in the US violated banking privacy laws while using Big Tech open platforms to communicate banking information. Some banks used WhatsApp to message clients and for internal uses, which is a privacy violation, resulting in over $2B in fines. The solution is Sekur Private Data’s Sekur products which offer encrypted secure communications and data management. SekurMessenger allows for private and secure texting and provides the receiver of text messages from the subscriber with the same encrypted features. Sekur’s “Chat-by-Invite” app, available in 61 countries, allows texting to occur in a closed-loop system hosted and owned by Sekur in Switzerland. The platform offers archiving, a requirement for many regulated industries, including banks and other financial institutions. Alain told viewers that growth continues in Central America and other South American countries and expects more small-medium business (SMB) enterprises and governments to sign up for Sekur. In the US market, B2B partnerships are growing, too. Sekur’s “Chat-by-Invite” app is available on iOS and Android; go to Sekur.com to download it. Sekur Private Data, Ltd. operates its internet platforms and security businesses under the country of Switzerland’s very tough privacy laws. The Company never asks for a phone number to subscribe. Sekur is on track for an exciting 2023. The on-screen QR code is available during the show to download more info or visit Sekur Private Data, Ltd. – https://www.sekurprivatedata.com/ and http://www.Sekur.com. The segment is an updated version that originally aired on November 6, 2022.

From the New to The Street’s Nasdaq Marketsite studio, Kate Bahnsen, Chief Executive Officer of GMSacha Inchi (OTC: QEDN) ($QEDN), joins TV Host Jane King to talk about the Company. Established in 2013 in Columbia, the Company creates nutritional products. It looks for sustainable farming initiatives which could help farmers make a better wage and plant crops that are not considered illegal. Known as a super food, the Sacha Inchi plant is grown for its seeds. The plant is high in nine essential amino acids, proteins, and Omega 3,6 and 9. The harvesting is about every 15 days giving farmers a sustainable crop with profits and growing consumer markets. The Company is working on a beverage with only 30 grams of calories and full of nutritional benefits, the only Sacha Inchi seed beverage worldwide. Because it is a seed and not a nut, there are no known allergies from consumption. The Company makes flour out of the seed, which adds nutrition to other food preparations. Also, the Company has products for athletes, pets, and snack food industries. Kate talks about a pending US SEC Reg A offering as either a Tier 1 or Tier 2; upon effectiveness, this will allow the Company to obtain investment funding. Kate believes 2023 will be an excellent year for the Company as it rolls out its beverage and other products into the marketplace. The on-screen QR code is available during the show to download more info or visit GMSacha Inchi – https://gmsacha.com/.

On New to The Street’s “Sekur Privacy & Sekur Security Segment,” Alain Ghiai, internationally acclaimed internet privacy expert and CEO of Sekur Private Data, Ltd. (OTCQX: SWISF) (CSE: SKUR) (FRA: GDT0) talks about online shopping with TV Host and Multi-media Journalist Ana Berry. Ana says it is easy to store credit card information online on sites frequently used to shop. With the holiday season, online consumer sites are targets for hackers. Alain gives an analogy: would you leave your credit card at a retail location, informing the cashier you will come back tomorrow? So, leaving your credit card information stored on the web is the same premise. The answer is NO, so don’t keep your credit card or other private data on the web. Most online retail sites use a Big Tech platform for their transactions, with credit cards held in a database. Consumers often hear about database hacks where stolen credit card information and other sensitive data occurs. The SekurMail/SekurMessenger products can ensure a private communication platform for emails and texts. SekurMail sends a link to a recipient, which opens an email link for secure communication. Similarly, the SekurMessenger, with its “Chat-by-Invite” app, available in 61 countries, allows text messaging on a close-loop encrypted platform. When a non-Sekur subscriber agrees to link with a Sekur account holder, they, too, are part of the close-loop encryption available through Sekur Private Data’s fully-owned and controlled servers based in Switzerland. The Company never asks for cell phone numbers for any of its services and prides itself as an encrypted end-to-end privacy and data security company. Its Sekur products are available to businesses and consumers for reasonable monthly rates. The Company never shares data, never data mines and has no third-party programs. The on-screen QR code is available during the show; download or visit Sekur Private Data, Ltd. – https://www.sekurprivatedata.com/ & http://www.Sekur.com. “What is your privacy worth during the holidays”?

About Quantum Computing, Inc. (NASDAQ: QUBT) ($QUBT)

Quantum Computing ,Inc. (QCI) (NASDAQ: QUBT) is a full-stack quantum software and hardware company on a mission to accelerate the value of quantum computing for real-world industry applications, delivering the future of quantum computing today. The combination of QCI’s flagship ready-to-run software product, Qatalyst, with its industry-leading Entropy Quantum Computing (EQC) system, Dirac 1, provides a broadly accessible and affordable enterprise quantum solution capable of solving real business problems now. QCI’s expert team in finance, computing, security, mathematics, and physics has over a century of combined experience with complex technologies, from leading-edge supercomputing to precision sensors and imaging technology, to the security that protects nations – https://www.quantumcomputinginc.com/.

About American Rebel Holdings, Inc. (NASDAQ: AREB) ($AREB):

American Rebel, Inc. (NASDAQ: AREB), through its wholly-owned operating subsidiaries, operates primarily as a designer, manufacturer, and marketer of branded safes and personal security and self-defense products. The Company also designs and produces branded apparel and accessories and now intends to enter the E-Bike market – www.americanrebel.com.

About The Sustainable Green Team, Ltd. (OTC: SGTM) ($SGTM)

The Sustainable Green Team, Ltd. (OTC: SGTM) ($SGTM) is an emerging provider of environmentally beneficial solutions for preserving natural resources and the municipal waste and recycling industries. The Company is a wholesale manufacturer and supplier of wood-based mulch and lumber products, primarily in the Midwest, Southeast, and Ohio Valley regions. The Company also provides arbor care and storm recovery services to municipalities, corporations, and consumers, primarily in the southeastern United States. The Company plans to expand its operations through organic growth and strategic acquisitions that are both accretive to earnings and positioned for rapid growth from the resulting synergistic opportunities identified. The Company’s customers include governmental, residential, and commercial clients – https://www.thesustainablegreenteam.com/.

About VRM BioLogik Group:

Since 1987, VRM BioLogik has developed and implemented technological advances globally that catalyze natural reactions, aiding in soil restoration, resolving environmental emergencies, and cleaning through attaining and sustaining ecosystem balance. VRM’s agricultural product range works to enhance crop yield while restoring the nutrients in soils naturally. Its cleaner product range naturally removes residues from surfaces that harbor viruses and pathogens. The environmental management product range works to address and amend difficult environmental circumstances, including balancing wastewater, control of odor and organics digestion during emergency spills, and eliminating odors. VRM’s livestock product range is a probiotic approach to environmental management in intensive growing situations – https://www.vrm.science/.

About Volt Inu (CRYPTO: VOLT) ($VOLT):

Volt Inu (CRYPTO: VOLT) ($VOLT) is a hyper-deflationary token aiming to invest in multiple asset classes such as NFTs, nodes, altcoins, staking & farming of stablecoins. This investment diversity allows for mitigating the risk while taking advantage of the possible non-correlated growth of the trending assets. Since $VOLT is intended to be a hyper-deflationary token, profits made on treasury investments are then used to buyback & burn $VOLT tokens – https://voltinu.in/.

About Hempacco Co., Inc. (NASDAQ: HPCO) ($HPCO):

Hempacco Co., Inc.’s (NASDAQ: HPCO) ($HPCO) goal is Disrupting Tobacco’s™ nearly $1 trillion industry with herb and hemp-based alternatives to nicotine cigarettes by manufacturing and marketing herb, spice, and cannabinoid smokables and rolling paper. Hempacco owns The Real Stuff™ functional hemp cigarette and rolling paper brands. Hempacco’s operational segments include manufacturing of smokables and hemp rolling paper, smokable technology development, The Real Stuff™ brand of functional smokables and rolling paper, and Cheech & Chong Hemp Cigarettes and Hemp Hop Smokables with Rick Ross. Learn more at www.hempaccoinc.com and order products at www.realstuffsmokables.com.

About Apotheosis Investments Global, Inc. ($OSIS) (“OSIS”):

Apotheosis Investments Global, Inc. ($OSIS) (“OSIS”) created the OSIS utility token. The OSIS token is behind the education, tokenization, and exchange ecosystem that offers users the ability to launch their own NFTs & tokens. OSIS’ mission is to help all transition from Web2 to Web3 by simplifying access to the blockchain & ushering in a tokenized economy. The OSIS ecosystem includes everything you need to start your Web3 journey and take advantage of the tokenization revolution – https://osisplatform.com/.

About Sekur Private Data Ltd. (OTCQX: SWISF) (CSE: SKUR) (FRA: GDT0):

Sekur Private Data, Ltd. (OTCQX: SWISF) (CSE: SKUR) (FRA: GDT0) is a cybersecurity and internet privacy provider of Swiss-hosted solutions for secure communications and secure data management. The Company distributes encrypted emails, secure messengers, secure communication tools, secure cloud-based storage, disaster recovery, and document management products. The Company sells and serves consumers, businesses, and governments worldwide through approved wholesalers, distributors, and telecommunications companies. Contact Sekur Private Data, Ltd. at corporate@globexdatagroup.com or visit https://www.sekurprivatedata.com and https://www.sekur.com.

About GMSacha Inchi (OTCMKTS: QEDN) ($QEDN):